Otaviano Canuto: The Dollar’s ‘Exorbitant Privilege’ Remains

Otaviano Canuto discusses the ongoing role of the greenback in international monetary systems…

There has been talk of “de-dolarisation” of the global economy, with recent initiatives and policy moves by China and other countries to extend the reach of use of the renminbi in the international monetary system.

The greenback’s share in global reserves has slightly shrunk in relative terms, sparking frequent debate about what all this means in terms of global currency functions, and as means of payment and store of value.

While we point out a relative decline of the dollar’s weight in those functions, there are gravitational factors that tend to uphold its position. The “exorbitant privilege” that the US dollar has provided to its issuer is likely to remain.

The financial sanctions on Russia after the invasion of Ukraine sparked speculation that the weaponization of access to reserves in dollars, euros, pounds, and yen would stimulate a division in the international monetary order. China would tend to strengthen its international payments system and accelerate the establishment of the renminbi as a rival reserve currency to reduce its vulnerability to moves against it. Countries facing geopolitical risks in their relationship with the US and Europe would seize the opportunity to switch out of the dollar system. However, there is a way to go between willing and doing in this case…

In March, Brazil and China agreed to use local currencies in their bilateral trade. China is the destination of more than 30 percent of exports and the origin of more than 20 percent of imports. Given the trend towards surplus flows on the Brazilian side, it is assumed that Brazil will accumulate reserves in renminbi (RMB).

At the Russia-China summit in March, Vladimir Putin said that business transactions between Russia and countries in Asia, Africa, and Latin America would be conducted in RMB. Last December, China, and Saudi Arabia conducted their first yuan transaction, following Saudi statements that they were looking to diversify from the US dollar. Add Iran, another country grappling with US sanctions, and petrodollars might be replaced by “petroyuans”.

Also worth noting is French company Total Energies’ purchase of liquefied natural gas (LNG), settled in yuan, from Chinese state-owned CNOOC. Since the global financial crisis, China has sought to extend the use of the renminbi in international trade and as a reserve asset at central banks. It pursued a proliferation of currency swap lines with central banks in other countries — including Brazil.

It is not surprising that the “de-dollarisation” of the global economy, “multipolarity” or “bipolarity” of the international monetary system have become buzzwords. However, it is crucial to gauge the real scope of what is happening.

Currencies for Payment

Consider the difference between using currency to settle transactions — as a means of payment — and its role as a store of value. From the point of view of a central bank that needs to be ready for those payments, using the currency in transactions tends to lead to the constitution of reserves in the corresponding currency.

But it is worth distinguishing between currencies’ uses for payments (flows) and stores of value (stocks, reserves) because transactions may be settled without using a store of value. The recent Brazil-China agreement means that importers will make payments in local currencies, with settlements happening periodically. A similar scheme was used in the past by Brazil and other Latin American countries to economise on the need to use the greenback on all individual cross-border transactions (reciprocal payments and credit conventions, or CCR in Portuguese and Spanish).

It should be noted in this context that the bulk of foreign exchange transactions corresponds primarily to financial operations, not trade in goods and services. The size of Chinese foreign trade constituted a basis for the potential use of its currency — but not on the financial transaction side.

In 2015, when the RMB was approved to be part of the special basket of currencies that serves as the base for Special Drawing Rights (SDRs, the accounting currency issued by the IMF). It joined the dollar, euro, yen, and pound because of its weight via China’s foreign trade, not for its use in financial transactions.

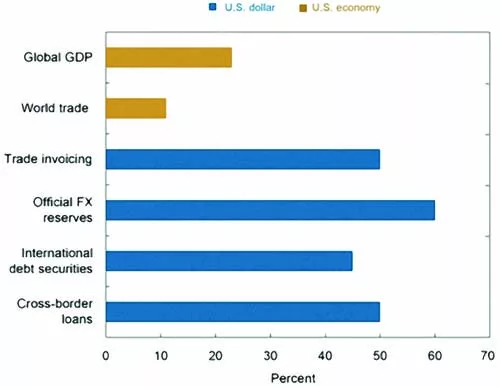

The global use of the dollar in the international monetary system is much higher than the relative size of the US economy (Figure 1). The dollar’s shares of foreign trade invoicing, international debt issuance, and cross-border lending are well above the country’s shares of international trade, international bond issuance, and cross-border borrowing would suggest.

Figure 1: The US dollar’s role in international monetary system eclipses America’s presence in the global economy.

