Paolo Sironi, IBM: Regenerating Banking via Bots — AI Has Our Full Attention

Financial services specialists — like professionals in so many sectors — are embracing the radical technology, to great effect…

Generative AI has seized the world’s attention like no technology before it. Executives are either dazzled by bright futures or dismayed by dystopian scenarios, and boardroom discussions have become polarising.

The financial services sector is not immune to all this.

Banking executives are brainstorming the best ways to assess and prioritise the technology’s economic potential, estimate the access costs, and manage the attendant risks that come with it.

The real power of large language models (LLMs), which underpin generative AI, lies in speed and affordability. Foundational models enable multiple solutions to be derived from one base.

The most widespread application thus far is to shape compelling narratives and conversations. Without underestimating business and ethical imperatives to control bias or “hallucination” risks, generative AI can help to redefine a bank’s competitive edge in client relationships by taking communication to new levels of personalisation. This empowers financial institutions to capitalise on long-term investments in Cloud and AI tech, paving the way for customised and digitalised client interactions.

Smartphones allowed digital banking to mature as a primary engagement platform. A global survey of 12,000 consumers was conducted by IBM Institute for Business Value. Of the respondents, 62 percent were using a mobile app, and 12 using a bank website. While branches still have a crucial role to play in banking intermediation, their numbers have been shrinking since 2012.

In Italy, figures are down 38 percent; stands at 32 percent in Germany, 23 percent in Australia, and 10 percent in France and the US. This is primarily due to intense M&A activity — chivvied along by declining demand and revenue pressures from the low-interest rates over the past 10 years. Branch networks are growing in some advanced and emerging economies, along with economic wealth, the earning capacity of banks, and the provision of services to previously unbanked citizens. Service provision has risen by 53 percent in India, 19 percent in China, and eight percent in Indonesia.

In the short term, the recent hike in interest rates is boosting global banking profits. But given clients’ enthusiasm for the convenience and efficiency of digital banking, a return to branch network expansion is unlikely.

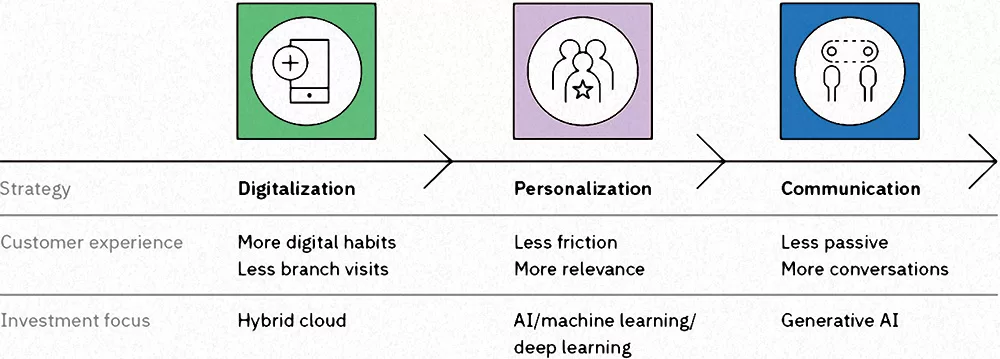

How have banks responded to this increasing digital adaptation, and the need to shift from branches to mobile contact points? Banks have focused on three strategies supporting customer service. Each phase corresponds to a different investment focus in their tech portfolio (see Figure 1).

Figure 1: Evolving with exponential tech. Three technology pillars to build better customer service. Source: IBM Institute for Business Value

Clients, accustomed to managing their personal and business lives via mobile apps, are reshaping the landscape. Already, 16 percent of global consumers are comfortable with a branchless, fully digital proposition — and that figure is significantly higher in advanced and emerging economies. In Brazil, 29 percent of respondents report holding a primary account with a neobank — a firm offering applications, software, and other technologies — to streamline banking experiences.

But providing digital access doesn’t automatically translate to personalised, frictionless digital services. Apps can’t capture the same “soft” information about clients as human branch managers, but machine learning offers new avenues to determine client preferences and needs via their transactions.

Advantages notwithstanding, insights and new information alone have failed to drive a comprehensive shift in client intermediation. Mobile, being demand-driven, is effective for users who can self-direct — but most banking revenues originate from offers. Bank officers typically offer products to clients who rely on them to make informed financial decisions.

Without sufficient conversational touchpoints, many might pivot to digital banking before resolving important financial decisions. While 69 percent of consumers prefer to execute investments online, financial advisors are 29 percent more likely to trigger investment decisions than factors such as access to planning tools, mobile support, or timely news.

First-generation chatbots, powered by natural language processing (NLP), provided rudimentary conversational capabilities to assist clients — but rarely provided an adequate conversational experience. This restricted their capability to handle relationships in a confined, rule-based set of domains.

