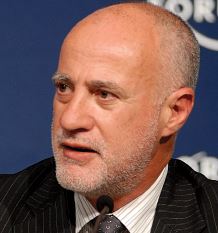

Michael Joseph: Banking for the Masses Fuels Mobile Networks

M-Pesa, mobile money, is the lasting legacy of Michael Joseph’s decade-long term as CEO of Safaricom, the largest mobile network operator in Kenya. M-Pesa allows mobile phone users to send each other small amounts of money, and access a host of other financial services via their handsets. It is, by far, the most developed mobile money system in the world.

M-Pesa, mobile money, is the lasting legacy of Michael Joseph’s decade-long term as CEO of Safaricom, the largest mobile network operator in Kenya. M-Pesa allows mobile phone users to send each other small amounts of money, and access a host of other financial services via their handsets. It is, by far, the most developed mobile money system in the world.

M-Pesa is nothing short of a financial revolution and it took a revolutionary to conceive it. A South African by birth, Mr Joseph – a self-described “Bolshevik character” without the finishing school polish of his peers in the business – left his country in the 1980s to flee the restrictions of apartheid. He went on to tramp the world setting up mobile networks wherever he went: Hungary, Spain, South Korea, Greece and Brazil. In Argentina, he engineered that country’s first mobile network in record time – a feat that is still unmatched.

When he arrived at Safaricom in 2000, the fledging company had about 20,000 subscribers. Part-owned (40%) by Vodafone, the expectation of corporate strategists at the time was that Safaricom could grow to about 400,000 subscribers given the best of circumstances. For the new CEO that was just not good enough. After Michael Joseph was done with Safaricom, the network boasted no less than ten million paying customers.

Over the past three years the company added another three million to its subscriber base. In 2012 the company reported revenue of $1.25bn and an operating profit of about $300m. Safaricom is currently the most profitable business in East Africa and keeps growing both its revenue and its profits at double digit rates.

M-Pesa has been the key ingredient of this astonishingly successful business. As a branchless banking service, M-Pesa enables anybody with a dollar or two to spare for the acquisition of a basic mobile phone to move and keep money – no matter how modest the amount. Customers must provide some form of identification in order to sign up for the service but need not have a fixed address, proof of income or any other document. Paperwork is kept at a bare minimum. The expanding gamut of M-Pesa services is offered at the tiniest of fees, promoting financial inclusion and allowing millions their first taste of banking.

Not one for false modesty, Mr Joseph calls M-Pesa “the mobile phone industry’s greatest-ever innovation”: Perhaps an overstatement, but not by much. M-Pesa now moves about $3m daily in Kenya and neighbouring Tanzania. The service has been rolled out in Afghanistan, South Africa and India with Egypt following shortly.

After leaving Safaricom in 2010, Mr Joseph accepted an offer from the World Bank to join its fellowship programme which aims to tap into development expertise. Earlier this year, Kenyan president Uhuru Kenyatta appointed Michael Jospeh as the chancellor of the Maseno University.

You may have an interest in also reading…

Michael Lewis: Explaining Human Foibles

Few writers can match Michael Lewis’ uncanny sense for capturing, and explaining, the zeitgeist. After detailing the inner workings of

Bill Clinton: Words of Real Value

As nations and economies converge, interdependencies are created between people and give rise to new challenges. To strengthen the capacity

IFC: Banking On Women – Changing the Face of the Global Economy

Women entrepreneurs are changing the face of the global economy, helping to sustain job creation and economic growth. While investors