Colliers: Ireland’s Slow Recovery Contains Some Real Reasons for Optimism

Ireland’s recovery will be slow, as second-wave Covid restrictions are imposed and government employment support is moderated.

Despite low volumes of transactions and international travel restrictions in 2020, big-ticket sales happening on and off the market give grounds for some optimism. But travel restrictions will continue to impact transaction volumes. This is evident when considering the fact that the volume of capital from overseas buyers was some 70 percent of the total in 2019.

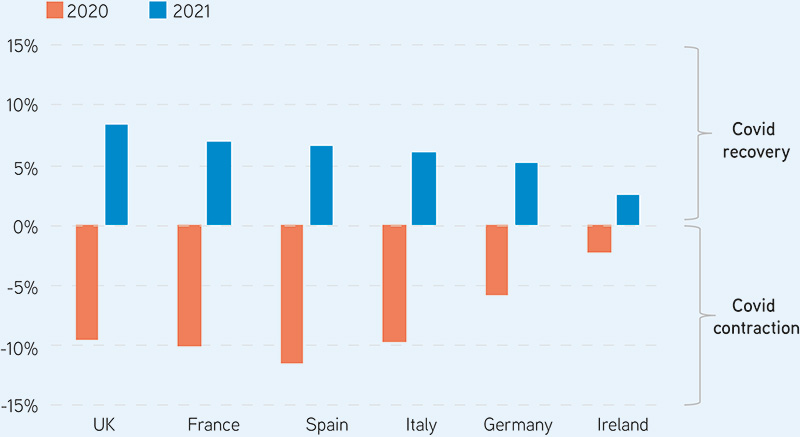

Figure 1: GDP Forecasts for 2020/2021. Source: Oxford Economics, 20th September 2020.

What is encouraging is the continued appetite from buyers to deploy capital in Irish real estate. It is heartening to see new entrants looking at a country that is now an established player in the global capital markets.

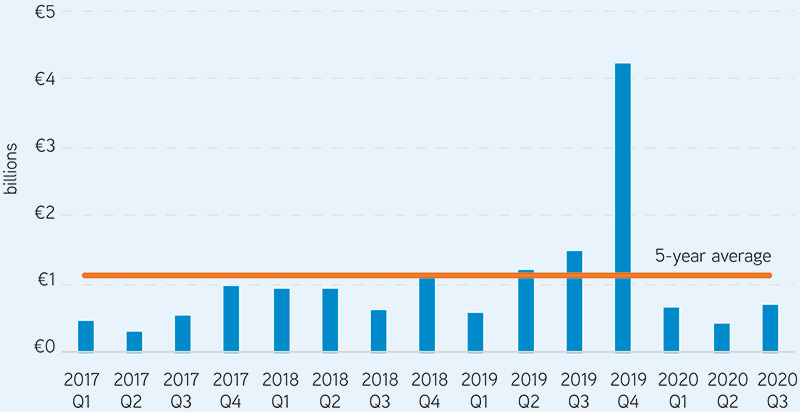

Investment spend this year (depending on the outcome of deals currently being transacted) could comfortably exceed €2.5bn in 2020. Impressive, but a dramatic drop from the €7.5bn spent in 2019.

Buyers are seeking core and core-plus opportunities, with a primary focus on Dublin. Many buyers are looking outside Dublin for opportunities as they seek more value.

Offices, logistics and PRS are the main drivers at the moment. However once the retail, food and beverage, and the hospitality sectors are stabilised in 2021, renewed interest is expected in these sectors. They haven’t gone away.

On sub-€10m deals there appears to be a wait-and-see approach from buyers, which is likely to continue in 2021. Hopes for the initial Irish V-shaped recovery are fading, according to the latest purchasing manager indices. The Irish composite PMI fell to 46.9 in September, consistent with economic contraction. The services sector (45.8), especially transport, tourism & leisure, continues to struggle. Manufacturing (50.0) has slowed due to supply chain disruption and reduced exports attributed to Covid and Brexit, but aggravated by renewed weakness in the Eurozone (50.4). The latest “flash” PMI estimate in October shows further Eurozone weakness (49.4).

