Investing in Africa? Here Are Six Reasons to Choose Ghana

The West African nation is on the rise in several vital areas, including stability and ease of doing business…

As the world shakes off the dust of the recent recession, the search is on for the next global commerce hotspot. Emerging markets in Africa, Latin America and the Middle East are all viewed as potential new engines of growth.

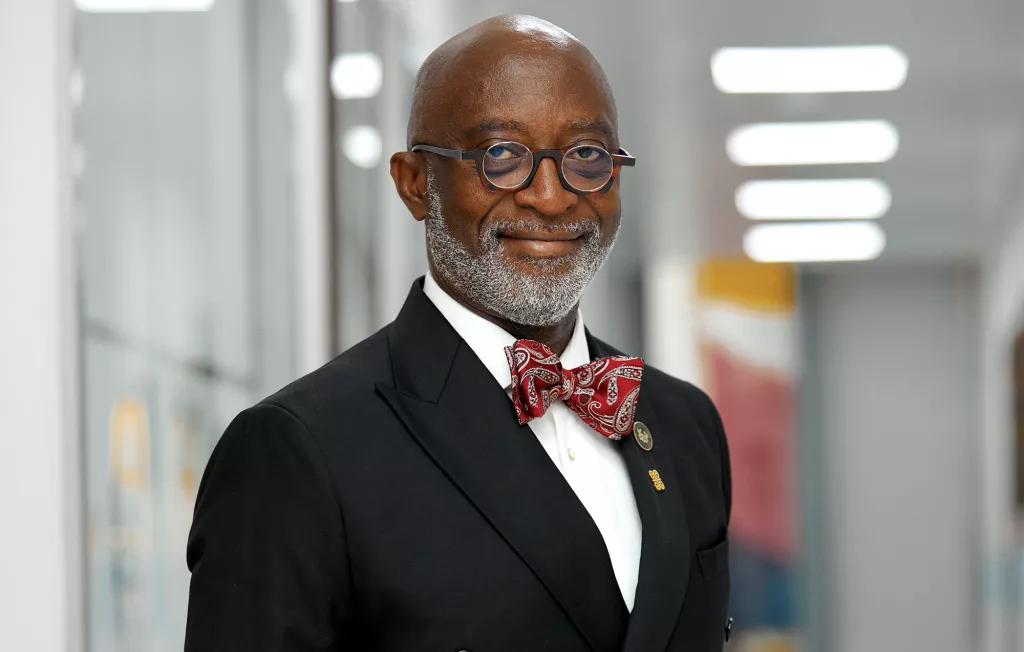

CEO of Ghana Investment Promotion Centre (GIPC): Yofi Grant

Amid hot debates and ponderings, the case for Africa is growing stronger by the day. It continues to show strong indications of a significant take-off — soon.

Africa the world’s second-largest continent in terms of area and population, and has a wealth of untapped natural resources.

There is also great promise for sustainable agriculture, and the establishment of the Africa Continental Free Trade Area (AfCFTA).

The great continent now has the largest free market in the world — and the Ghana Investment Promotion Centre (GIPC) is ready to let that fact be known.

With the ongoing economic revival in Africa around it, Ghana has established itself as the nation to watch in terms of trade, investment, and tourism. It combines a conducive business climate, transparent regulations and political stability as well as one of the continent’s most favourable economic environments for investors.

There are six good reasons why the country has taken centre-stage in investment discussions.

Ghana’s Independence Arch

Stability and Security

Ghana is ranked as the most stable political environment in West Africa, with advanced democratic institutions and systems to ensure good governance and application of the rule of law. On the Global Peace Index, the country occupies first place in West Africa, and second in the whole of Africa.

Ghana’s strong and transparent democratic institutions have made it a beacon of hope for the region — and the safest place to hone your investment skills.

Strong Resource Pool

Ghana is resource-rich, possessing an enormous pool of untapped raw materials that can be leveraged, especially now, amid its industrial revolution.

The country is the number one gold-producing country on the continent, and the second-largest cocoa producer in the world. It also has the third-largest bauxite reserve in Africa, with an estimated reserve base of 900 million tonnes valued at $50m in its raw state — and $400bn when refined.

Ghana has five million hectares of arable land, four million hectares of cultivable land, and 228,792 hectares of irrigable land. This is in addition to more than 189,000 barrels of oil produced daily and eight trillion cubic feet of natural gas reserves.

Ease of Doing Business

Ghana has some progressive policies, including a vision to transform it into an industrialised nation by 2030. Those policies have created a business-friendly environment. Ghana is one of the best places in West Africa according to the Ease-of-Doing-Business reports. In 2023, the AT Kearney Global Services Location Index adjudged Ghana the best destination for investment in West Africa, and the third-most attractive on the entire continent. Ghana is regarded as one of Africa’s most competitive economies by the World Economic Forum’s Global Competitiveness Index.

Accessibility

With an average eight-hour flight time to and from Europe and the Americas, Ghana is geographically the closest country to the centre of the earth, according to the World Population Review.

Investors looking to export, or access markets in regions like the Americas, Asia, and Europe, will find Ghana to be a prime location because of its location on the globe.

Investors have easy access to the rest of the world through Ghana’s main airport, Kotoka International — again, ranked as the best in West Africa, and the best in Africa for service. In addition, Ghana also has Tema Port, one of the largest in West Africa. An excellent network of trunk highways serves the port, making it easier to conduct business.

Competitive Labour Force

Businesses in Ghana have a huge available pool of skilled and trainable workers. The country has one of the highest literacy rates in West Africa, according to the World Bank Group, as well as the most competitive minimum wages in the sub-region. This is beneficial for businesses setting up in Ghana: it ensures low production costs and ease of obtaining, and retaining, a skilled workforce.

Headquarters of AfCFTA

As an emerging economy playing a central role in Africa’s Free Trade Area Agreement (and hosting its Secretariat), Ghana is in pole position to work with investors. The go-ahead policies and dynamism of the country make it easy to access products and services from a continent-wide market of 1.3 billion people.

As the headquarters of AfCFTA, Ghana’s hospitality industry will receive a boost, as will its services sector. The alliance will also generate increased international exposure. This greater visibility, along with increased investment, will further stimulate trade, creating opportunities for Ghanaian businesses as well as those seeking access to the African market.

Ghana is on the path to becoming a regional commercial powerhouse as it continually adopts policies that reduce the general cost of doing business to incentivise investors.

The country is not only the best place to do business in West Africa, it’s a hub that connects investors to the vast African continent.

The government’s investment promotion wing, GIPC, plays a pivotal role in helping investors navigate Ghana’s business environment. It provides insights on opportunities and incentives, and follows-through with necessary guidelines and assistance to help investors manage risks.

These efforts have brought about the desired result: a positive business environment that enables local and international investors to capitalise on opportunities — and grow their businesses.

You may have an interest in also reading…

NBG Securities: Redefining Investment Services with a Vision for Growth

As a subsidiary of the National Bank of Greece, NBG Securities has evolved into a top-tier brokerage firm, leveraging its

Unleashing the Economic Potential of the Maghreb – the Role of Foreign Investment

Excerpts of a speech given by Christine Lagarde, Managing Director, International Monetary Fund at a conference in Mauritania in January,

Otaviano Canuto, World Bank Group: Navigating Brazil’s Path to Growth

Brazil’s macroeconomic management faces four major immediate challenges. The response to them will be strengthened if economic agents could have