Saudi Aramco PhD Student Wins MIT Research Award

MIT

Zeid Al Ghareeb, a Saudi Aramco sponsored student pursuing a Ph.D. in Petroleum Engineering at the Massachusetts Institute of Technology (MIT), has been awarded a Seed Fund grant of $150,000 for doctoral research from the MIT Energy Initiative (MITEI).

The proposed research was endorsed by founding and sustaining members of MITEI, including Saudi Aramco, BP, Shell, Schlumberger and Chevron, among many others.

Al Ghareeb was recognized for his research titled “Optimum Decision Making in Reservoir Management Using Reduced-Order Models.” Al Ghareeb’s research focuses on broadening the application of oil reservoir simulation for decision making in light of geological, operational and financial uncertainties using fast, physics-based reduced-order models. The award will help in tackling real world problems.

Incorporating operational and financial models with geologic models throughout the decision-making framework is not common, according to Al Ghareeb, and will require collaboration with energy economists, engineers and geologists.

Zeid Al Ghareeb

This multidisciplinary approach to reservoir simulation and management is expected to include seminars and summits through MITEI to address this challenge and emphasize the effect of coupling these models in the reservoir optimization and decision-making process. The goal is to make this process educational to engineers and scientists, and attractive to energy economists.

A recent memorandum of understanding between Saudi Aramco and MIT will help expand the partnership between the school and the company, and includes research encompassing renewable energy, energy efficiency, energy economics, CO2 management and conversion, desalination, advanced materials and a range of hydrocarbon production areas, such as computational reservoir modeling and simulation, geophysics and unconventional gas.

You may have an interest in also reading…

Janamitra Devan: The Innovation Imperative

Overcoming the Myths and Recognizing the Realities of Innovation, Job Creation and Prosperity By Janamitra Devan Innovation drives competitiveness, and

Otaviano Canuto, Center for Macroeconomics and Development: Is There a Middle-Income Trap?

The “middle-income trap” has become a broad designation trying to capture the many cases of developing countries that succeeded in

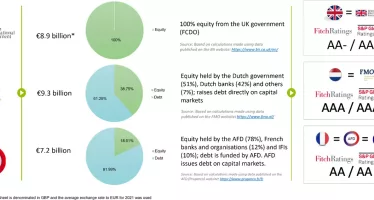

OECD: The Funding Models of Development Finance Institutions

The drum beat of reform is increasing for the development system and particularly for the Multilateral Development Banks (MDBs). While