South Africa and the Struggle for Reform

South Africa: Cape Town

Widely considered a bellwether for emerging market sentiment, South Africa’s rand has been on a dizzying rollercoaster ride, seesawing on currency markets as traders try to match fact with perception and decipher the country’s true predicament. On 11 June, the rand suffered its biggest single-day decline (-3.8%) in four years. The next day, the currency clawed back as markets realised that the South African Reserve Bank was having no trouble raising cash at knock-down interest rates. At the start of the corona pandemic, the currency lost 9 percent in value against the US dollar, only to stage a 13-percent rally in the weeks that followed.

The cost of credit default swaps, essentially an insurance premium to cover debt default risk, retreated to its pre-corona low after registering a spike in early April following Moody’s downgrade of the country’s sovereign credit rating. Though no longer investment-grade, South African bonds remain a favourite amongst both local and overseas investors. It is as if the descend into junk territory never happened. In fact, the country is currently paying less to borrow than at any time in the five years preceding the downgrade.

In Paris, Société Générale strategist Jason Daw is not at all worried about South Africa’s increasingly perilous fiscal position and expects a fairly strong post-pandemic recovery to sustain the rand. Daw even recommends investors an ‘overweight’ position in rand-denominated instruments. The weekly debt auctions of the National Treasury continue to attract considerable interest with fresh bond issues oversubscribed by an average of 40 percent. Yields have moved lower as the pace of inflation slowed due to low oil prices and repressed demand.

Globally, the economic consequences of the pandemic have not yet improved the yield of financial instruments, forcing investors to keep looking for returns in relatively low-risk emerging markets. The impression is that Moody’s and the two other major rating agencies may have jumped the gun on South Africa.

In its latest analysis, published early June, the Organisation for Economic Cooperation and Development (OECD) noted that South Africa may benefit more than initially expected from the fiscal and monetary stimulus initiatives of Europe and the United States. A quick recovery in China is also likely to sustain demand for South Africa’s commodities. The OECD report concludes that the country should not experience too many difficulties in sourcing the funds needed to support households during the lockdown period and businesses in hard-hit sectors such as tourism. The organisation recommends South Africa engage with multilateral lenders and implement the broad economic reforms already considered before the viral outbreak.

Slowly emerging from an exceptionally strict lockdown, South Africa faces a 5.5 percent contraction of its GDP. The OECD expects activity to pick up significantly next year but warns that continued shortfalls in the supply of electric power may dampen growth whilst a bloated bureaucracy and complex tax legislation discourage investment. The organisation calls on the South African government to improve the business climate and put the state finances on a more sustainable footing by streamlining its own apparatus and shedding loss-making state-owned enterprises. The World Bank is a bit more pessimistic in its outlook and forecasts South Africa’s GDP to shrink by 7.1 percent this year – this would constitute the largest decline in economic activity in over a century. Most predictions exclude the possibility of a second wave of corona infections. Should one occur, all bets are off and the precipice beckons.

Even with the current outbreak, this year’s fiscal deficit is expected to reach 14.4 percent of GDP whilst public debt will likely balloon to 81 percent of the domestic product. Any attempt to consolidate state expenditure depends to a large degree on the successful renegotiation of the generous 2018 public sector wage agreement. So far, this has proved elusive. Finance Minister Tito Mboweni has failed to convince trade unions of the need to amend the agreement which includes significant annual increases. Mboweni now needs to shave R160 billion ($9.4bn) off the public sector wage bill over the next three years. However, the country’s largest unions argue that the 2018 deal is binding and have taken their case to the Labour Court for arbitration.

Professor Phillipe Burger, vice-chancellor for Poverty, Inequality, and Economic Development at Cape Town’s University of the Free State, suggests that South Africa must improve its sovereign credit rating as a matter of the utmost urgency if the country is to attract the investment volumes needed to shape its future. In his policy paper Future South Africa Vision, Burger argues that society needs to reimagine what the country can look like in 15 to 20 years: “We must look beyond present-day problems and work towards a high-growth, green, urban, and investment-driven tomorrow. To do that, the country needs to properly address its current issues and ditch the junk-status mindset that many have fallen into.”

Burger is worried that the downward shift in investments registered over the past years will prevent the nation from tapping its potential for growth. “To grow the economy effectively, government must provide room for the private sector to invest in high growth industries and reduce the red tape and policy uncertainty. Government and private sector must together identify and address the stumbling blocks. In exchange, the private sector must commit to their investment targets for economic growth and job creation.”

