Menu

Back to homepageTen Recent Technology Advances That Asset Allocators Should Have on the Radar

A CFI.co briefing on the engineering breakthroughs, grid innovations and early deployments that are compressing cost curves and reshaping the risk–return map for energy and infrastructure investors. For much of the past decade, the energy transition debate was framed as

Read MoreSpecialised Performance: What the Humble Penguin Can Teach the Modern C-Suite

Far from being mere fodder for nature documentaries, the specialised behaviour and remarkable resilience of the world’s most formally attired bird offer instructive lessons in adaptation, organisational efficiency, and disciplined focus. This eclectic anthology emerges as an unexpected yet persuasive

Read MoreOrchestrating the Transition: enso Group Builds the Enabling Structures for Reliable Clean Power

From Austria’s hydropower tradition to African grid-scale platforms, enso’s “system orchestrator” model fuses technology, finance and governance into investment-ready energy ecosystems that deliver dependable, independently sourced renewable power. In an energy world defined as much by complexity as by ambition,

Read MoreAngola’s Transport & Infrastructure Evolution: Rebuilding a Nation, Rewiring a Region

Few African countries have pursued infrastructure renewal on Angola’s scale or under comparable historical pressure. Emerging from decades of civil conflict in the early 2000s, the country confronted an all-encompassing reconstruction agenda: roads and bridges, ports and railways, airports and

Read MoreEaglestone Management: Experience Forged in Global Infrastructure Finance

Eaglestone’s leadership team reflects the firm’s positioning at the intersection of banking discipline and real-economy delivery. With deep roots in international project finance and a long track record across infrastructure, energy, transport and concessions, the management combines capital markets fluency

Read MoreFrom Penetration to Inclusion: How CRC Credit Bureau Is Re-Engineering Nigeria’s Credit Ecosystem

Nigeria’s journey towards broad-based financial inclusion has accelerated markedly in recent years, with credit penetration emerging as one of the most telling indicators of structural progress. Once constrained by fragmented data, limited formal participation, and low consumer awareness, the country’s

Read MoreThe Dissonance of Davos 2026: Capital Allocation in an Age of Fragmentation and the AI–Energy Nexus

The World Economic Forum’s 56th Annual Meeting opened beneath the banner of “A Spirit of Dialogue”. What emerged in Davos-Klosters was something sharper: a widening gap between political theatre and boardroom reality. While populist rhetoric attacked the language of climate

Read MoreLeadership at the Helm of Kenya’s Renewable Power Champion

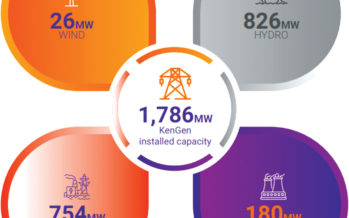

KenGen’s executive team brings together deep technical expertise, financial discipline, legal rigour and strategic foresight to steer East Africa’s foremost electricity generator through an era of energy transition, sustainability and growth. Eng Peter Njenga Managing Director and CEO Born in

Read MoreKenGen Powering East Africa’s Clean Energy Future

Kenya Electricity Generating Company PLC (KenGen) stands as East Africa’s leading power producer, entrusted with the mandate to develop, manage and operate the power plants that underpin Kenya’s economic and social life. The company’s vision is to be the market

Read MoreThe “Sell America” Trade Returns — With Greenland at the Centre

A familiar market pattern reasserted itself on 20 January 2026: the dollar slid, Treasury yields rose, US equities fell sharply, and investors rushed into precious metals. This is the classic “sell America” trade — and its reappearance says less about

Read More