Otaviano Canuto, World Bank Group: China, Brazil – Two Tales of a Growth Slowdown

China and Brazil are both facing a growth slowdown, as compared to the period prior to the global financial crisis. They were both able to respond with aggressive anti-cyclical policies to the post-Lehman quasi-collapse of the global economy. In both cases, such policies led to a growth rebound by reinvigorating previous patterns of growth. This brought forth the exhaustion of such patterns and the need to transit to other growth regimes.

Their previous growth models were mirror images to each other, in the sense that ultra-high investment to GDP ratios in China contrasted with low ratios in Brazil. China climbed up the ladder toward an upper middle income status along the last three decades, becoming the second largest economy in the world. Brazil in turn has remained in its relative position, in a sort of “middle income trap”, notwithstanding its improved macroeconomic performance – combined with substantial poverty reduction – in the 2000s. Both countries are currently facing a common challenge of reforming policies toward new growth directions, as well as a legacy from the post-Lehman crisis response.

China: From the Great Transformation to the Great Transition

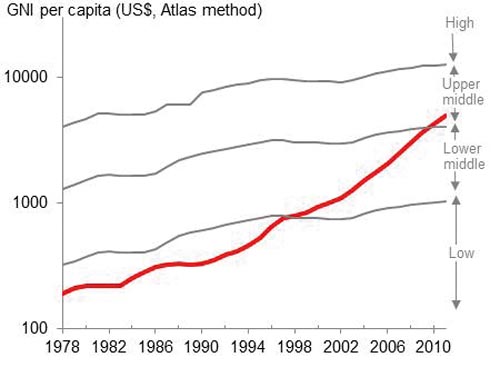

The Chinese economy has changed dramatically over the last three decades. While its per-capita income was only a third of that of Sub-Saharan Africa in 1978, it has now reached an upper-middle income status, lifting more than half a billion people out of poverty. The numbers are dramatic: per capita income has doubled for more than a billion people in just 12 years (Chart 1). What was once a primarily rural, agricultural economy has been transformed into an increasingly urban and diversified economic structure, with decentralization and market-based relations rising relative to the traditional government driven command-based economy.

Chart 1 – China’s GNI Per Capita Source: Schellekens (2013)

Keeping that extraordinary pace of transformation over the next decades will demand a change of course (World Bank and DRC, 2013). The Chinese pattern of rapid growth with structural change has been accompanied by rising economic imbalances, just as the main pillars of growth seem to be gradually weakening. High and sustained GDP growth rates were based on elevated investment to GDP ratios, which in turn were only possible with low shares of wage income and domestic consumption, as well as with cheap and repressed finance. Another factor was dynamic markets abroad willing and capable to absorb a huge Chinese export expansion. Today, the economic doldrums faced by advanced economies are challenging the growth pattern associated with twin current and capital account surpluses. Growing income disparities were a domestic flipside of that model, becoming potential sources of social strain, in addition to changes in the external environment.

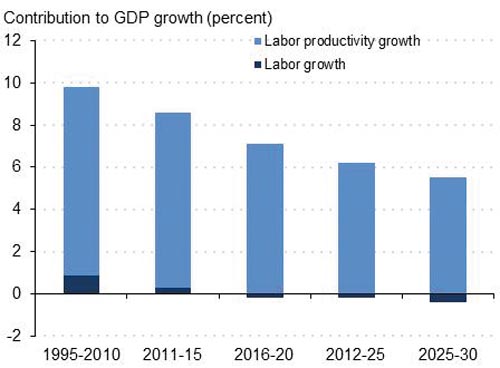

Schellekens (2013) highlights three mutually reinforcing paths of transformation ahead in the Chinese economy. First, a structural slowdown of growth looks clearly to be in the cards. The productivity increases and growth seen through transferring resources from low-productivity agriculture activities to industry — a typical feature of economies moving from low- to middle-income levels (Canuto, 2013) — has to a large extent already happened. On the demographic front, the old-age dependency ratio will likely double in the next two decades. Furthermore, gains in economic efficiency and technological progress based on absorption of existing, imported technologies have from now on to be increasingly replaced by local innovative efforts. The set of second-generation policy reforms necessary for that will require time to bear fruit, whereas low-hanging fruits in terms of productivity increases will be less available (Chart 2).

