UNCTAD Investment and Enterprise Division: An Investment Perspective on International Taxation

Tax avoidance practices by multinational enterprises (MNEs) often depend on corporate structures that are built by routing investments through offshore investment hubs or conduits that help shift profits from higher to lower tax jurisdictions. In essence, corporate structures built through FDI (foreign direct investment) can be considered “the engine” and profit shifting “the fuel” of MNE tax avoidance schemes.

Tax avoidance practices by multinational enterprises (MNEs) often depend on corporate structures that are built by routing investments through offshore investment hubs or conduits that help shift profits from higher to lower tax jurisdictions. In essence, corporate structures built through FDI (foreign direct investment) can be considered “the engine” and profit shifting “the fuel” of MNE tax avoidance schemes.

In order to analyse the scope, dimensions, and effects of tax-efficient corporate structures (fuel-efficient engines) we can look at FDI flowing through conduit jurisdictions (transit FDI). Transit FDI does not equate with non-productive FDI. Foreign direct investment designed as part of tax planning strategies of MNEs can have a real economic impact on the countries involved. For example, an investment from a North American firm in Asia to start a new production plant may be channelled through Europe for tax reasons (potentially penalising tax revenues in both home and host countries) but still carries the productive-asset-creating effects of a greenfield investment.

Offshore investment hubs, can be differentiated in two groups:

- Tax Havens – Small jurisdictions whose economy is entirely, or almost entirely, dedicated to the provision of offshore financial services.

- Jurisdictions offering SPEs (special purpose entities) or other entities facilitating transit investment. Larger jurisdictions with substantial real economic activity that act as major global investment hubs for MNEs due to favourable tax and investment conditions.

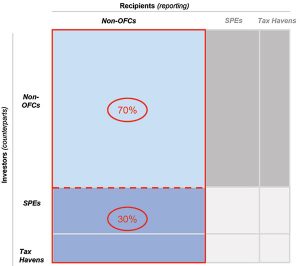

Our Offshore Investment Matrix (see figure 1) provides a comprehensive mapping of corporate international investments through offshore investment hubs. For each unit of MNE international investment stock, bilateral data provide a pairing of direct investor and recipient jurisdictions, which are grouped under SPEs, Tax Havens, or non-OFCs (offshore financial centres). When the investor/recipient is a jurisdiction offering SPEs only part of the outward/inward investment is allocated to transit investment activity (the SPE component) while the remaining part is allocated to the non-OFC group. Thus the matrix really focuses on the transit FDI phenomenon.

The matrix shows the pervasive role of offshore investment hubs in the international investment structures of MNEs. In 2012, out of an estimated $21 trillion of international corporate investment stock in non-OFC recipients (blue area in figure 2), more than 30% or some $6.5 trillion was channelled through offshore hubs (dark blue area). The contribution of SPEs to investments from conduit locations is far more relevant than the contribution of Tax Havens. The largest offshore investment players are SPE jurisdictions.

A mirror analysis of the inward investment into offshore hubs (dark grey area) reveals that 28% of the total amount of cross-border corporate investment stock is invested into intermediary entities based in hubs. In some cases these entities may undertake some economic activity on behalf of related companies in higher tax jurisdictions, such as management services, asset administration, or financial services (base companies). However, often they are equivalent to letterbox companies, legal constructions conceived for tax optimisation purposes (conduit companies) and potentially to benefit from other advantages associated with intermediate legal entities.

The prominent pass-through role of these entities in financing MNE operations causes a degree of double-counting in global corporate investment figures, represented by the dark grey area (investments into offshore hubs) which broadly mirrors the dark blue area (investments from hubs). Note that in UNCTAD FDI statistics this double-counting effect is largely removed by subtracting the SPE component from reported FDI data.

The share of stock between hubs (light grey area) is also relevant, at 5% of global investment stock. This confirms that offshore investment hubs tend to be highly inter-connected within complex multi-layered tax avoidance schemes. The Double-Irish-Dutch-Sandwich employed by many IT multinationals is a relevant example.

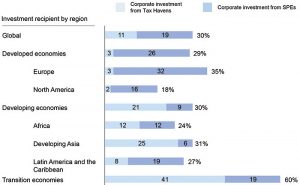

Between the start and end of the 2000s, the average share of investment flows to/from non-OFC countries routed through offshore hubs (Offshore investment share) increased from 19% to 27% (Figure 3). More recently, increasing international efforts to tackle tax avoidance practices have managed to reduce the share of offshore investments in developed countries, but exposure of developing economies is still on the rise.

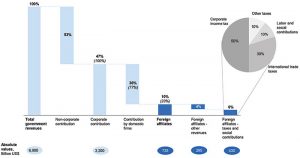

Looking at transit FDI to analyse MNE base erosion and profit shifting (BEPS) practices yields new insights on the size of the phenomenon and on geographical patterns. It also provides new avenues to estimating tax revenue losses for governments around the world. Ongoing work in the international community on BEPS will benefit from this new analytical approach.

About the Author

Bruno Casella is an economist at the Trends and Data Section in UNCTAD’s Investment and Enterprise Division, based in Geneva. He is one of the lead authors of the annual World Investment Report.

Prior to joining UNCTAD in 2013, he was junior manager at McKinsey & Company where he served a wide range of corporate clients worldwide. He holds a PhD in Statistics and a degree in Economics at Bocconi University. He has co-authored research papers on probability, statistics, economics and finance, some published in refereed international journals.

You may have an interest in also reading…

Lord Waverley: Quest for Balance and Unity Hampered by Blurred Lines and Differing Standards

There is an increasing recognition of the need to reassess the intersection of global co-operation and security, and how Western

Baker & McKenzie: Kazakhstani International and Domestic Securities Offerings

By Edward A. Bibko With its large natural resources and relatively transparent legal regime, Kazakhstan has long been a destination for

PwC: Africa’s Hospitality Sector Poised for Growth

Africa’s hospitality industry is set to meet the rising demand from international tourists, local business travellers, and the continent’s own