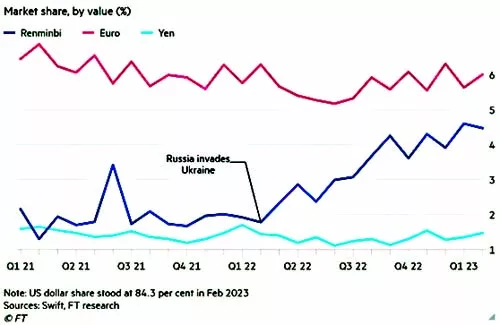

Trade can stimulate trade finance in a currency. Lenders extend credit to facilitate the cross-border movement of goods and services. The renminbi’s share of trade finance has more than doubled since the invasion of Ukraine, as its share by value of the market rose from less than two percent in February 2022 to 4.5 percent a year later (Figure 2). That reflected the use of China’s currency to facilitate trade with Russia and the rising cost of dollar financing since the start of the ongoing Fed’s interest-rate hikes (Locket and Leng, 2023).

Figure 2: China has more than doubled its share of global trade finance.

While the euro and yen account for six and less than two percent of the total respectively, the dollar’s share was 84.3 percent in February 2023, down from 86.8 percent a year earlier.

The renminbi’s rising share of trade finance reflects China’s drive to accelerate its internationalisation. It constitutes a challenge to the West’s use of sanctions to bar major Russian financial institutions from using the Swift platform of payments. The renminbi’s latest rise among trade finance currencies has not been matched by greater use in international payments made on Swift, which have plateaued at about two percent of the global total.

China had already made an effort to internationalise the renminbi in the years leading up to August 2015, when a devaluation led to severe capital flight. China’s central bank reversed course and imposed draconian capital controls that stalled its progress in promoting the currency. It seems to have shifted back to pushing internationalisation since the beginning of 2022 by searching for greater use of the currency in the settlement of cross-border commodities trades and improving global access to derivatives tied to renminbi assets.

Stores of Value

Besides approaching the weight of currencies in their use as the primary conduit to conduct international transactions (flows), either for trade or for finance, one needs to measure their roles as reserve currencies of choice (stocks) by central banks and other cross-border wealth holders.

Trade transactions and reserves from central banks and other global public investors could bolster the renminbi’s position as an alternative currency to the dollar, euro, yen, and sterling. However, to go beyond the settlement of transactions and trade finance, the qualitative leap towards the internationalisation of the renminbi as a reserve currency will only happen when confidence in its convertibility is sufficient to convince private investors to keep reserves of it.

Central banks must have reserves in currencies with which they can operate in the various exchange-transaction areas. It is not by chance that foreign exchange swap lines with China have been little used, while those of countries with the US Federal Reserve have been activated in times of need to stabilise flows. Tight capital controls maintained by China will curb the renminbi from dramatically moving up the ranks of global payments currencies and a stock functioning as a store of value.

Over recent decades, some two-thirds of the world’s foreign reserves were maintained in US Treasuries and other quasi-sovereign USD assets. A gradual decline in the dollar’s share in total reserves occurred in the 2000s, and it was interpreted as a natural diversification by central banks reflecting trade and financial globalisation. Even the introduction of the euro, despite bets at the time, did not substantially change the dollar’s dominance in foreign reserves.

That dominance remained despite the falling share of US GDP. From the 1970s, it survived the end of gold convertibility and the fixed exchange rate regime inherited from Bretton Woods. Its presence in banking and non-banking transactions grew after the 2007-08 global financial crisis.

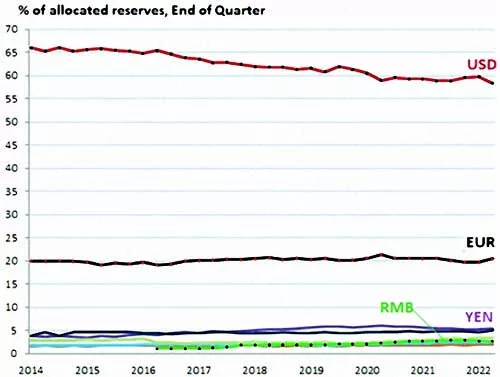

The International Monetary Fund (IMF) releases quarterly data on official foreign exchange reserves (COFER). The latest report shows a reduction in the degree of dollar dominance, with its share of central bank reserves falling 12 percentage points from 71 percent in 1999 to 59 percent last year (Figure 3).

Figure 3: U.S. dollar share of global reserves. Source: Richter (2023)

That is not in favour of the pound sterling, the yen, or the euro, despite the rise that the latter experienced in its first decade of existence. Instead, it favours what Arslanalp et al call “non-traditional reserve currencies” (Australian and Canadian dollars, Swiss franc and others). The Renminbi reached 2.6 percent of the total (Figure 4).

Figure 4: Currency Composition of Global Foreign Exchange Reserves 2014-2022 (percent). Source: Richter (2023)

At the end of Q4 of last year, non-US central banks held $6.47tn in USD-denominated assets, such as US Treasury securities, US corporate bonds, and US mortgage-backed securities. Even as the dollar’s share has dropped since 2014, holdings of dollar-assets rose from $4.4tn in 2014 to $7.1tn in Q3 2021 before falling as the Fed initiated its QT and interest-rate hikes.

