CBRE – Adapted Retail & Alternative Assets: Rental Trends Adjusting With the Times

Author: David Casas Alarcón CBRE Property Management Accounting Lead

Economic growth is driving increased demand for retail and alternative real estate assets, while spare capacity is gradually being eroded, particularly in the big cities.

This could mean further rental growth in 2019 and 2020, especially for prime properties.

The continuing adjustment in consumer trends has been the catalyst for retail to reinvest in the aspects of physical shopping that the online experience can’t provide – but which remain relevant to shoppers. There have been high levels of take-up from food and beverage and leisure operators in prime centres, as landlords use these avenues to increase dwell-time, and improve the overall social experience of retail.

Asset managers should, however, remain focused on how their offering fits with target customers. Smaller convenience centres must avoid copycat offers that mimic regional malls by carefully creating food and beverage / service options that are more tailored to the type of shopping these centres attract. Food and beverage accounted for nearly 20% of all leases in Europe in the second half of 2018. In smaller centres we are seeing some growth in the use of service providers (hairdressers, beauticians and opticians) as well-placed convenience malls start to become truly local centres.

The level of retail investment in continental Europe remains strong and well above the 10-year average, also reflecting the contribution of maturing markets in CEE. However, negative sentiment from the UK and the US is affecting distribution and reducing the numbers of buyers in the market. More than just e-commerce penetration, these two markets are suffering from structural challenges that include council business rates costs (UK) and a heavy reliance on department store anchor tenants over-servicing retail space.

“Although e-commerce only makes up around 9% of total retail sales for Western Europe, this is will continue to grow, and the store is no longer the only viable way to purchase goods.”

While these threats are not as pressing elsewhere in Europe, there is an underlying level of uncertainty. As a result, investors have become far more selective in their choice of assets.

Large Stores and Local Service

Retailers are being far more selective in their chosen store format and network development. Although e-commerce only makes up around 9% of total retail sales for Western Europe, this is will continue to grow, and the store is no longer the only viable way to purchase goods. Nevertheless, with many larger retailers rationalising their store networks, the demand for larger store units is rising. A strategy of having fewer, larger stores is allowing retailers to maximize the contribution of every retail location. These strategic locations provide the opportunity for stores to be at the heart of the retailer’s omnichannel strategy, focus on providing in-store experiences and an avenue for customers to interact with products. While this may not necessarily generate in-store sales, the relationship between a positive store experience and online sales remains strong.

Figure 1: Retail investment, Europe (excluding UK) rolling 4-quarter totals. Source: CBRE Research.

Although prime areas can attract large occupiers using space for flagship stores, this is not necessarily the case for more local assets and high streets. This is where the greatest divergence between successful and failing retail is likely to exist. But assets, retailers and, increasingly, service providers that truly cater to the convenience aspects of retail could thrive by offering higher levels of convenience than online channels.

A growing trend of localism is also supporting occupier demand in these smaller conveniently placed assets. Retailers from food and entertainment options to bookshops are thriving in the right locations. Consumers are embracing original retail environments and products that have local credentials or claims, as they consider these products to be more sustainable, of higher quality and healthier than non-local alternatives.

Momentum for Eastern Europe

As retailers become more reluctant to expand in prime European locations, they are turning to the cities where expansion has not been as widespread but economic and retail fundamentals remain positive.

In the shopping centre market, there is a strong divide between east and west. In Europe, prime rental prospects appear muted, with real rental decreases expected in weaker properties and locations as brands appear more selective on their store portfolios. Key cities in Central and Eastern Europe (Warsaw, Budapest and Prague) are more buoyant, with retailer demand and rents growing in prime centres and secondary assets appearing more stable than their Western European equivalents. This is driving construction levels, as most European shopping centre construction is happening in eastern European capitals. While construction of new shopping centres in western Europe is subdued, centres in the better locations are using extensions to expand their leisure and food and beverage options, making these centres more experiential and more defensive against changes in consumer preferences.