Chart 2 – China: Prospects of Labor-related Sources of Growth Source: Schellekens (2013)

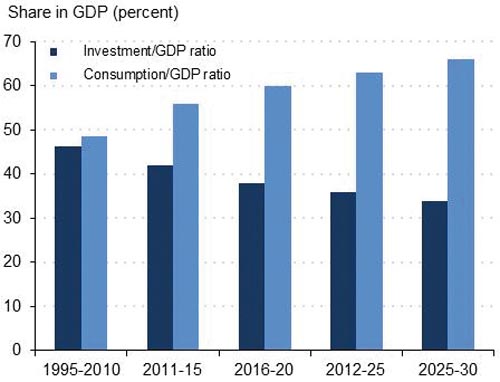

Second, a required rebalance is expected. Higher shares of services and consumption, following rising wages, with a decrease in exports, savings and investment ratios to GDP, must accompany the increased reliance on domestic sources of aggregate demand. Government consumption is also to rise, in order to meet social demands, as well as the needs of operations and maintenance. The income gap between coastal areas and middle and western regions should fall as the pool of underemployed labor shrinks. Interestingly, the perception of rising prosperity by the population will likely be higher than before, with rising purchasing power, despite somewhat lower GDP growth rates.

Chart 3 – China: Investment and Consumption as Shares of GDP Source: Schellekens (2013)

Third, a shift up the value chain in both tradable and non-tradable activities shall augment the previous paths of change. A transition to more sophisticated production processes is a target being already pursued.

Ripples of China’s Transformation

Ripples of China’s economic metamorphosis will be felt abroad in the years ahead. One channel of transmission is likely to be through their demand for imports. Its growth rebalancing will tend to favor commodities more associated with consumption, like agricultural goods, while metals and minerals will be negatively impacted in relative terms by the investment slowdown (although the latter may be partially offset by a still rising demand for residential construction and durable goods in the medium term). Meanwhile the rising share of services will lead to import leaks depending on current trends toward increasing tradability. Current imports of capital goods will move toward more sophisticated ranges.

A second channel will be through the erosion of China’s current competitive edge on low-cost labor-intensive manufacturing. Notwithstanding some reasons pointed out by Schellekens (2013) for why the out-migration of those activities “may not happen overnight and may never play out fully”, a window of opportunity will open to those countries with appropriate endowments and policy actions to benefit from the Chinese domestic factor price evolution.

Finally, a third channel of transmission will be China’s march up the value chain, establishing a new front of head-to-head competition abroad. Both winners and losers may be produced in the rest of the world, depending on whether a country faces the challenge by introducing its own structural reforms to support innovation and adaptation to the new context, including by strengthening its position in the range of high-end goods and services.

The metamorphosis of the Chinese economy may involve painful growing pains, including the risks of a hard landing that many analysts attribute to the current transition. A set of structural reforms will be essential, including a strengthening of the public provision of social services and protection, in order to induce lower household savings. Furthermore, as we outlined in Canuto (2013), the experience of economies that have succeeded in moving up the income ladder suggests a need to reinforce property rights and other market-economy features. It is in remolding banking out of a “command-and-control” system that, perhaps, the challenge will be highest. Particularly because of the legacy in terms of excess credit – especially through non-banking institutions – and over-investment that followed the stimulus package after 2008.

Brazil: The Twilight of a Consumer-Led Boom

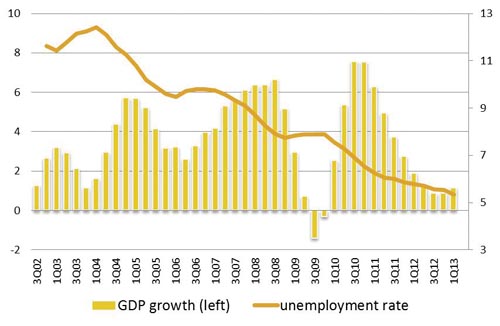

After the 2008-09 global financial shock, Brazilian unemployment rates have remained at low levels and the economy rebounded in 2010, as a result of aggressive fiscal and monetary crisis-response policies (Chart 4). However, the overall GDP performance has been lackluster, and prospects for 2013 look not much brighter. The sharp downfall of production, investment and exports of the Brazilian manufacturing industry in the last two years has signaled that something deeper is at play (Canuto, Cavallari, and Reis, 2013).

Chart 4 – Brazil: GDP growth and unemployment rates Source: World Bank

Brazil had indeed a good ride, with a long spell of economic growth. Poverty rates and income inequality have diminished steadily now for more than a decade, with the labor market dynamics playing the major role, besides targeted social policies and a steady rise in access to education (Canuto, 2012). But some of the economic drivers from last decade have clearly been exhausted.

Some structural reforms and policy refinements enacted mainly in the period spanning from 1994-2005 yielded results in terms of productivity increases along the first decade of the new millennium. I would highlight the consolidation of stabilization gains – in terms of lower macroeconomic risk premiums and correspondingly higher levels of sustainable credit across the board – after the government transition in 2003 with a reassured (and tested) commitment to fiscal responsibility and macroeconomic stability. Benefits from the post-privatization revamp in telecommunications, as well as institutional innovations improving credit risks in several fronts – e.g., payroll-bill loans, a new bankruptcy law, and improved recovery of guarantees – also helped. Steady technology-laden productivity gains in agriculture have also been remarkable.

