UNCTAD: COVID-19 Has Hurt Global Investment but the Recovery Offers the Chance to Build a More Sustainable Economy

The crisis caused by the COVID-19 pandemic has severely impacted investment and trade flows, but it arrives on top of existing challenges to the system of international production and trade. Flows of cross-border investment in physical productive assets stopped growing in the 2010s, the growth of trade slowed down, and GVC trade declined. The 2010s were only the quiet before the storm however. The new industrial revolution (robotics, digitisation, additive manufacturing), growing economic nationalism and the sustainability imperative are all shaping economic development as we move into the 2020s. The UNCTAD World Investment Report 2020 discusses these trends and proposes how actions aimed at recovery from the pandemic, both by governments and business, can help establish a more sustainable economy, especially in developing countries that have been hardest hit by the crisis.

The COVID-19 pandemic has created not just a health crisis but an economic crisis, pushing the global economy into recession and millions of people into unemployment. But as governments and businesses look beyond the global lockdown, recovery from the pandemic presents opportunities, not least the chance to put sustainability, including human health, at the heart of future business strategies and investment decisions.

UNCTAD’s World Investment Report, which this year celebrates 30 years as the leading authority on global investment trends and analysis, forecasts the dramatic impact of the pandemic on global foreign direct investment (FDI) by multinationals. It estimates the fall to be as much as 40 per cent in 2020, bringing FDI to below $1 trillion for the first time since 2005. FDI is projected to decrease by a further 5-10 per cent in 2021. A gradual recovery can only be expected starting 2022.

The significant fall in investment flows, caused by the pandemic, will make the task of channeling private sector funds to sustainability-related sectors, especially those relevant to the UN’s Sustainable Development Goals (SDGs), harder. This situation is even more pronounced in developing countries where the hit to investment has been greater. Fragile health care systems in developing countries could come under additional stress due to the pandemic. There is a risk that progress made on sustainable development and investment in the last few years could be undone.

Figure 1: FTSE funds performance – environmental opportunities versus others, 2003-2020 (Billions of dollards). Source: FTSE-Russell.

However, investing in sustainability, including the SDGs, is not just about mobilizing funds and channeling them to priority sectors. It is also about integrating good environmental, social and governance (ESG) practices in business operations to ensure positive investment impact. Global capital markets are instrumental in this process, supporting not only good corporate governance, but providing a platform for sustainable finance. ESG-themed funds and indices, including some focused on the SDGs, are increasingly becoming a focus of investor interest and company reporting.

UNCTAD estimates that the total value of private sustainability-dedicated bonds and funds is now between $1.2 trillion and $1.3 trillion.[1] It consists mainly of green bonds (nearly $260 billion), sustainability-themed equity funds (about $900 billion) and social bonds ($50 billion), plus COVID-19 response bonds ($55 billion). Nevertheless, given that more than 90 per cent of sustainability funds are concentrated in developed countries, sustainability financing largely bypasses developing countries, in particular the poorest countries among them.

