North America

Back to homepageBlackstone’s Data Centre Push: When Private Capital Opens The AI Rails To Public Investors

As the AI boom shifts from model-building to infrastructure-building, data centres have become the new industrial real estate. Blackstone’s reported move to launch a publicly traded REIT focused on stabilised, leased facilities could give retail investors a direct line into

Read MoreTen Recent Technology Advances That Asset Allocators Should Have on the Radar

A CFI.co briefing on the engineering breakthroughs, grid innovations and early deployments that are compressing cost curves and reshaping the risk–return map for energy and infrastructure investors. For much of the past decade, the energy transition debate was framed as

Read MoreThe Great Rebalancing: Capital Allocation in an Age of Fragmentation and Convergence

After a long stretch in which US markets served as the default setting for global portfolios, 2026 is beginning to look like a turning point. Concentration risk, stretched valuations, fiscal strain, and a rewiring of supply chains and reserves are

Read MoreThe “Sell America” Trade Returns — With Greenland at the Centre

A familiar market pattern reasserted itself on 20 January 2026: the dollar slid, Treasury yields rose, US equities fell sharply, and investors rushed into precious metals. This is the classic “sell America” trade — and its reappearance says less about

Read MoreHeat Pumps That Pay: How Industrial Process Heat Is Becoming a Cost-Saving Asset

Table of contents Why industrial heat is now a balance-sheet issue 1) The commercial frontier: process heat up to ~200°C Why 200°C is financially meaningful A CFO-style payback lens (illustrative) 2) The breakthrough beyond 200°C: sound-driven thermoacoustic heat pumps Why

Read MoreOtaviano Canuto: The US Economic ‘K’

Global GDP growth has proven resilient in 2025, despite the shocks caused by the trade policies implemented by United States President Donald Trump in the first year after his return to office. The gloomy projections offered by multilateral and private institutions in

Read MoreTrump Targets Wall Street Landlords, Putting Private-Equity Underwriting on Notice

A proposal to bar large institutional investors from buying single-family homes has jolted real-estate equities and reopened a long-running political argument: is housing unaffordable because capital is crowding out families—or because the US simply does not build enough homes? On

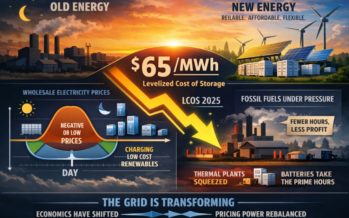

Read MoreThe Cost Curve That Is Squeezing Coal and Gas

By the end of 2025, the energy transition’s most persistent objection — that renewables cannot be relied upon when the sun sets and the wind drops — looked far less convincing. Not because politicians mandated a new outcome, but because

Read More2025: When Markets Made Renewables Dispatchable

For years, the energy transition was argued as much on ideology as on engineering. Supporters framed renewables as a moral imperative; critics framed them as an expensive, unreliable add-on that would always need a parallel fleet of fossil backup. In

Read MoreCan Google Escape Nvidia’s Gravity?

If Gemini’s training run proves anything, it is that Google’s in-house silicon is no longer a science project. The bigger question for markets is whether TPUs can bend the economics of AI at scale—and, in doing so, redraw the cloud

Read More