Investors Engaging with Alternatives

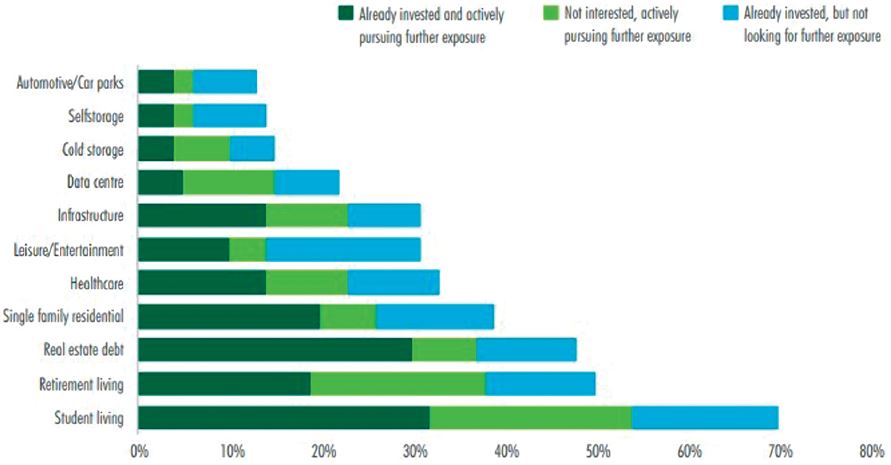

Investors are taking an increasingly favourable view of opportunities in the alternatives sector. Student housing is the most popular in this respect, followed by retirement living, healthcare and leisure. The key attractions of the sector from an investor perspective are the availability of higher yields than traditional property investment classes, asset diversification, income stability and capital growth potential. These priorities will set the tone for 2019.

Figure 2: Investor sector exposure to alternatives, EMEA. Source: CBRE Research.

However, if investors are to realise their ambitions for increased exposure to alternatives, they will need to cross borders and engage with real estate structures and sectors that are, in many cases, not within their range of experience.

Some major institutions are already engaged in cross-border investment in a range of alternative real estate sectors, AXA-REIM being a notable example. Nevertheless, there has been a change in the number of investors taking such a holistic view. These include investors new to the sectors as well as those who, having developed expertise in one specific area, are now diversifying.

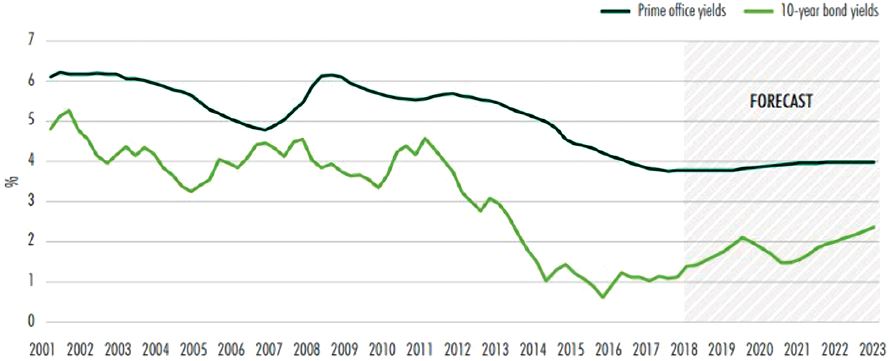

Figure 3: Eurozone prime office yields and 10-year government bond yields (%), 2001-2023. Source: CBRE Research.

Risks More Apparent

The economic outlook is positive at least for the next two years, but there are various risks. Property investors should be particularly alert to the prospect of a sharper-than-expected rise in interest rates. This could put upward pressure on yields, and could be associated with an emerging market default in view of the level of greenback-denominated debt held in some of these economies.

About the Author

David Casas Alarcón is an economist at the university of Malaga, Spain, with more than 10 years of experience in the real estate and finance industries. In 2012, he took over the role of Outsourcing Analyst for Capgemini Consulting, where he advised the company’s real estate clients on the most efficient solutions for financial process externalisation. Since 2016, Alarcón has been part of the CBRE Corporate Outsourcing Hub in Warsaw, which drives the finance process transformation for property management and other CBRE business lines across Europe, Middle East and Africa (EMEA) region, delivering efficiencies and compliance.

About CBRE

CBRE Group, Inc is a commercial real estate services and investment firm. It is the largest company of its kind in the world. It is based in Los Angeles, California and operates more than 450 offices worldwide and serves clients in more than 100 countries.

CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. The CBRE Global Investors subsidiary sponsors real estate investments via investment funds and direct investments that it manages. As of September 30, 2018, the division had US$104.5 billion in assets under management. The Trammell Crow Company subsidiary is the largest commercial real estate developer in the United States, according to Commercial Property Executive’s annual ranking.

About CBRE Property Management

With a network across the Americas, Europe, Africa, the Middle East and Asia Pacific (EMEA), CBRE leverages global best practices and real-time data to improve Real Estate operational performance.

Their team collaborates across a complete spectrum of integrated services to help investors achieve optimal asset and portfolio management.They strategically position assets in the most diverse markets, through the most challenging market conditions – making significant investments each year in their service platform to deliver cutting-edge solutions. This includes employment of the highest industry standards in all of their processes to ensure regulatory compliance, consistency and service excellence.

You may have an interest in also reading…

MIGA (World Bank): During the Storm – Shift from North to South FDI

By Manabu Nose and Moritz Zander[1] At MIGA (the Multilateral Investment Guarantee Agency) we see the principal near-term risks for

One Man’s View of the Mountain: UK Urgently Needs to Rejoin EU to Create Economic Security

Both parties are promising growth, but which policies are most likely to generate it? Growth is essential for continually improving

Summit Commitments of the G8 Leaders

Extracted from Remarks made by David Cameron on Thursday 18th June. Our economies together make up around half of the