These figures must be adjusted to compensate for fluctuations in relative currency prices and avoid distorting the perception of climbs or downfalls in their reserve status.

De-dollarisation will remain slow and bounded.

Four gravitational factors favour the continuation of the dollar’s central position in international financial markets, in trade invoices and payments, and in public and private foreign exchange reserves. Call them “network — complementarity and synergy — effects” (Arslanalp). The relative expansion of the other currencies depends on how successfully they manage to offset those factors.

First, the more extensive installed base for dollar-denominated transactions favours the currency. The increase in liquidity and the reduction in transaction costs in the “non-traditional” foreign exchange markets — including technological improvements — helped reduce this.

No other monetary system offers an equivalent volume of “investment-grade” government bonds. That volume allows central banks to accumulate reserves and private investors to use them as a haven, something reinforced by the quantitative easing since the global financial crisis.

There was a significant announcement by then-President of the European Central Bank, Mário Draghi, in the euro crisis in 2012, that he would do “whatever it takes” as a last-resort provider of liquidity for euro-denominated assets issued in the eurozone. The European Recovery Fund was created last year. The global supply of liquid and safe-haven assets usable as central bank reserves tended to widen in favour of the euro.

Third, it is also worth noting that “non-traditional currencies” were favoured by a partial search for returns in reserve management. Central bank balance sheets — of advanced and emerging economies — have taken on enormous proportions. Some of them separate what would be the appropriate tranche for “liquidity management” (the reason why there are reserves in liquid and low-risk assets, with the purpose of stabilisation), from another “investment tranche” (possible to be allocated in less liquid, but more profitable, assets).

Many countries have created SWFs (sovereign wealth funds) to manage the investment tranche of the public sector’s foreign currency holdings. The search for diversification helped “non-traditional” reserves.

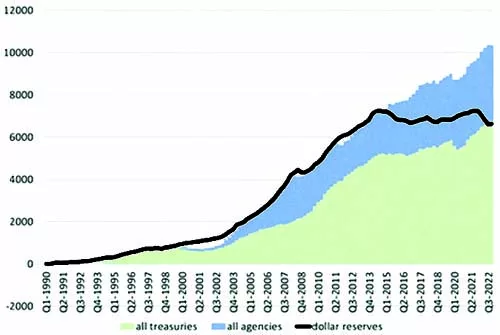

This is illustrated by Figure 5, taken from an April 2 tweet by Brad Setser (from the US CFR, or Council on Foreign Relations) displaying how the foreign acquisition of US treasuries and agencies has decoupled from official dollar reserves. Brad Seter recently compiled data suggesting how the accumulation of dollar assets by official institutions other than central banks has grown in the past decade. He remarks that “the big [current account] surplus countries (China, the GCC, Russia, Singapore) have large state sectors that dominate the balance of payments”, and that “state asset accumulation outside of reserves is, well, quite strong”.

Figure 5: Drivers of foreign purchases of U.S. Treasuries and Agencies. Source: Brad Setser (CFR), Tweet of April 2, 2023.

The fourth gravitational in favour of the dollar would be the absence of regulations restricting liquidity and asset availability, including capital controls. Despite the sanctions already applied in Iran, Venezuela and Russia, there is a difficulty here for Chinese bonds compared to those in dollars and the other three major currencies.

Since the global financial crisis, China has sought to extend the use of the Renminbi in international trade and as a reserve asset at other central banks. This was followed by a proliferation of foreign exchange swap lines with other countries.

While trade transactions and reserves by central banks and other global public investors may reinforce the renminbi’s position, the qualitative leap toward the internationalisation of it as a reserve currency will only happen when confidence in its convertibility is sufficient. It is not by chance that the currency swap lines with China have been little used, while those of the countries with the Federal Reserve have been activated in times of need to stabilise flows.

Chinese financial authorities do not appear to be considering relinquishing control. They will probably seek to expand the use of the renminbi without relinquishing controls and without the ambition to build some parallel regime or substitute. The reserve issuer must accept that large amounts of its currency circulate the world and, therefore, that foreign investors have some weight in determining domestic long-term interest and exchange rates.

After Russia invaded Ukraine, portfolio foreign capital movements in and out of China were illustrative of the potential costs for China of rushing out of its existing regime. Data released by the Institute of International Finance (IIF) revealed a large outflow of portfolio (debt and equities) capital from China. Such flows remained stable in other emerging economies.

Although it was later partially reversed, the timing suggests that it had some correlation with the war in Ukraine and sanctions. The same sanctions that stimulated the rise of the renminbi on transactions also sparked capital movements out of China. Given the magnitude of repressed domestic financial wealth in China, one may guess dramatic outflows would follow that capital-account liberalisation in search of diversification as it happened in 2015.

