Lord Waverley: Africa Enters an Age of Optimism

The upcoming UN General Assembly (UNGA) in New York presents an opportunity for world leaders to assess the drivers of global uncertainty. In doing so, Africa must not be sidelined. Genuine engagement with the continent is essential as a matter of shared global interest. A recalibrated international framework must prioritise the promotion and protection of African nations’ interests, enabling them to thrive within a more equitable and sustainable global order. This requires strategic commitments.

The global community must redouble efforts to implement the Sustainable Development Goals (SDGs), especially those targeting poverty alleviation, education, healthcare and gender equality. Strengthening healthcare infrastructure and pandemic preparedness (ensuring equitable access to vaccines and medical resources) should be a key focus. Likewise, Africa requires robust financial and technical assistance to meet the dual challenges of climate adaptation and environmental sustainability.

Genuine partnerships must replace paternalism. Africa’s role in a multipolar world must be defined not by dependency but by sovereignty. Economic engagement should be based on mutual respect and aligned interests. That includes fostering inclusive growth, advancing technology transfer, and building regional value chains, not extracting raw materials for external gain.

Conflict remains a challenge in parts of the continent. Continued diplomatic mediation and peacekeeping support are necessary in fragile states. Yet the longer-term imperative is to invest in African-led capacity-building: strengthening governance, reinforcing civic institutions, and supporting the rule of law. An Africa truly governed by Africans, for Africans, must foster ownership, agency and accountability. Development must be holistic embracing the political, social, economic and cultural dimensions of growth.

Education plays a transformative role in this vision. While a privileged few have accessed foreign education, far too many still lack basic learning infrastructure. Investment in quality education (especially in rural areas) must be matched by the rollout of vocational and digital skills programmes aligned to local industry needs. New technologies, including AI and digital connectivity, can help bridge infrastructure gaps and unlock new opportunities for youth employment.

The African Continental Free Trade Area (AfCFTA) has created the world’s largest free trade zone by number of member states, covering 1.3 billion people with a combined GDP of \$3.4 trillion. This platform offers Africa the chance to boost intra-regional trade, industrialise on its own terms, and raise living standards continent-wide. If harnessed effectively, AfCFTA will be the bedrock of Africa’s transformation: driving investment, facilitating regional supply chains, and anchoring long-term economic resilience.

Africa is not homogenous. Its history is marked by linguistic, political and cultural diversity, ranging from anglophone, francophone and lusophone spheres to the Arabic-speaking North African bloc. These distinctions carry real implications for development, integration and diplomacy. Yet rather than sources of division, they can be bridges to wider global partnerships, if approached with strategic foresight.

Portuguese-speaking Africa is increasingly attractive to investors. Angola, Cabo Verde, Guinea-Bissau, Mozambique to name a few, that share historical and linguistic ties to Portugal and Brazil. They are offering incentives to attract investment across sectors, from agriculture to energy. Mining is growing in prominence in Burkina Faso and Niger, while hubs like Casablanca, Abidjan and Dakar are positioning themselves as gateways to francophone markets and beyond.

North Africa (from the Maghreb to Egypt) is a region of strategic weight. As an energy provider, a trade nexus, and a proximity partner for Europe and the Middle East, it holds immense geopolitical and commercial significance. Its role in building value chains and sustainable trade corridors should not be underestimated.

Looking forward, Africa has the potential not just to join the digital revolution, but to lead aspects of it. Two initiatives exemplify this shift. First, the UN’s Model Law on Electronic Transferable Records (MLETR) is laying the groundwork for paperless trade. By enabling electronic and physical documents to operate in parallel, it accelerates supply chains, reduces transaction costs and improves liquidity, especially for SMEs. Removing the reliance on physical paperwork enhances speed and transparency and will boost Africa’s participation in global trade flows.

Second, a dedicated foreign trade data analytics platform, AdamFTD, is under development. It will leverage big data to map supply chains, forecast market trends, and identify trade and investment opportunities. For African exporters and policymakers, this tool can support decision-making, improve competitiveness, and foster smarter integration into global markets.

Intra-African trade is vital for sustainable development. By creating regional markets for African goods and services, nations can reduce dependency on commodity exports and diversify into higher-value sectors. Infrastructure development (particularly transport, logistics and communication systems) is central to this agenda. Connectivity will not only enhance trade flows but catalyse job creation, attract foreign direct investment, and deepen economic ties across borders.

The optimism surrounding Africa’s potential must be accompanied by practical steps. The continent is move beyond its colonial-era fragmentation. Francophone, anglophone, lusophone and Arabic-speaking states are increasingly aligning their efforts. While anglophone giants such as Nigeria, South Africa, Kenya and Botswana often dominate the headlines, there is growing momentum in the francophone world.

