Sell in May and Go Away

First the good news: The S&P 500 just finished its best month since January 1987 with a gain of 12.7 percent in April. Now for the bad news: The bellwether index is still some 16 percent down from the all-time record high it touched on 19 February. There is a silver lining as well: The S&P 500 is up 30 percent from the corona-low visited on 23 March, staging a rally that few could have hoped for, and fewer still dared predict.

First the good news: The S&P 500 just finished its best month since January 1987 with a gain of 12.7 percent in April. Now for the bad news: The bellwether index is still some 16 percent down from the all-time record high it touched on 19 February. There is a silver lining as well: The S&P 500 is up 30 percent from the corona-low visited on 23 March, staging a rally that few could have hoped for, and fewer still dared predict.

Proving that he is the right man to watch over the world’s largest pile of cash, BlackRock founder and CEO Larry Fink was one of the first to publicly dismiss talk of a complete meltdown and concluded in early April that the market had touched bottom.

Mr Fink has not signalled his intentions for this month. A surprisingly superstitious lot, investors and analysts take stock in the well-worn advice ‘Sell in May and Go Away’, with the latter part indicating a six-month trading furlough. Addicted to statistics as much as they are to sayings repeated over many generations, investors recognise that, whilst historically true, the strategy has been disproved over the last decade or so with May-to-October runs posting above average returns each year, save for 2015.

The usually bullish Barry Bannister, chief institutional equity strategist at Stifel, may yet celebrate tradition as he suspects that the market may struggle to keep its forward momentum. Sparked by the massive intervention of the US Federal Reserve, April’s bull run is likely to peter out over the coming weeks as volatility and trading volumes remain high, indicating a tug of war between bulls and bears both puzzled by the absence of a clear long-term trend.

Turning to history yet again, markets usually bounce back vigorously after an initial crash, only to pull back for a second time before finding a solid foundation to support a staged recovery. Going forward, this time-tested script would seem to advocate for caution. Whilst US unemployment numbers keep rising at an alarming rate, companies filing dismal quarterly reports and issuing unsettling guidance notes add to the steady drumbeat of bad tidings.

Some well-respected strategists such as Peter Cecchini at Cantor Fitzgerald suspect that investors may have misunderstood the joke and cite three reason why the April rally makes no sense at all: the duration of the pandemic is unknown; the oil shock puts a damper on earnings; and the inverted yield curve points to a weakening economy. Taken together, Mr Cecchini argues, these three indicators should introduce investors to a sense of realism.

There are plenty of other warning signs as well. Stock market rebounds are often pulled by ‘early cycle’ groups such as car manufacturing, financial services, retail, and consumer durables. However, these tell-tale sectors were lagging far behind as the April rally gathered steam. At large-cap level, the bulls were led by tech, healthcare, and consumer staples. These steady secular-growth groups were, in turn, pulled ahead by Amazon, now boasting a stratospheric $1.2 trillion market cap, which accounts for nearly 40 percent of the S&P 500 consumer-discretionary component.

Another sign that the overall market is listing dangerously to one side comes from the rush of capital into ETFs (exchange-traded funds) that track that Nasdaq 100 which is dominated by tech, healthcare, and utilities – all sectors considered somewhat immune to the pandemic. This part of the market is now showing signs of overheating as investors take heart when developments on Main Street move from awful to less bad. A correction seems due.

Making sense of the stock market is unlikely to get any easier as post-corona recovery plans are unveiled and point to the need for a shortening of ‘cheap and cheerful’ supply chains and the subsequent retreat of globalisation. It is not just US President Donald Trump who is expected to push for a rearrangement of cross border trade rules and tariffs. European governments will also actively seek to onshore production and bring backs jobs lost to low- and mid-income competitors.

The European Commission has already indicated that it will no longer be as cautious as before when responding to US tariffs on steel and aluminium. With the exception of China, most US trading partners have exercised a commendable level of restraint in the face of President Trump’s aggressive stance on trade, considering that before long his tenure will probably end. The pandemic has, however, changed the outlook. The EU’s recently sealed trade deals with Canada, Japan, Brazil, and Argentina suddenly appear a lot less attractive than before.