One may conclude that the relative dominance of the US dollar appears to be declining, but at a gradual pace. Events have boosted the renminbi as a payment-and-reserve currency, but any declaration of “de-dollarisation” seems to be premature.

In the 1960s, Valéry Giscard d’Estaing, then the French Minister of Finance, coined the term “exorbitant privilege” to describe the dollar’s position as a primary global currency. Such a position allows a country to supply cash or safe assets needed by the rest of the world in exchange for goods and services or long-term assets.

“Countries that issue reserve currencies, especially the United States, tend to benefit from what is called an ‘exorbitant privilege’,” he said. “This broadly refers to the effect of the global demand for safe assets on the reserve currency issuers’ funding costs, which tends to tilt consumption towards the present and leads to higher investment.

“Global demand for reserve assets also tends to appreciate the currency of reserve issuers. These effects unambiguously weaken reserve currency issuers’ current accounts … The estimated coefficient suggests that for each 10 percentage points of global reserves held in its currency, a country’s current account balance, is weakened by about 0.3 percent of GDP.”

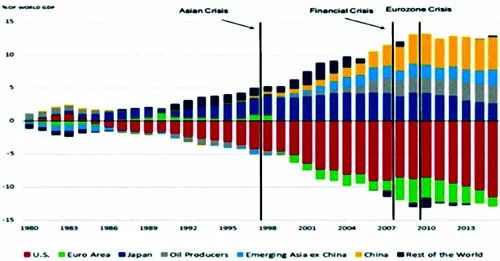

Country-level mismatches between supply and demand for safe assets appear in the evolution of corresponding net stocks of safe foreign assets. Figure 6 portrays the US and euro area below the line, as safe-asset providers, while China, Japan, oil producers, and emerging Asia ex-China are net purchasers above the line.

Figure 6: Net safe positions as a fraction of world GDP. Source: Caballero, R.J., Farhi, E., and Gourinchas, P.O. (2020).

To the extent that the world stock of safe assets moves upward, cross-border net purchases of safe assets give carriers of the “exorbitant privilege” a higher amount of goods and services and investment assets from the rest of the world in exchange for those safe assets.

There are those, however, who see that “bonus” as an “onus”. It all hinges on whether the goods and services and investment assets “imported for free”, corresponding to a certain level of current- and/or capital-account deficit that the issuer of safe assets can incur in exchange for the provision of those assets, come in addition to or replacing local production, regardless of whether the “safe-asset provider” runs a surplus or deficit in the other balance-of-payment accounts.

The “onerous” view is presented by Pettis, for whom it “allows many of the world’s largest economies to use a portion of American demand to resolve deficient domestic demand and fuel domestic growth, for which the US economy must then make up by increasing its household or fiscal debt.

“These economies, in other words, can increase their international competitiveness by lowering the relative share households retain of what they produce. They can then run the large surpluses needed to balance their domestic demand deficiencies while keeping growth high. This is the form of beggar-thy-neighbour trade policy that Keynes most urgently warned against.”

Pettis’ argument, however, is not solely framed against the balance associated with the provision of safe assets, which he blurs into the broader issue of U.S. current-account deficits (Figure 7): “Without the widespread use of the US dollar as the mechanism that allows global imbalances to be absorbed by the US economy, these imbalances cannot exist.”

Figure 7: U.S. current account. Source: Stell and Della Rocca (2023).

Excessive or insufficient current-account balances are better approached through the IMF’s methodology of evaluation of current-account imbalances relative to countries’ fundamentals in its annual external sector report (IMF, 2022). The “exorbitant privilege” should not be confounded with countries’ occasional shortcomings in obtaining full employment or efficient allocation of resources.

Despite the drive by China for a higher plurality of main currencies, raising the use of the renminbi, de-dollarisation looks bound to be partial and limited. Higher speed and depth of such a transformation would require a metamorphosis of China’s regulatory and policy regime, which the country most likely will not have the desire to implement right now.

While the euro has remained mostly a regional reserve currency, the US may retain its exorbitant privilege through the provision of dollar-safe assets for longer.

A previous version was published by the Policy Center for the New South

About the Author

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a visiting public policy fellow at ILAS-Columbia, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past 11 years.

Follow him on Twitter: @ocanuto

You may have an interest in also reading…

G8: Could the Solution to Growth be Simpler Taxes?

There has been much talk of the need for growth at the G8 meeting. Could it be that the solution

World Bank on COVID-19 in Africa: Can Safety Nets Ease Social and Economic Impacts?

Across the world, governments have geared up to respond to the socio-economic shock of the coronavirus pandemic. Early action in

Saudi Aramco PhD Student Wins MIT Research Award

Zeid Al Ghareeb, a Saudi Aramco sponsored student pursuing a Ph.D. in Petroleum Engineering at the Massachusetts Institute of Technology