Paolo Sironi, IBM: Creating Digital Advantage for Uncertain Times

Changing a car tyre isn’t that hard — unless the vehicle’s moving. And financial institutions have been trying to achieve the corporate equivalent of this feat over recent years.

It’s never been easy. It’s still not easy. Geopolitical uncertainty causes market shocks and recalibrations. Client demand grows. Business leaders look for sustainable products and solutions. All the while, financial services’ C-suites respond, rather than reacting.

Changes and uncertainty have made a dramatic comeback after more than a decade of relative stability in the world economy and capital markets — and it appears they may remain centre-stage for some time. The landscape will continue to transform in 2023. Financial institutions are faced with a challenge: How to preserve increasingly expensive capital, while investing in transformation to emerge stronger after the storm. Leaders will be expected to adapt and respond to geopolitical and macro-economic tensions, new “digital-native” competitors, and environmental and sustainability challenges.

In doing so, they have to redefine the real value of digital transformation.

Macro-economic tensions spur changes, epitomised by spiking inflation, which has led major central banks to raise interest rates (except in China — and Japan might be just late to the party). The US Federal Reserve Board was the first to raise rates, aware of the negative potential in an economy whose real GDP is stagnant. The European Central Bank followed, despite the recessionary effects of energy supply challenges caused by the war in Ukraine.

Sudden reversals in monetary policies may prove untenable, adding more uncertainty to future decisions. From a banking perspective, higher interest rates should favour interest rate margins which have steadily declined over the past decade, especially for institutions centred on retail and wholesale lending. But recessionary expectations are resulting in growing credit-risk appraisal and a significant increase in the cost of operations — which might offset most economic benefits for financial intermediaries.

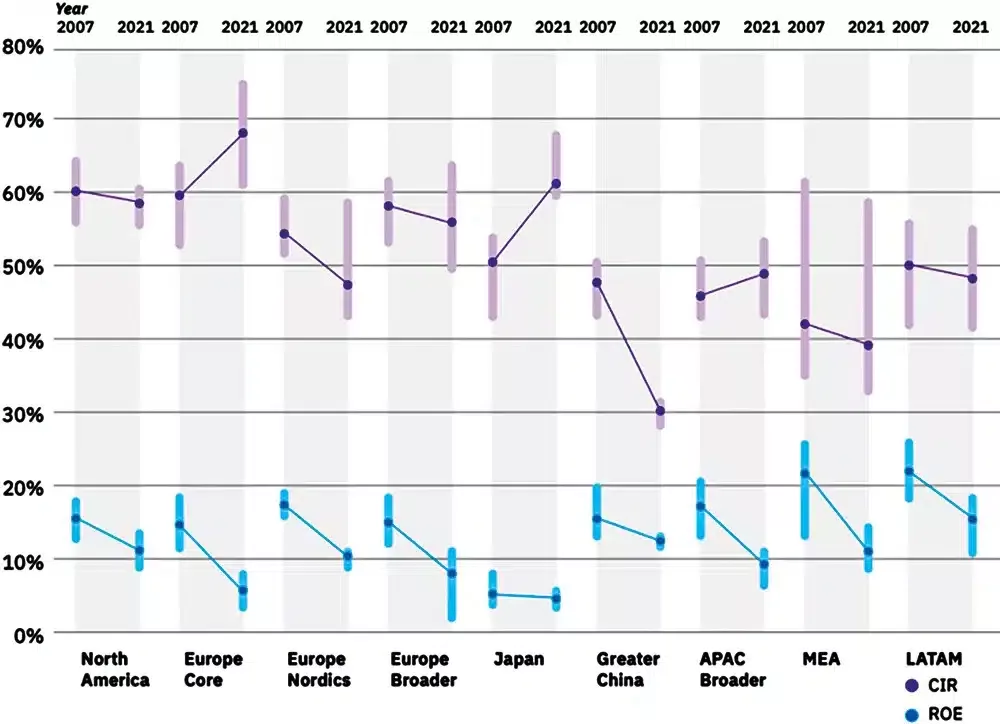

Figure 1: CIR remains sustained compared to 2007; ROE declined globally since the GFC erupted. CIR measures a banks efficiency; ROE measures performance based on average shareholder equity. ROE and CIR 5y averages of the median, 1st and 3rd quartile calculated in each region across the top 25 banks by Total Assets.

Note: CIR from 2010 MEA only. Note: Single year when different than 2007. Source: S&P Global, IBM Institute for Business Value.

Geopolitical risk brings economic headwinds, and calls for a refreshment of strategies. Economic decoupling tests the resilience of value chains while heightening financial risk across geographies and sectors. As globalisation helped to reduce costs, deglobalisation will drive them up, fuel inflation, and change financial clients’ needs.

New competitors brought new challenges with them — and they continue to do so. Digital adoption is accelerating, exposing the shortcomings of traditional financial services. This creates an opening for digital-savvy competitors to capture and engage clients, resulting in potential revenue loss for incumbents. Large traditional institutions are hindered by legacy business and operating models that are not sufficiently agile. Many of these models were designed in another era, for another era, a time before the speed enabled by modern technologies.