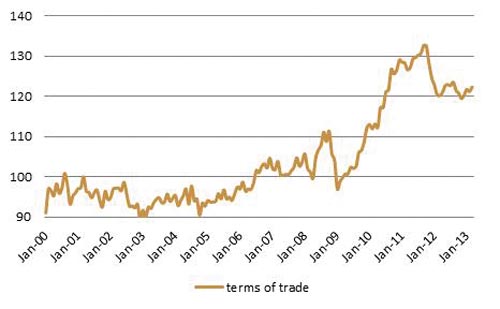

Favorable external factors also supported the Brazilian domestic real-side economic dynamics. Commodity price rises and improved terms of trade – Chart 5 – enabled not only the strengthening of balance-of-payments conditions and external accounts, but also generated domestic positive wealth effects in a reasonably widespread way, through agriculture land and real estate. Notice that terms-of-trade gains have not fully reversed and commodity prices have been hovering around current levels.

Chart 5 – Brazil’s Terms of Trade Source: FUNCEX

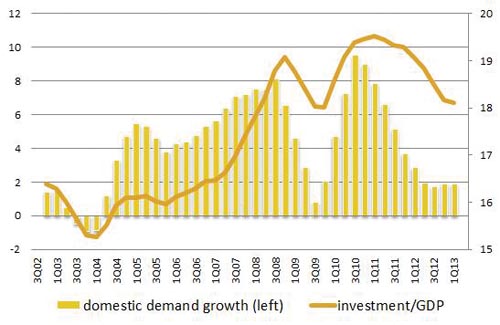

The combination of favorable external factors (including wealth effects), productivity gains, improved household credit risk, and government policies of raising minimum wages at a pace above those productivity gains then sparked a self-reinforcing virtuous dynamic between steady decrease of unemployment rates (Chart 4) and booming domestic aggregate demand (Chart 6). However, such pattern of growth was poised to exhibit a limited – even if long – breadth, unless boosted or superseded by other sources of dynamism. The growth spurt in 2010 was a sort of last vent of the previous pattern of growth, as counter-cyclical policies mainly anticipated the use of the remaining existing space for sustainable household credit.

Chart 6 – Brazil: domestic demand growth and investment ratios Source: World Bank

What happened to “animal spirits”?

The subsequent fall in investment ratios – which remained all the way below 20% (Chart 6) – has taken place on the private-sector side: according to the Institute of International Finance (IIF) estimates, the ratio of private investment to GDP declined from 14.3% to 12.7% last year, more than compensating for the increase of 0.4 percentage points in public investments to 5.4% of GDP. So, why haven’t the entrepreneurial “animal spirits” waken up and taken the lead at some point of the long growth spell? Why have private sector investments retrenched more recently?

First of all, it is worth noticing that low investment ratios since the 1980s have been a flipside of low infrastructure investments, a factor that has become an increasingly tightening bottleneck – and productivity deterrent – as the economy grew in size. Furthermore, while the macroeconomic dimension of the Brazilian “investment climate” improved, the pace of microeconomic reforms nearly stalled in the last few years. Key financial intermediation reforms have been implemented, but complex tax systems and costly business transactions still correspond to a heavy toll on the value added generated by private investments. Large physical investments face hindrances derived from complex, uncertain and costly processes of authorization and implementation.

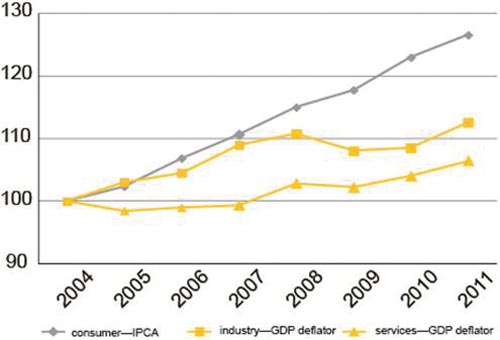

Second, those factors became especially stringent on the manufacturing-industry side as the recent pattern of growth unfolded. While the resource-based tradable side of the economy was ring-fenced by a favorable price dynamics abroad, and non-tradable services could respond to rising wage costs by marking-up their prices, the non-resource tradable part of the economy faced increasing costs – real wages and service inputs, including infrastructure-related ones – and crushed profit rates. Despite creeping ratios of manufacturing import penetration, the surviving manufacturing park could chug along while domestic demand kept going up. That’s why, suddenly, the combination of rising costs and the perceived inflexion on consumer demand growth looked like a “competitiveness cliff” (Canuto, Cavallari and Reis, 2013).