The commission was shocked – mind the understatement – to discover that even intra-union trade barriers sprung up mere days after the first reports of the viral outbreak as member states blocked exports of medical supplies. Outside the EU, governments were also quick to place restrictions on foreign sales of medical goods with the United Kingdom taking the lead – with a pinch of irony. The country’s departure from the union was, after all, to a significant extent inspired by a heart-felt wish to unleash its buccaneering free marketeers onto the world stage.

European governments are also quite sensitive to any moves by China to directly or indirectly support its manufacturing sector as the country’s factories try to make up for lost time and protect market share. Already now, untold thousands of containers with unsold consumer goods are being amassed at gateway ports such as Rotterdam and Hamburg, waiting for the moment to flood markets. Local industries keep a wary eye on this avalanche coming their way and are sure to kick up a considerable fuss as soon as these goods leave the port area.

Just as the European Commission seems no longer willing to accept unfair US trading practices, it is expected to take on China at the first sign of renewed tampering with the frayed WTO (World Trade Organisation) rulebook. When it comes to the introduction of tariffs under exceptional circumstance, the WTO is actually fairly relaxed and accommodating. All an industry needs to do is demonstrate that is has been hurt by an externality – not a particularly high bar to meet given the pandemic.

Another feature of the WTO rulebook sure to gain notoriety is the concept of ‘countervailing duties’ which may be introduced to compensate for state interventions that distort market conditions. It doesn’t require any prescient powers to predict that a number of countries will argue that the trillions being doled out by governments to help businesses weather the downturn fully justify the setting of stiff countervailing duties.

A resurgence of protectionism in the post-corona world is almost a given. Only concerted action by world leaders may prevent global trade from taking a severe hit. Considering that the pandemic has revitalised the nation state to the detriment of international cooperation, such a grand deal seems unlikely at present. Also, the timing of the Corona Recession is unfortunate. Global trade relations were already strained before the pandemic hit in a scenario much different from the one at the onset of the last downturn in 2008 when G20 leaders, prodded by then-US President George W Bush, pledged to refrain from raising new barriers to cross border trade – a commitment that held throughout the years that followed.

This time around, US Trade Representative Robert Lighthizer struck an entirely different note, calling his country’s overdependence on others for medical products a ‘strategic vulnerability’ that needs to be addressed as a matter of urgency. The 30 March ‘virtual’ meeting of G20 trade ministers largely ignored protectionist pressures and resulted in a somewhat lame final statement that EU trade commissioner Phil Hogan described as ‘less ambitious’ than he had hoped for. Of course, Mr Hogan had some difficulty in explaining to his peers why the EU’s own export controls were not protectionist in nature.

Whilst jittery stock markets shoot up and down only to stumble sideways, and protectionism is on the rise, the smart money is shifting to bonds as a relatively fail-safe and fool-proof way of preserving capital. Present conditions and the abundance of uncertainty are such that the direction of any post-corona recovery remains shrouded in mystery. However, by this time next month, some of those uncertainties will have dissipated as the world settles into its new normal and finds ways to co-exist with the novel virus.

You may have an interest in also reading…

South Africa Teetering on the Edge of Political and Economic Precipice

Keep South Africa Safe: the slogan is stamped on President Cyril Ramaphosa’s favourite facemask, and could refer to more than

Uzbekistan ‘s Enter Engineering announces Covid years project updates and operations guidance

According to Ulugbek Usmanov, General Director at Enter Engineering: “Enter Engineering is involved in a variety of projects central to

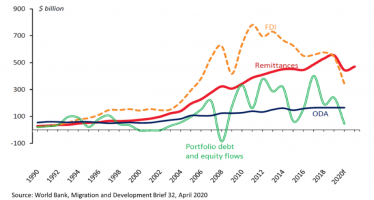

Otaviano Canuto: Channels of Transmission of Coronavirus to Developing Economies from Abroad

In a previous article, we highlighted how developing economies have faced simultaneous shocks from their external environment, as pandemic and