Francophone Africa is expected to record some of the highest growth rates on the continent. Côte d’Ivoire, for example, is projected to be the fastest-growing economy in sub-Saharan Africa. With a total market of more than 350 million people and a predominantly young demographic, the francophone bloc presents a compelling case for investment across sectors, from agribusiness to fintech.

There is a palpable desire within these countries to build more diverse partnerships. Moving beyond former colonial relationships, there is increasing interest in engaging with Asian, Middle Eastern and Latin American partners. This multi-vector diplomacy creates new opportunities for investors and expands Africa’s strategic autonomy on the world stage.

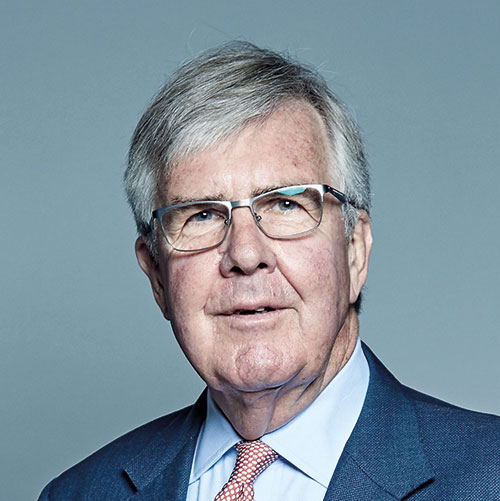

President Faustin-Archange Touadéra

One country exemplifying the risks of non-engagement and the promise of renewal is the Central African Republic (CAR). Though long associated with conflict and instability, CAR is now charting a course toward reconciliation and reform. During a recent visit to Bangui, I had the honour of inviting President Faustin-Archange Touadéra to visit the United Kingdom. His upcoming trip, timed ahead of the UN General Assembly, will mark the first such visit by a CAR head of state and open new avenues for bilateral cooperation.

CAR’s future holds promise. The recent peace agreement signed on April 19, 2025, between the government and tribal-affiliated armed groups, fostered stability and creating opportunities for reintegration and development. This deal, marked by the dissolution of major rebel groups on July 11, 2025, signals a potential for improved security and economic growth. Strategically located in the heart of the continent, the country has the potential to become a transit hub for African trade, linking regional markets through improved infrastructure and transport corridors. Its mineral wealth (including diamonds, gold, uranium and timber) can be responsibly leveraged for development. And its vast arable land presents opportunities for agricultural self-sufficiency and job creation.

President Touadéra has committed to disarmament and inclusive governance. If implemented successfully, CAR could serve as a model for post-conflict recovery elsewhere on the continent. Its natural endowments, combined with political will and international support, could turn it into a beacon of sustainable development.

More broadly, the current retreat in Western development assistance risks creating vacuums that others are quick to fill. Countries such as China have stepped in where the United States and United Kingdom have scaled back. This is not a call to return to aid dependency, but to advocate for a more strategic use of aid, anchored in economic transformation and private sector engagement.

Too often, aid donors and business investors operate in parallel rather than in partnership. This must change. Triangular dialogue between African governments, donors and commercial actors is essential. Aid should not be a substitute for trade and investment, but rather a tool to create enabling environments, supporting infrastructure, regulatory clarity and capacity-building that allows private capital to flourish.

The old mantra of “trade, not aid” must evolve. The new imperative is to align aid with investment, to ensure development financing is catalytic, not paternalistic. By creating shared value and sustainable returns, Africa can attract the capital it needs while advancing its own priorities.

As Ghana’s Foreign Minister astutely remarked: “Africa’s future cannot be built abroad; it must begin at home.” That future must rest on the principles of rule of law, democratic governance, and zero tolerance for corruption. Free and fair elections, strong institutions, and accountability must underpin Africa’s rise.

Africa stands at the threshold of a new era. The continent has the human capital, natural resources, and entrepreneurial spirit to shape its own destiny. But to realise that potential, the global community must engage not as benefactors but as partners, supporting Africa’s ambition while respecting its agency.

The age of African optimism is not a mirage. It is a call to action for Africa’s leaders, for its people, and for the world.

Author: Lord Waverley

Contact: [email protected]

You may have an interest in also reading…

United Nations Office for Project Services (UNOPS): Infrastructure to Empower Women

On the face of it, building a road is simply about connecting two points. In reality, a road is so

BBE’s CEO & MD Victor van der Kwast: AI is Certainly Coming to Banking Sector — It’s All About Integration

BBE’s CEO and managing director Victor van der Kwast initiated an all-encompassing, digitally focused transformation journey in 2020. It has

Upcoming Greek Vote a Buying Opportunity?

Mark Zandy is worried that Greece may yet prove the undoing of the euro as the country prepares for elections.