Inverted Yield Curves and Central Bankers Pull Focus to the Tetons as BRICS Founders

Another day, another financial event — the 46th US Federal Reserve Summer Symposium — for Wim Romeijn to ponder…

As BRICS leaders discuss ways to challenge US hegemony and overthrow the mighty dollar as the global reserve currency, the minders of the financial status quo are descending on Jackson Hole.

The picturesque town — refuge for the millionaires and artisans of Wyoming — sits at the foot of the rugged Teton mountain range. The event drawing the financial shot-callers is the three-day US Federal Reserve Summer Symposium, an annual meeting of the world’s pre-eminent central bankers.

This 46th edition is organised by the Federal Reserve Bank of Kansas City, and has an impressive roster of central bank governors and academics in attendance.

Jackson Hole, Wyoming

It’s a get-together of more consequence than the BRICS sideshow in Johannesburg, where rather bored-looking leaders sit on throne-like white seats facing an audience of people deemed very important by those who are less so.

Xi Goes AWOL

China’s President Xi Jinping failed to show up at the BRICS event, his whereabouts a mystery. Just hours before his vanishing act, he had received the Order of South Africa, an award coined for the occasion, for unspecified services to the host nation. Professional Jinping-watcher Bill Bishop of the Sinocism newsletter noted that throughout August, Jinping has been avoiding public view, cancelling commitments without explanation.

Also absent, of course, was Russian President Vladimir Putin. He stayed in Moscow, fearing arrest on a war crime warrant issued by the International Criminal Court in The Hague. That left South African President Cyril Ramaphosa visibly annoyed and flanked by just two of his BRICS fellows, Prime Minister Narendra Modi of India and President Luis Inácio da Silva of Brazil.

Meanwhile, investors and market analysts are primed to record, weigh, dissect, and replay every word uttered by Jerome H Powell, chair of the Board of Governors of the US Federal Reserve System. The hunt is on for clues about where the interest rate may be heading. Powell is expected to signal a “higher-for-longer” policy, and refrain from declaring victory over inflation. (It hasn’t yet been accomplished, although it is on a downward trajectory.)

Central bankers must now fine-tune their policies to arrange a soft landing for the economy, without hurting the job market or prices while coping with ripples from the pandemic and the war in Ukraine. The Fed, the European Central Bank (ECB) and Bank of England (BoE) are struggling to determine an inflection point for their benchmark rates. The Fed and the ECB seem to favour a pause in rate rises, while the BoE may be eyeing the upward path.

A Cautionary Tale

China, so notably absent in Jackson Hole, has shown what happens when interest rates are kept too high for too long. This week, the People’s Bank of China shaved a tenth of a percentage point off its key one-year rate, taking it to 3.45 percent — but left the five-year rate used for mortgages and consumer credit unchanged at 4.2 percent.

Earlier this month, the bank lowered its interbank rate by 0.15 percentage points. By slightly increasing the spread between the one-year and interbank rates, policymakers granted commercial banks a slightly wider profit margin. That may help to offset some of the losses suffered since China’s housing bubble burst in 2021.

Chinese property developer Country Garden, an estimated $200bn in debt, last week issued a profit warning expecting operating losses to exceed $7.5bn after the company missed a $45m bond coupon payment on August 8. Market watchers consider a repeat of the infamous Evergrande collapse a distinct possibility.

A Bit Problematic

With inflation in retreat and manufacturing output slumping, the job market in the US and Europe remains surprisingly strong. Its resilience prompted Raghuram Rajan, former governor of the Reserve Bank of India, to call the recent data “a bit problematic”. Rajan is worried that a strong job market signals a long “last mile” to reach the two percent inflation target maintained by most central banks.

Most of the participants of the Summer Symposium fear that the so-called neutral rate of interest — when it neither encourages nor discourages economic growth — may have crept up from its pre-pandemic level of 2.5 percent (0.5 percent in real terms, after discounting two percent inflation). Researchers of the New York Fed suspect “R-star” may indeed have gone up, but expect it to come back down.

The much-desired soft landing, the current holy grail of central bankers, may again prove elusive. The yield curve hit its deepest inversion since 1981, a sure sign of economic trouble ahead. An inverted yield curve happens when the yield of short-term bonds exceeds the one of long-term bonds in a reversal of the norm.

Analysts have been quick to point out that since 1978, the yield curve has inverted six times — and preceded a recession on each of those occasions. Currently, two-year T-bills yield 4.95 percent against just 3.86 percent for the 10-year treasury notes.

Banks borrow short and lend long. An upside-down yield curve makes this an unprofitable proposition, and takes an average of 15 months to deliver a recession.

The current inversion started a year ago. Is a downturn due by next October?

You may have an interest in also reading…

Permanent Output Losses from the Pandemic

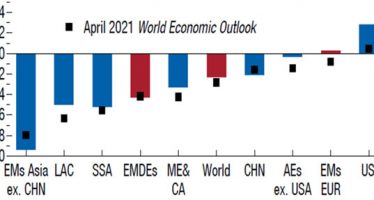

In the World Economic Outlook, published October 12, the International Monetary Fund (IMF) slightly lowered its forecast for global economic

Glued to the Box, or Linked to a Laptop? Streaming is Up-ending Entertainment

Digital consumer habits are reshaping the entertainment industry. A recent report by consulting firm Deloitte found that UK residents are

Casting Russia Adrift: The Decline of Western Power May Have Been Exaggerated

The Austrian subsidiary of Sberbank, Russia’s biggest lender, has collapsed after its parent company was unable to provide the liquidity