This is illustrated in Chart 7, where those effects are examined through the lens of different wage gains by consumers and producers. Nominal wages are deflated there not only by the index of consumer prices (IPCA), but also by the GDP deflator for the specific sector. Gains realized by consumers can be gauged by deflating wages by the consumer price index (IPCA). Clearly, the latter benefited from higher terms of trade. However, few producers could take partial advantage of better prices and pay higher wages, alleviating some of cost pressures. Demand for labor can still be argued as greater than in the absence of this external shock, and the economy moved toward full employment. Therefore, cost pressures revealed to be much more intense in non-commodity-related industrial sectors. Notice how real wage costs went up particularly after 2008.

Chart 7 – Brazil: real average wages Source: Canuto, Cavallari and Reis (2013)

Third, the path to a reorientation of public policy chosen by the government has not lifted animal spirits as intended. The intensive resort to targeted tax relief and trade measures, and to expanding subsidized lending partially backfired as they generated a wait-and-see (or rent-seeking) attitude by investors. The manifested proclivity to cap or drive rates of return in energy and infrastructure concessions has also shun investors. Confidence on policy making eroded further as those targeted fiscal measures were seen as a failed attempt to avoid anti-inflation fiscal and monetary policies, particularly as inflation rates slid toward the upper limit of the 2.5-6.5% inflation target.

In a chapter apart, Petrobras has been overburdened with ambitious and conflictive objectives: raise corporate financial leverage to comply with its responsibilities on Pre-salt oil exploration, contribute to lower inflation by absorbing imported oil price hikes, and implement local-content requirements. Is investments and purchases – and corresponding multiplier-accelerator effects – have been below potential.

Moving to an investment-led new growth cycle will be faster if attention is focused on those structural factors that have maintained investment ratios below the 20% ceiling, instead of attempting short-cuts with policy tinkering. A framework of public-private partnerships that leads to a more intense crowding-in of private investment and management in infrastructure is necessary. The overall agenda of improving the investment climate and “doing-business” conditions must also be retaken.

Furthermore, a review of the current pattern of government expenditures, with shrinkage of transfers non-targeted to the poor, should also open fiscal space for raising public investments. In this regard, the mass movement on streets last June, during the FIFA Confederation Cup, may have constituted a wake-up call for such a review. In what may be called a “football spring” – given that the beauty and costliness of newly-built stadiums seem to have constituted a trigger of widespread manifestation – the population complained about the current quality of public services (health, transportation, security, and education) and a perceived aloofness by the political establishment. Public sector management and governance issues have now come to the fore on the political agenda, and there is no sustainable way to respond to that but by undergoing a review of government tax and spending policies.

Concluding Remarks

Together with other emerging markets and developing countries, China and Brazil are among those countries expected to play a major role in rescuing the global economy from its current doldrums. Depending on their ability to tap on existing potential sources of growth, those countries may even reverse roles with advanced economies and “switchover” positions as growth locomotives in the global economy (Canuto and Giugale, 2010). However, as illustrated by the Chinese and Brazilian experiences – including the on-going inflection on their growth trajectories –appropriate domestic reforms and policies shall be in place for that scenario to become full-fledged.

About the Author

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

References

Canuto, O. and Giugale, M. (eds.), 2010. The day after tomorrow: a handbook on the future of economic policy in developing countries, Washington: World Bank.

Canuto, O., 2012, Bucking the trend: poverty reduction and inequality in Latin America, Huffington Post, June 7.

Canuto, O., 2013. Overcoming middle-income growth traps, Capital Finance International, Winter 2012-2013, p.88-89.

Canuto, O., Cavallari, M., and Reis, J.G., 2013. The Brazilian competitiveness cliff, Economic Premise n.105, World Bank, February.

Schellekens, P., 2013. A changing China: implications for developing countries, Economic Premise n.118, World Bank, May.

World Bank and DRC – Development Research Center of the State Council, The People’s Republic of China, 2013. China 2030: Building a modern, harmonious, and creative society.

You may have an interest in also reading…

Ross Jackson: The EU as a Green Powerhouse – A Green Opportunity

The recent revelations regarding our American allies’ spying on Angela Merkel and other leading EU politicians, raises – once again

Partners Who Put Their Faith in Egypt’s Burgeoning Economy

Aly El Ghannam and Marwan El Khedry – “The Partnership”, as they choose to be called – established Ostoul Capital

Cement Recycling: a Breakthrough for More Sustainable Construction

Reuse and recycle — it makes sense, even in the most basic steps of the building trade… The global construction