The professor posits that before the corona outbreak, South Africa’s malaise was mainly caused by a lack in consumer and business confidence: “This ‘junk status vision’ originates from our dilapidated infrastructure and insolvent state-owned enterprises. What we need most is a sense of optimism and confidence in our collective ability to build a better country.” Economic growth has been difficult to sustain over the past five years. South Africa’s GDP has barely moved political infighting prevented a national accord on a reform package.

Pushed close to the edge by the pandemic, South Africa has appealed to the International Monetary Fund (IMF) for support – a first in the country’s history. The National Treasury has also applied for emergency financing at the Chinese-led New Development Bank, the World Bank, and the African Development Bank.

The Ramaphosa Administration has asked the IMF for $4.2 billion in emergency support. According to Lumkile Mondi, a lecturer in Economics at the Johannesburg Witwatersrand University, the move was prompted by more than just financial considerations: “The ruling African National Congress has always held that going cap in hand to the IMF was out of the question since it is seen to undermine the country’s sovereignty. In the years following the end of apartheid, it was decided to put the house in order without prodding from the IMF or other multilaterals. That article of faith has now been ditched.” President Cyril Ramaphosa hopes that the appeal to the IMF may shock the ANC in action.

Inheriting an economy broken by international sanctions, the ANC initially moved quickly and effectively to put South Africa on a sustainable footing. In 2007, the country recorded its first post-apartheid budget surplus. At the time, public debt represented just 26 percent of GDP. However, the call of riches proved too luring to ignore and over the following decade the performance of South Africa’s fiscal accounts deteriorated steadily whilst the state wage bill increased by at least 40 percent in real terms.

Though the administration of Ramaphosa advocates forcefully for structural adjustments to the economy, and a return to the prosperous times of before, it has not been able to get congress on board. After 26 years in power, the ANC has become a political arena with periodic fights between disparate factions vying for a turn at the depleted trough. As a result, little gets done in the way of governing.

However, the financial damage wrought by the corona pandemic is expected to spark congress into action as its lethargic approach to crucial policy issues can no longer be sustained without risking a complete meltdown. The National Treasury expects a $17 billion drop in tax revenue as a direct result of the lockdown.

Moreover, Ramaphosa has indicated that the crisis currently unfolding is too serious to waste. As current head of the 53-member African Union, he said that the pandemic must strengthen the collective resolve to ‘forge a new economy in a new reality’.

That message resounds throughout the continent. In Nigeria, the government managed to leverage the pandemic to scrap costly fuel subsidies, arguing that it needs the $2 billion spent annually on providing cheap fuel for fighting covid-19. Nigeria has also pushed through long-awaited changes to its exchange rate mechanism and implemented policies to wean the country off its dependency on oil exports.

Taking an early and proactive approach to the pandemic, Nigeria secured a $3.4 billion IMF credit facility and tapped into other sources of relatively cheap credit. This boosted investor confidence even as oil prices plummeted. The yield on the benchmark 2047 dollar-denominated bonds dropped from 13.2 percent in March to 9.1 percent two months later.

Though Nigeria’s underlying fundamentals remain weak, the country has managed to outperform other Sub-Saharan emerging markets during the first and crucial phase of the pandemic, leading analysts to believe that its economy can escape relatively unscathed and bounce back quickly. Nigeria is also helped by the modest size of its public debt which now stands at 34.8 percent of GDP.

Investor confidence has been bolstered by the IMF’s stamp of approval, the elimination of fuel subsidies, and the unification of the niara exchange rate. South Africa is paying attention and hopes to emulate the example set by the continent’s biggest economy.

You may have an interest in also reading…

Permanent Output Losses from the Pandemic

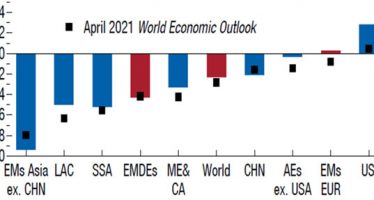

In the World Economic Outlook, published October 12, the International Monetary Fund (IMF) slightly lowered its forecast for global economic

Orban on Orbán: Cease and Desist, Your Position Is Untenable

Europe’s other ‘Orban’ sounds much more reasonable than the vociferous original one. Prime Minister Ludovic Orban of Romania yesterday chastised

Resistance Is Futile as Berlin Backs EU Solidarity

For the third time in her 15-year reign, German Chancellor Angela Merkel has sprung a major surprise and taken the