World Bank on Social Protection in Africa: Can Safety Nets Close the Poverty Gap in Burkina Faso and Ensure Family Welfare?

A beneficiary from the World Bank’s Youth Employment & Skills Development Project and added on Mobile Childcare project. Photo credits: Amina Semlali / World Bank.

With focused and courageous policy decisions, Burkina Faso’s government can cover the country’s poor with an effective and efficient safety net. This end is achievable simply by realigning and better targeting existing expenditures. The reallocation of energy subsidies that mainly benefit the rich would further open fiscal space.

A social safety net is a set of programmes meant to catch you if you fall on hard times.

It is “poverty insurance”, and many countries have some form of non-contributory protection. If you fall below a certain poverty line, you should be eligible and get the benefits at no cost. These safety nets are usually a component of larger social protection systems that also include contributory social insurance, as well as labour market policies and programmes.

Predictable cash transfers to poor households — often in exchange for school attendance or for family health checks — have become one of the most effective global poverty reduction strategies. Investments in these programmes — especially those that target vulnerable children — generate high returns. Each year, social safety net programmes in developing countries lift an estimated 69 million people out of absolute poverty, and assist some 97 million people in the bottom 20 percent.

“There is a clear gap between the impact of current safety nets and the impact they would have if resources actually reached the poorest people. The exciting news is that with improved targeting the poverty gap in Burkina Faso could be eradicated! The size of the actual poverty gap equals 2.26 percent of GDP, which is close to the actual spending on safety nets.”

Life in a rapidly changing world is fraught with complex risks, making social safety nets more important than ever. They help to protect households exposed to shocks from disasters such as droughts, floods, epidemics and illnesses. They are interventions that, in principle, help poor households manage risk and invest in their livelihoods. Without them, poor people are often forced to adopt negative coping strategies that can lead to chronic poverty.

A Central Part of African Development

In Africa, social safety nets have become a central part of development strategies and are being rapidly expanded. While there is substantial variation across countries, on average, governments in Africa spend about 1.3 percent of Gross Domestic Product (GDP) on social safety nets. That rate which is slightly lower than what transition economies spend (on average 1.5 percent).

Although these increasing levels of social safety nets expenditure are good news, the existing programmes fail to cover most of the people living in poverty. In fact, only 18 percent of the poorest quintile in Africa are covered.

Research conducted on social safety nets in Burkina Faso (and presented in the recent book The Way Forward for Social Safety Nets in Burkina Faso) show a similar pattern.

The Land of Honest People

Burkina Faso — the “Land of Honest People”, as the Republic of Upper Volta was named in 1984 by then-president Thomas Sankara — is a landlocked country in West Africa, surrounded by Mali to the north, Niger to the east, Benin to the south-east, Togo and Ghana to the south, and Côte d’Ivoire to the south-west. The country has experienced sustained economic growth over the past decade, primarily due to its main export commodities of cotton and gold — but this growth has not benefited the majority of Burkinabe.

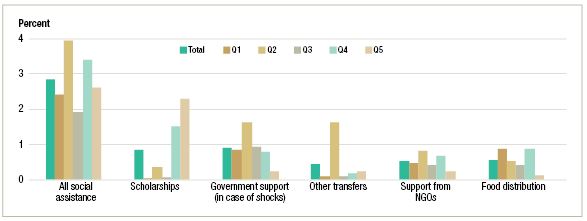

Figure 1: Social safety net coverage by type of program and quintile. (Q1=poorest quintile, Q5=richest quintile)

Although the poverty headcount ratio has declined, the absolute number of poor has increased and extreme poverty is rampant in rural areas. More than 61 percent of its youth are illiterate, the nation is one of the least developed in the world.

Social Safety Net Spending Has Increased

Overall, social protection expenditure in Burkina Faso has increased at a steady pace, which is positive. Expenditure on social safety nets increased from 0.3 percent of GDP in 2005 to 2.3 percent in 2015. This increase indicates a growing Government appetite for finding more effective methods of protecting the poor. Burkina Faso outspends other sub-Saharan countries on social safety nets relative to GDP, but challenges remain.

