European Commission Warns Banks

There is money in the bank – and that is where it mostly stays. The credit facilities that are meant to help households and businesses finically survive the pandemic are being approved at an alarmingly relaxed rate by banks struggling to grasp the urgency of the moment and adjust their loan assessment criteria accordingly. Though governments and central banks acted swiftly to prevent the collapse of business and support households, most commercial banks have so far displayed no such sense of urgency.

There is money in the bank – and that is where it mostly stays. The credit facilities that are meant to help households and businesses finically survive the pandemic are being approved at an alarmingly relaxed rate by banks struggling to grasp the urgency of the moment and adjust their loan assessment criteria accordingly. Though governments and central banks acted swiftly to prevent the collapse of business and support households, most commercial banks have so far displayed no such sense of urgency.

Yesterday, the European Central Bank (ECB) reported that credit take up has slowed due to tightened credit standards. Though commercial banks have gained more regulatory freedom and benefited from lower reserve requirements, the allocation of credit has not kept pace with developments. The loosening of standards has freed up an estimated €1.8 trillion of capital.

The European Commission has now clarified the easing of the union’s prudential and accounting framework in an attempt to encourage lenders to make better use of ‘flexibility’ introduced into the system. In an ‘interpretative communication’, the commission stresses the importance of discounting the current crisis when assessing a loan applicant’s SICR (significant increase in credit risk).

The commission also wants banks to largely ignore the impact of private or statutory moratoria on the customer’s risk profile, using instead their own ‘qualitative and quantitative’ judgment to draw conclusions. The commission emphasises that moratoria – the temporary suspension of loan repayments – are an ‘important tool’ for the preservation of liquidity when normal business operations have been upended by the pandemic.

The commission has sent draft legislation to the European Parliament that includes €450 billion in provisions to cover eventual losses on the credit portfolio of commercial banks that can be attributed to more tolerant lending criteria. Commission Executive Vice President Valdis Dombrovskis said that the EU will engage with the financial sector to iron out any differences and spell out the new best practices. Consumer and business groups have been invited to join the discussion.

Mr Dombrovskis seemed not best pleased with banks and criticised the disjointed implementation of the new rules. In particular, the Latvian commissioner was irked by reports that lenders in some countries raised interest rates, added extra fees, shortened maturities, and demand additional collateral: “Since we are currently dealing with a symmetrical shock which is hitting all EU member state economies, it is important that the banking sector’s response is more uniform.”

Policymakers have reminded bankers that the pandemic offers them a ‘chance at redemption’ after their sector loomed large in the last financial crisis. Mr Dombrovskis said that the commission will not fail to act should lenders continue their foot dragging in providing timely financial relief and may even decree a formal moratorium if the scheduled talks break down. He also warned that in the meantime the European Commission will closely monitor how banks deploy the freed-up capital and treat customers in their time of need.

However, the ECB expects commercial banks to adjust operations and processes to the new reality before long and loosen their purse strings once the full extent of government guarantees is properly internalised. In the UK, Bank of England Governor Andrew Bailey told lenders to ‘put their back into it’.

The apparently slow response from the financial sector to the Corona Recession has fuelled the debate on the need for a digital currency as a way to manage the flow of money. The central banks of France and The Netherlands have signalled their readiness to start pilot projects. Central Bank Digital Currency (CBDC) differs in fundamental ways from cryptocurrencies such as bitcoin that are not issued by governments and do not add to the M1 ‘narrow’ money supply.

An ongoing topic of discussion that has gained significantly in both relevance and urgency, e-money is being proposed as a relatively easy way to quickly get funds to where the need is highest – and do so with pinpoint accuracy. CBDC bypasses banks and does not require overly complex financial technology.

In its most-effective form, e-money would reach households and businesses via an account at the central bank into which ‘helicopter money’ is dropped for a specific set of purposes such as the payment of bills, wages, and/or operational (living) expenses. Such e-money accounts do not accept deposits of ‘old-school currency’ and may not be used to park savings – the whole point of the exercise is to inject liquidity into a moribund economy. Deposits that remain unused vanish in the same way that they magically appeared – at the convenience of the issuer.

The spending of e-money can be easily tracked with a unique identifier attached to each ‘virtual’ euro. Its use for unintended purposes, say the payout of bonusses to management or the acquisition of luxuries by households, can either be blocked or flagged.

As talk amongst economists shifts to formerly taboo topics such as expanding the narrow money supply, the e-money debate slowly moves centre stage. Most European central banks have dabbled with the novelty, assessed the pros and cons, and concluded that digital currency may offer significant advantages as long as the resource-intensive and self-imposed (deflationary) limitations of cryptocurrencies are avoided.

According to Rémi Bourgeot, chief economist at the French think tank IRIS, digital money allows central banks to formulate a much more targeted response to exogenous shocks without the need to rely on traditional ‘financial transmission channels’, i.e. commercial banks. Mr Bourgeot argues that the vast volumes of money currently being injected into the European economy reach the intended recipients in a roundabout way which significantly decreases the effectiveness of the intervention. The economist emphasises that CBDC looks nothing at all like the cryptocurrency since anonymity would be absent. Although a number of central banks mull CBDC as a way to simplify some transactions and settlements, none seems willing to develop the concept a few steps further. “It remains unlikely that Europe will take the lead in financial innovation,” says Mr Bourgeot.

Meanwhile, the fiscal response to the recession is slowly gathering steam, albeit in an uncoordinated manner with each European country tracing its own unique path to salvation. Though in the works, a coordinated post-corona reconstruction effort is not expected for some months. It takes time to chisel away at northern resistance to the pooling of debt and risk. However, in one way or another, the estimated €1.5 trillion cost of the pandemic will be shared by member states. The waiting is on a politically palatable solution that enables politicians to cross their red lines whilst appearing to stand firm.

The debate, perhaps no longer as acerbic as three weeks ago, moves into the direction of prodding the nominally independent ECB into drifting even further away than it already has from its mission to preserve monetary stability. This is the path of least resistance: the taboo on tinkering with the status of the central bank is not nearly as strong as the one that rests on fiscal solidarity. The thinking is that the Eurozone can use a little bit of inflation to kickstart its economy and encourage households and businesses to embark on a spending spree. However, the ability of commercial banks to adjust their credit assessment criteria and speed up internal processes to match the urgency of the moment remain key. For what it’s worth: the European Commission is now on their case.

You may have an interest in also reading…

From the Black Plague to the Covid Crisis, Quarantine has Affected Maritime Trade

An overly familiar term in the 2020s, “quarantine”, dates from the 14th Century and is derived from quarantena — Italian

The Fabric, and the Notion, of EU Solidarity is Being Ripped Apart

Italians are suffering – but they are also angry and defiant. EU flags are being burned. On social media, Italy’s

Otaviano Canuto: More Than One Coronavirus Curve to Manage – Infection, Recession and External Finance

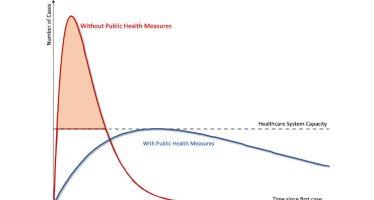

Flattening Coronavirus Curves – Otaviano Canuto First appeared at the Policy Center for the New South The global reach of