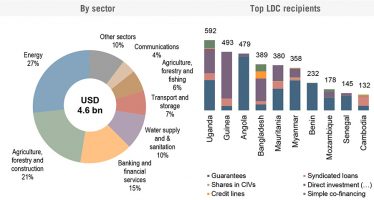

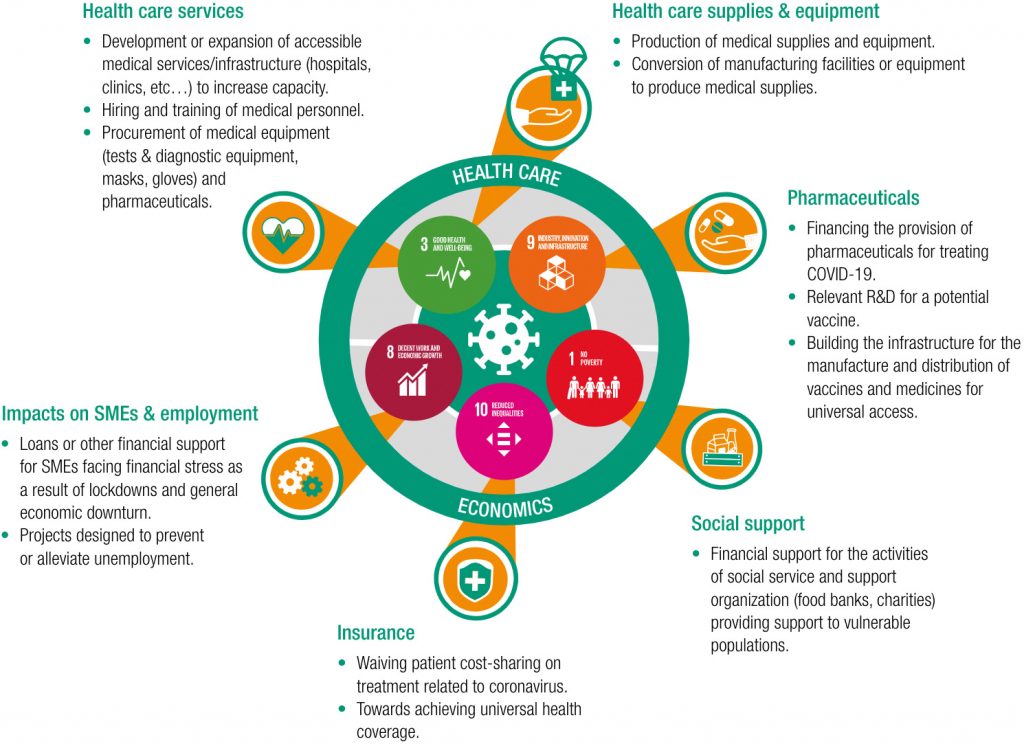

The pandemic has expedited the issuance of bonds focused on relief issues and SDG 3 (Good health and wellbeing) as well as other SDGs. These COVID-19 response bonds fund a range of activities, from supporting the transition of production lines to health care materials, to providing bridging finance for SMEs struggling with the effects of national lockdowns, to raising money for the development and distribution of a COVID-19 vaccine, along the lines of the “vaccine bond” first issued in 2006 by the International Financing Facility for Immunization (see infographic).

The use of social and sustainability bonds in response to the COVID-19 crisis has increased focus on the potential applications of these financial instruments and has elevated their status and scale closer to that of green bonds. When the pandemic subsides, the remarkable momentum that has built up behind social bonds and the lessons learned regarding their issuance and use of proceeds should be channeled to focus on financing sustainability-related investments, including in SDG relevant sectors.

Meanwhile, the surge in sustainable indice and funds, including mutual funds and exchange-traded funds, is making equity markets more aligned with sustainable development. Sustainability equity index data are also reinforcing the view of many that sustainability issues are material to the performance of industries in the long run. A well established example is the FTSE Russell’s Environmental Opportunities index. Since the launch of the SDGs in 2015, the index has significantly outperformed not only its benchmark global all-companies index, but especially the fossil fuels index. The index’s consistent outperformance indicates that investors are recognizing the materiality of sustainability in the new policy context established by the SDGs (see Figure 1).

Over the next 10 years capital markets can be expected to further develop and strengthen their sustainability-related activities. One key challenge, however, will be identifying and promoting a pipeline of projects and companies to respond to the growing demand and interest in sustainability-related investments and emerging and frontier markets. Towards this end, a related challenge will be to improve the quality and credibility of sustainability-themed financial products.

Investment promotion efforts in most countries are not specifically targeted at attracting investment in sustainability-related or SDG-relevant sectors. To the extent that incentives or other promotional measures that focus on specific sustainability targets or SDG sectors are in place, they often leave out core sectors, such as health, education, ecosystems and biodiversity, water and sanitation, and climate change adaptation. The recovery from the pandemic should therefore focus on more systematic efforts to mainstream sustainability and the SDGs into the overall investment policy framework of countries and to embed sustainability strategies into investment promotion schemes.

COVID-19 pandemic response bonds (use of proceeds).

Source: UNCTAD, based on ustainalytics and IFC.

The pandemic once again proves that failure to act on sustainability can be costly in every aspect, and the prompt response of capital markets to the urgent need to fight the pandemic has demonstrated the importance of sustainability financing in addressing global challenges. Any recovery plan from the pandemic should therefore take sustainability into full account as a long-term solution to current environmental, social and health problems and as an opportunity for investment and growth, for both governments and business.

The UNCTAD World Investment Report has been bringing contemporary investment issues, including in developing markets, to the attention of a global audience for 30 years. It is now leading the charge to reorient investment towards a sustainable future and embed sustainability and the SDGs across the entire investor landscape. Recovery from COVID-19 could in fact present an opportunity to accelerate this transition.

[1] The lack of consistent definitions makes it difficult to estimate the global asset size of sustainability-aligned investment. According to the IMF’s 2019 Global Financial Sustainability Report, estimates of the global assets of sustainability investment as of 2018 range from $3 trillion (JP Morgan) to $30.7 trillion (GSIA). For analytical purposes, UNCTAD groups the variety of sustainable investments into two groups according to their contributions to sustainable development: responsible investment (the vast majority) and sustainability-dedicated investment (focused on funds targeting ESG or SDG-related themes or sectors, such as clean energy, clean technology, sustainable agriculture and food security).

About the Author

Author: James Zhan

Dr James Zhan is senior director of investment and enterprise at the United Nations Conference on Trade and Development and lead editor of the World Investment Report.

You may have an interest in also reading…

Christoph D Kauter: Leading Beyond Capital Partners with Vision and Purpose

Christoph D Kauter, Founder and Managing Partner of Beyond Capital Partners, has built a career that blends entrepreneurial vision with

OECD: Plugging the SDG Financing Gap

Ensuring Blended Finance can mobilise private finance, particularly in the Least Developed Countries and towards Social Sectors, will require a

IMF Mission Reports Positive Developments in Georgia

An International Monetary Fund (IMF) mission visited Tbilisi from November 27 to December 12, 2012 for discussions on the first