Yet Only Few Benefit

Social safety net coverage is not in line with poverty, with only 2.6 percent of the entire population benefitting. A notable example is that the fourth-richest quintile (Q4) benefits more from all safety nets than does the absolute poorest quintile (Q1). For example, scholarships benefit next to no poor people.

And Those Most in Need Are Left Unprotected

Coverage in Burkina Faso is not in line with vulnerability across the life cycle. There is an urgent need to use social protection expenditure to build human capital where it matters most: early childhood development, nutrition and literacy.

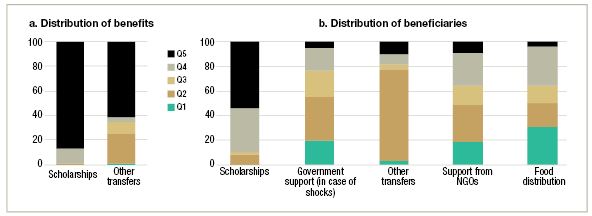

Figure 2: Social safety net targeting, by share of benefits and beneficiaries.

Looking at poverty headcounts by age groups and risks along the life cycle offers important insights on where public interventions should focus. Risks are not evenly distributed and are typically higher earlier in life. Children are the poorest and most vulnerable members of the population, yet only six of Burkina Faso’s main programmes focus on the 0–5 age group. Only two percent of the country’s children benefit from critical early childhood development programmes — the second lowest rate in the World after Afghanistan.

Poorer Regions Are Barely Targeted

Social safety nets are not aligned with poverty across the country’s regions, and mainly target beneficiaries on a geographical basis. Data show that the largest concentration of beneficiaries of cash transfers (34.7 percent) reside in the wealthier Central region, with only a few percent reaching the poorest regions.

Most Safety Net Benefits Are Accrued by The Rich

Distribution of beneficiaries and benefits (the latter is only available for scholarships and ‘other transfers’) also shows that most of the benefits are accrued by the richest quintile.

“Even though many beneficiaries are in the second poorest quintile (Q2), their transfers are small; while the large transfers are mainly collected by a few rich households.”

Moreover, even though many beneficiaries are in the second poorest quintile (Q2), their transfers are small; while the large transfers are mainly collected by a few rich households.

…But the Gap Can Be Closed

There is a clear gap between the impact of current safety nets and the impact they would have if resources actually reached the poorest people. There is a need for better targeting and an integrated approach to assess socio-economic needs. Interventions must be aligned with areas that suffer from high poverty rates and low coverage.

The exciting news is that research and simulations show that the poverty gap in Burkina Faso could be eradicated without increasing current spending on social safety nets. The size of the actual poverty gap equals 2.26 percent of GDP, which is close to actual spending on safety nets.

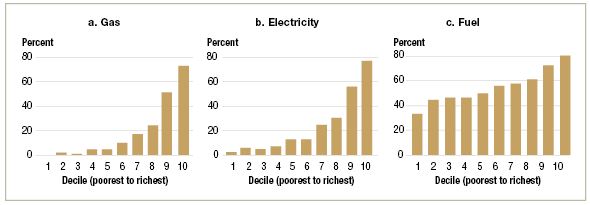

The Richest Reap the Benefits of Energy Subsidies

Part of the social protection budget is allocated for energy (1.05 percent of GDP in 2015). But there is a fundamental problem with this: subsidies benefit the richer segments of society more than the poor. They are expensive and inefficient, failing to deliver value equal to the money spent on them.

…While Fueling Climate Change

Burkina Faso relies on extremely costly imported heavy fuel oil and diesel and buys a large share of its electricity from neighboring countries. Globally, energy subsidies contribute toward climate change by depressing the price of fossil fuels and thereby encouraging greater production and wasteful consumption – and thus carbon emissions. Moreover, energy subsidies discourage needed investments in clean energy. Burkina Faso has, for example, excellent solar irradiation, and solar energy could potentially become a low-cost source of energy.