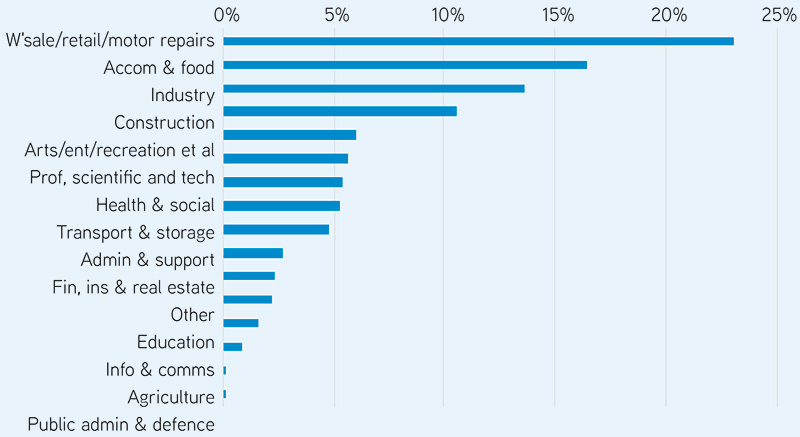

Figure 2: Percent of TWSS recipients (Percent of total recipients between 12 March & 31 August, 2020). Source: CSO

Irish business, financial, and related professional services, as well as the TMT sectors, are less impacted, but are also shedding jobs as government support is reduced. The TWSS (Temporary Wage Subsidy Scheme) ended in August and was replaced by the EWSS (Employment Wage Subsidy Scheme) targeted at businesses whose turnovers are expected to remain down.

Despite closure of the TWSS, the Live Register fell modestly in September to 211,492. This stability suggests that many of the 300,000 workers supported by the TWSS may be finding support in the EWSS (data not yet available).

The Irish government also announced a €17.8bn budget in mid-October which assumes no UK/EU trade deal and no widely available vaccine in 2021. This includes a €3.4bn recovery fund with measures to prevent further job losses, support businesses forced to shut due to Covid restrictions, further Brexit support, reductions in VAT for hospitality, support for tourism businesses and live entertainment.

The corporate rate of taxation remains unchanged at 12.5 percent, despite ongoing EU pressure for EU-wide corporate tax harmonisation. Additional government support may also be forthcoming should the European Recovery Fund disbursement amounting to €1.5bn in EU grants, along with €90m in loan guarantees over the next few years.

Despite weaknesses in the Irish trajectory, Irish annual GDP is forecast to recover to its 2019 level in 2021, although the most impacted sectors will lag behind.

After a fairly dismal Q2 (The Covid Quarter), investment activity accelerated in Q3, up by 63 percent to €700m, compared with €430m in Q2.

Figure 3: Quartelry investment spend. Source: Colliers International

Despite on-going worries about the economic, viral waves, Brexit, and a tightening of finance, Ireland continues to attract considerable cross-border investment — led by European capital, especially German, which accounted for 75 percent of total Irish investment. Local private investors remain focused on sub-€10m deals — but are hesitating until the economic recovery path becomes clearer. Specialised funds, property companies and institutional investors driven by investment mandates are all actively seeking opportunities in the €20m-plus range.

Demand remains strong across the private rental, office and logistics sectors, with further substantial volumes of capital forecast to be deployed by year end. There are new market entrants, primarily European, which further boost confidence. Ireland remains an important target for global capital.

About the Author

Author: Michele McGarry

Michele McGarry is an acknowledged capital markets expert with extensive experience in the Irish commercial investment market across all sectors: retail, retail parks, shopping centers, office, multi-family and leisure. She represents a variety of international investors (including funds, property companies & private equity clients) and domestic high-net-worth clients on property acquisition and disposals throughout Ireland. She holds a BSc (Hons) in Estate Management Surveying University of Glamorgan. She is a member of Colliers International EMEA Investment Team.

About Colliers

Colliers International is a leading diversified professional services and investment management company that work collaboratively to provide expert advice and maximize the value of property for real estate occupiers, owners and investors.

You may have an interest in also reading…

Electronic Trading Came to the Fore in 2020, and Avelacom is Well-placed to Ease the Transition to Automation Technologies

The hold of electronic trading substantially tightened in world’s capital markets in 2020 as participants shifted en masse from voice-trading

Svenska Cellulosa Aktiebolaget SCA: Growing Forests and Renewable Products to Fight Climate Change

With 2.6 million hectares of forest in northern Sweden and 50,000 in Estonia and Latvia, SCA is Europe’s largest private

Banco Hipotecario: Betting the Bank on Inclusion and Women

To speak about financial inclusion in El Salvador is to reference no more than a decade of work which has