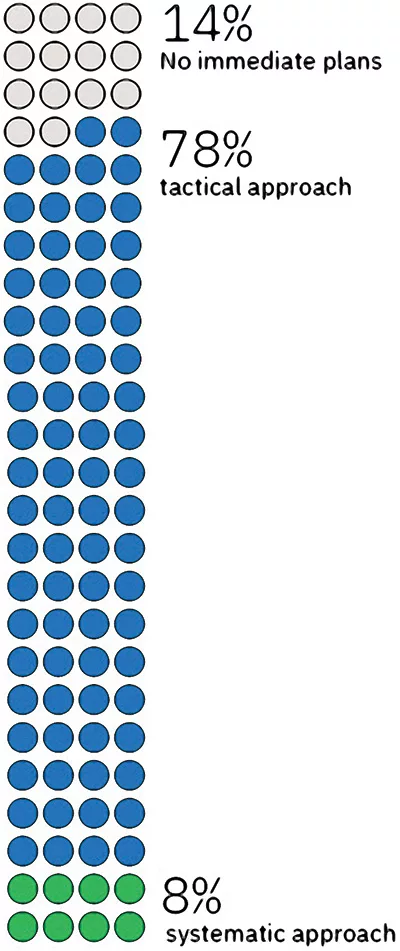

Figure 2: Almost 8 in 10 institutions are tactically implementing generative AI for at least one use case. 8% take more systematic, enterprise-wide approach.

Q: What is you institution’s approach to implementing generative AI for each use case presented? Note: For a list of domains and use cases, please see page 44 of IBM 2024 Global Outlook for Banking and Financial Markets.

As generative AI matures, this barrier is dissolving. While chatbots answer questions, generative AI engages clients and employees by assisting them in task management — with potential impact on productivity and financial performance.

The 2024 Global Outlook for Banking and Financial Markets, published by IBM Institute for Business Value, investigated what’s really going on via a global survey of 600 banking executives worldwide (see Figure 2).

It found 86 percent of banking organisations are in production, or preparing to go live, with at least one generative AI use-case. Eight percent are taking a systematic approach, covering all business domains: client engagement, risk and compliance, information technology, and other support functions. On the reverse side, 14 percent of organisations have no immediate plans to work with generative AI.

No typical starting point or implementation pattern has emerged. The 78 percent of institutions using a tactical approach work on a small number of use-cases or domains — without significant preference. Yet, they reveal more traction in the risk and compliance space, as well as client engagement.

Will generative AI’s potential to transform businesses and boost productivity scratch the surface of these economic models? Or will it help to course-correct their financial performance? The industry average has proved disappointing since the Global Financial Crisis. This requires meticulous assessment.

Banks’ investments in tech are not confined to user interfaces; they also address the need to redesign architectures end-to-end. In 2022, tech outlay in the banking sector averaged seven percent of total operating expenses. Besides technology, total operating expenses include workforce and real estate. Correlating the impact of spending on technology to financial performance is not straightforward.

More than other industries, traditional banking business models strongly depend on macro-economic conditions — and regulation defines application. Most importantly, the total spend does not determine outcomes. It’s the use of technology that holds greater significance. An effective technology spend can increase the value of services that motivate a willingness to pay for superior experiences, protect economic value from cyberattacks, and embed ecosystem interactions into non-banking platforms.

Research commissioned by the ECON Committee of the European Parliament has revealed some banks with a lower IT spend outperformed higher-spending counterparts, emphasising the importance of efficient IT use. Cost-to-income dynamics indicate that many banks struggle to translate efficiency-orientated initiatives into structural gains. Similarly, investments in innovation did not achieve expected productivity outcomes.

While total operating expenses have been growing over the past 15 years, the percentage directed to technology changed less than other domains. Workforce costs increased by almost five percent of the total amount, whole technology and communication expenses by 0.6 percent.

To significantly impact financial performance, tech investment must concurrently address automation and augmentation to re-balance bankers’ contributions to the bottom line, and generate more business value per workforce unit. This cannot happen tactically, but requires investments in platforms and an enterprise-wide strategy grounded on clear AI governance.

That engenders trust — not an easy task as new risks emerge (intellectual property considerations across the AI value chain, for example) and best practices are still shaping risk management.

Generative AI can be configured as a risk-management tool while alleviating the burden of compliance management. But it also presents challenges for financial organisations as they navigate the balance between value, innovation, and risk on platforms that must be both open and trusted. A pragmatic approach is indispensable, guiding institutions through continuous needed to guide the application of this new technology. And this gets personal: every employee must be not only be a risk manager, but also an AI-risk manager.

While the precise impact on productivity is yet to be realised, fully exploiting the benefits is likely to require a human response. What is required is a collaborative effort from industries and regulators, and a wholesale reimagining of business models and workflows. i

For more information, visit: ibm.co/2024-banking-financial-markets-outlook

About the Author

Author: Paolo Sironi

Paolo Sironi is the global research leader in banking at IBM, the Institute for Business Value, and he is author of business literature. His latest Banks and Fintech on Platform Economies has been Amazon bestseller in banking books worldwide.

You may have an interest in also reading…

Global Banking Alliance for Women – GBA: Banking the Female Economy

Inez Murray is the CEO of the Global Banking Alliance for Women, a global consortium of financial institutions driving women’s

Brian Cox: Science for the Masses

Amongst the remains of Kolmanskop, an old mining town in the Namib Desert, a scrawny metrosexual soliloquizes about the nature

Otaviano Canuto, World Bank: Making Returns on Knowledge – How Innovation Can Flow from Globalisation

The April issue of the International Monetary Fund’s World Economic Outlook (WEO) included a chapter on how globalisation has helped