The government is aware that there are more effective, less costly and more environmentally friendly methods for contributing to economic, human and social development. Energy subsidies have experienced a downward spending trend, with electricity subsidies weighing down the national budget over the past decade. In 2016, the government took steps to try to address this.

Fiscal Space Could Open Up

Simulations conducted for this review show that removing the gas subsidy alone would enable savings equivalent to 0.36 percent of GDP, which is the equivalent to one of the largest existing safety nets programmes (national school feeding). Savings from phasing-out subsidies and redirecting that expenditure toward social safety nets – and to a lesser extent renewable energy – would improve matters.

Figure 3: Share of household income spent on energy consumption, by decile.

Given rapid demographic growth, more resources will need to be allocated to programmes for the poorest and most vulnerable. Funding should be better aimed or the overall budget should be increased. Burkina Faso’s revenue sources are unlikely to create further substantial fiscal space. It is more realistic to reallocate expenditures from less efficient programmes before considering a budget increase.

The poor consume barely any electricity and it is important to educate the public about the benefits of safety net programmes before reducing energy subsidies.

…With A Few Corageous Policy Decisions

Research shows that with focused and courageous policy decisions, several issues related to the Burkinabe social protection system could be converted into opportunities. By regaining the fiscal space, the government could cover the country’s poor with an effective and efficient safety net. This end is achievable simply by realigning and better targeting existing expenditures. The reallocation of subsidies and scholarships would further open fiscal space, some of which could also be directed toward renewable energy.

Safety nets are affordable, while the social cost of not having them is high and disproportionately borne by women and children. It is a precondition for sustainable growth and social inclusion.

This important lesson from Burkina Faso could benefit a global audience of policy makers determined to reduce poverty (and carbon emissions).

About the Authors

Amina Semlali is a human development specialist that works on social protection issues for the World Bank – specialising in labor markets, skills development and social protection policies. She currently works on donor relations and on social protection in the Africa region. Prior to this, Semlali worked on senior leadership development and helped the World Bank articulate organisational strategy. She has conducted applied research on poverty and inequality and provided policy advice to numerous governments in the Middle East. She is an expert on strategic communications and led the communications work for the Bank’s Social Accountability Practice. Semlali holds a Master’s degree in Political Science from Uppsala University, Sweden.

Rebekka Grun von Jolk is an economist with 20 years of experience working on the design, appraisal, implementation and evaluation of policies. Grun has worked with the World Bank since 2005, currently as team leader for Social Protection in the Africa region. Before that, Grun was an advisor to the World Bank president, and led her sector’s re-engagement in the Middle East/North Africa after the Arab Spring. She has guest-lectured at Stanford and Georgetown, and received awards for her research and policy design work. Prior to joining the bank, she worked on the UK Prime Minister’s Strategy Unit and consulting. Grun holds a PhD in Economics from University College London and a lic.oec. from St. Gallen.

Frieda Vandeninden is a development economist with a specialisation in social protection policies. She has worked with the World Bank since 2012 on a wide range of social protection topics, including providing Government technical assistance, organising trainings, social protection policy dialogue, field data collection, and the management of the social protection global database ASPIRE. Vandeninden is the author and co-author of reports on social safety nets assessments and expenditure reviews. Alongside this work, she conducts academic research focused on the evaluation of social protection policies and aid effectiveness at the University of Liege and the United Nations University in Maastricht. Vandeninden holds a PhD in Economics from Maastricht University.

It should be mentioned that the World Bank’s Energy Sector Management Assistance Program (ESMAP) financially contributed to the Burkina Faso Social Safety Nets Review, for which the team is grateful. The Review was made possible with the help of funding generlously provided by the Sahel Adaptive Social Protection Program (ASPP).

You may have an interest in also reading…

A Memorable Faux Pas: Warren Buffett Gets His Facts Wrong

Billionaire investor guru Warren Buffett has come to the defence of the American Dream – the promise of intergenerational upward

Global Wage Report

Global wages remain far below pre-crisis levels, says a new United Nations report, which points to a continuing slowdown in

DESERTEC: Clean Power From Deserts

By Michael Düren Solar power from deserts can contribute significantly to a future renewable energy system. The technically accessible solar