IBM on Banks’ Reinvention Imperative: Don’t Leave Money On the Table!

The ability to change and digitally adapt has been a defining feature of business during the pan-demic. According to IBM, the Institute for Business Value (IBV), almost 60% of business lead-ers said they had already begun dramatically accelerating their companies’ digital transfor-mations as early as September 2020. With adversity serving as a catalyst for change, fully two-thirds of business leaders said the pandemic has allowed them to pursue specific transfor-mation initiatives that, pre-pandemic, had encountered stiff resistance.

Cloud technologies are central to this digital acceleration. And cloud is a fundamental enabler of successful transformation. But cloud adoption alone is insufficient to motivate significant gains in revenue and profitability. The ability to integrate functions and processes, and to enable intelligence and interoperability, is a key determinant in fully exploiting the potential value of cloud. Cloud – or, more specifically, hybrid cloud – can support levels of openness and collaboration far beyond what was possible in the past. Hybrid cloud, coupled with digital and business transformation, can generate unprecedented strategic and financial benefits for an organisation. In short, the democratisation of data and the dramatically increased intelligence and insight brought about by open hybrid technology and architecture promise to redefine the economics of business.

“Investment in cloud computing can generate up to 13 times greater benefits than cloud alone, when executed end-to-end in combination with other levers of business transformation. The potential impact on profitability can be up to 20 times when applied specifically to the banking industry.”

The IBV has recently conducted a study in collaboration with Oxford Economics, based on a survey of almost 7,200 C-suite executives (almost 680 from financial institutions) across 28 industries and 47 countries. The study suggests that investment in cloud computing can generate up to 13 times greater benefits than cloud alone, when executed end-to-end in combination with other levers of business transformation. The potential impact on profitability can be up to 20 times when applied specifically to the banking industry. To harvest all economic benefits, the relationship between cloud technologies and business transformation must include:

- Mastery of data capabilities.

- Level of adoption of technologies, including AI, IoT, and RPA.

- Maturity of operational enablers, including workforce skills, processes and extended intelligent workflows, and cybersecurity.

- Extent of shift toward an open organisation, including cultural transformation, innovation, platform strategies, and ecosystems engagement.

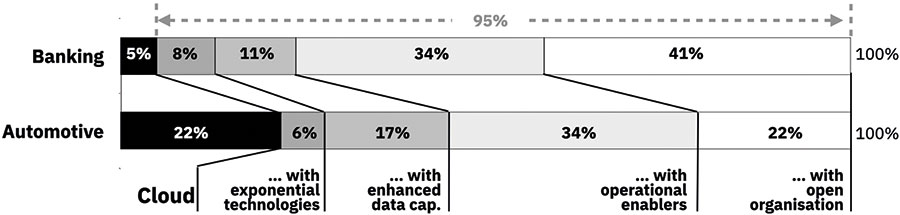

Essentially, let’s assume that end-to-end enterprise transformation unlocks extra business value, which is 100% of a potential revenue amount on the CEO’s table. In banking, cloud adoption alone will yield only 5% of the total potential revenue from new cloud investments. This means that 95% of all the money that a bank can further earn will remain on the table if the CEO fails to see the cloud strategy as part of a broader enterprise transformation effort. Cloud’s contribution to business value expands dramatically when business reinvention involves adopting both state-of-the-art technology and an innovation-friendly, employee-centric organisational culture.

Comparing banking with other industries can provide insights about the business rational. In both industries, most of the revenue potential is expected to be generated by the interaction of new cloud investment with the other enterprise capabilities, such as transforming the organisation and the operating model with a refreshed culture that embraces open innovation, ecosystem interplay and platform-oriented business models.

However, the study indicates that cloud investments alone already allow automotive firms to grab 20% of the money on the table. As said, banks could size only 5%.

Financial institutions need to do more to achieve more. Why this difference? Among other aspects, the shift to an open organisation is a clear driver.

Typically, clients want to buy a car with as much personalisation as they can afford. Carmakers act as providers of “all-in” solutions. They assemble vehicles based on guided preferences, engaging providers of components like automatic gearboxes, leather seats, or Hi-Fi players. Ultimately, each client meets one dealer who manages the whole tailored relationship.

About banking and financial intermediation, clients (families or corporate) looking for solutions to their financial health do not typically buy a single banking relationship but are asked to deal with a multitude of intermediaries organised across product-focused business units. However, it is the whole portfolio of opportunities that help clients personalise financial decisions over time and succeed in their financial journey. Clients have a relationship for payments and transaction banking, a relationship for treasury investments, a relationship for funding needs to buy machinery or real estate. All these dedicated interactions generate siloed data repository about the same client. Typically, bank business units – and IT departments – operate with seemingly different incentives, which are focused on the clients’ sub-needs instead of their continuous journey. Consequently, the culture and organisation of banks is way more split compared to other industries. This indicates that the benefits of hybrid cloud in terms of facilitating the accessibility and interoperability of data, insights and applications can be dramatically enhanced by an open banking organisation that can make clients the center of a platform solution shaped around personalised full needs, instead of specialised financial products.

Banks are asked to revise their operating models to think and act as “all-in” digital providers of solutions. For banks, shifting from “product centricity” to “client centricity” is not only a matter of marketing. Most of all, it means changing the incentives and mechanisms of their offers to leverage exponential technologies and operate as “all-in” business platforms. This can only work when business culture is transformed to embrace the open organisation.

The key message is that to maximise the revenue impact from cloud technology it is necessary to complement its adoption with enterprise transformation.

More insights about unlocking the business value of hybrid cloud can be learned by accessing the full IBM study.

More insights about banking platformisation can be learned by reading Paolo’s latest book Banks and Fintech on Platform Economies: relinks.me/1119756979

About the Author

Author: Paolo Sironi

Paolo Sironi is the global research leader in banking and financial markets at IBM Consulting, the Institute for Business Value. He is one of the most respected fintech voices worldwide, providing business expertise and strategic thinking to a network of executives among financial institutions, start-ups, and regulators. He is a former quantitative risk manager and start-up en-trepreneur. Paolo’s literature explores the biological underpinnings of financial markets, and how technology and business innovation can bolster the global economy’s immune system in today’s volatile times. Visit Paolo’s website thePSironi.com for more information.

Website: thePSironi.com

Read in the CFI.co Autumn 2021 Issue

You may have an interest in also reading…

Retail to the Rescue, but… ‘Zombie’ Stores Still Face a Battle to Service Debt

Retail has undergone some major transformations triggered by the pandemic. With unemployment and disease surging in the US it is

Martha Lane-Fox: Dot Everyone to Reclaim the Net for Civil Society

Seeking succour for the digitally-challenged, Britain’s Martha Lane-Fox – or Baroness Lane-Fox of Soho as she is known around Westminster

The Two Sides of Capital Flows into Brazil

There was a significant inflow of funds in Brazil’s external financial account in October and November for investments in both