Sustainability pressures mount, but data are not always available. Environmental concerns have led to new restrictions on business and economic activities. While banks can be an integral part of the sustainable solution to find new revenue opportunities, they are also exposed to fresh risks and complex compliance requirements. According to IBM research, eight out of 10 CEOs (83 percent) expect sustainability investments to produce improved business results in the next five years. But 57 percent of CEOs identify unclear ROI and economic benefits as a leading challenge, while 44 percent cite a lack of data-led insights. Financial institutions will need to navigate this area with great care, for their business and the planet.

Without business model innovation, growth and performance cannot be had. Infusing a model with new tech for increased efficiencies and enhanced value is essential. According to 2022 mid-year analysis by Wanclouds, total tech spending in retail banking bounced back from the pandemic — on target to grow by 4.3 percent and reach $250bn. Although many banks made headlines for their innovation efforts, sustained financial performance has not materialised since the Global Financial Crisis of 2008. Return on average equity (ROAE) faltered industry-wide in the past decade (see Figure 1), while a sticky cost income ratio (CIR) did not sufficiently improve and in some cases worsened.

Financial institutions set up innovation centres, configured as siloed experiments rather than real transformation engines. The outcomes often failed to achieve key ambitions as part of an enterprise strategy. Many firms lacked a holistic strategy to rapidly integrate fintech services on a secure platform. Most attempted to digitalise existing business models without changing the foundations of client engagement, continuing to replicate traditional processes on mobile interfaces.

Business models need to reflect digitalisation if they are to drive growth and performance. The shift to digital prompts financial firms to search for value-based approaches to customer relationships, and that can change the institution to its core. Adjusting the business and operating models together allows technology to deliver on its promise of innovation.

Advanced Technology

Technology is a deflationary force against current uncertainties, and a conduit to new revenue opportunities. Remaining mired in legacy constraints is not an option. Many financial institutions are moving to digital foundations and transformations, and not just to keep pace with competitors. They recognise that modern banking and financial markets require ecosystems with digital capabilities that preserve resilience while leading to healthier financial performance.

But the next systemic crisis might not be about finance. Operational risk has always existed, and the chances of it causing the next crisis are higher than they’ve ever been. Why? New digital channels and ecosystems bring increased risk — cyber-risk in particular. Over the next four years, the costs associated with cybercrime ($10.5tn annually by 2025) are estimated to exceed worldwide cybersecurity spending ($267.3bn annually by 2026).

Rather than living in a state of perennial defence, where attention is focused on mitigating threats and surviving to fight another day, chief risk officers (CROs) are recognising security as an essential thread that ties together an organisation’s business and tech strategies. They’re using it to unlock larger pools of value, aligning operations for greater efficiencies, and collaborating more effectively to deliver better outcomes.

According to 2022 IBV research, chief information and technical officers of global financial institutions have defined unified security frameworks — from cyber-risk to compliance postures — as their top priority to generate greater business value in the next three years

This year’s Global Outlook for Banking and Financial Markets, from the Institute for Business Value, reflects on these aspects of the global macro-economic environment, pondering the investments made by key institutions in every jurisdiction, and on the lessons learned. It also looks at new ways forward, unpacking the uncertainty that seems sure to remain in 2023.

Digital transformation has been difficult; limited success is often a reality before coding even begins — for several reasons.

First, C-suites need board engagement to help them address skills gaps in the workforce. Second, digital transformations require funding, but in ways that differ from traditional growth strategies, which can be challenging. Risk also must be managed — but in a new operational space, firms have limited experience dealing with a host of new vulnerabilities.

Add to this scenario the fact that 2,000 CIOs and CTOs around the world have identified a lack of multi-year commitment from top management as the main factor hindering the success of their cloud strategies.

In any business or digital transformation, there is an essential question to consider: Do customers and employees have better experiences as a result? Transformations that empower the workforce lead to more efficient servicing of dynamic customer needs. There must be access to data and AI platforms for optimal performance — combining human and digital intelligence. Transformations that enable better experiences help the enterprise move from reactive to responsive across the value chain.

In 2023 and beyond, what sits at the heart of growth and performance, cost and efficiency, risk and compliance?

It’s people.

It’s experiences.

The 2023 Global Outlook for Banking and Financial can be found at: ibm.co/2023-banking-financial-markets-outlook

About the Author

Author: Paolo Sironi

Paolo Sironi is the global research leader in banking and financial markets at IBM, the Institute for Business Value. He is a former start-up entrepreneur and quantitative risk manager in investment banking. Paolo is the author of literature about finance, banking, and digital innovation. Member of the IBM Industry Academy, his latest bestseller Banks and Fintech on Platform Economies explores how platform theory, born outside of financial services, will make its way inside banking and financial markets to radically transform the way firms do business.

Visit Paolo’s website thePSironi.com for more information.

You may have an interest in also reading…

AIM 2015 Focuses in FDI Based on Innovation and Technology Transfer to Achieve Sustainable Development

Foreign Direct Investment (FDI) projects are key means to continue the development of local skills and provide sustainable job opportunities.

Embracing ESG Transformation: Turning Ambitions Into Action

Two PwC Luxembourg partners giving support and guidance to companies in their transformation journeys. This year brought with it the

Grand Old Party: Wacky Is the New Normal

In contemporary US politics, reality is whatever the eye of the beholder wishes to ignore. Though the art and science