Otaviano Canuto, World Bank: Making Returns on Knowledge – How Innovation Can Flow from Globalisation

The April issue of the International Monetary Fund’s World Economic Outlook (WEO) included a chapter on how globalisation has helped technology leaders’ knowledge spread faster. Cross-border technological diffusion has not only contributed to rising domestic productivity levels in advanced and emerging economies, but also facilitated a partial reshaping of the innovation landscape. Some recipient countries have become significant new sources of research and development as well as patents.

Globalisation has diffused knowledge and technology…

More trade, foreign direct investment, and international use of patents have disseminated knowledge and technology across borders. This diffusion can lead to increases in average outputs at relatively low costs. Furthermore, its multiple use may generate positive network effects through cross-pollination.

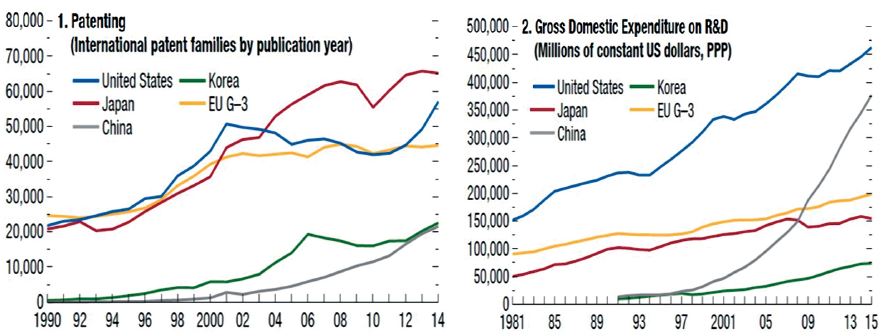

“International sources of technological innovation are changing, as R&D expenditures skyrocket in China and stocks of international patents pile up in South Korea.”

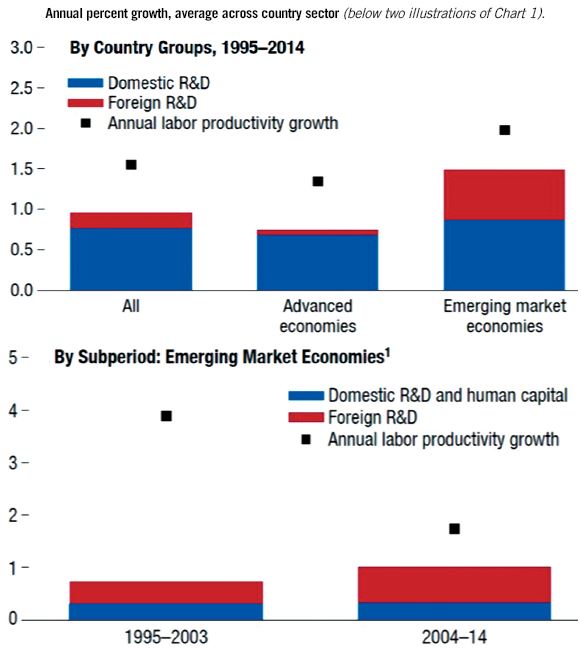

Knowledge flows from abroad can have an impact both on productivity, through the adoption of foreign technologies in the production process, and on innovation, when combined with domestic R&D. The WEO estimates that in emerging market economies, “from 2004 to 2014, foreign knowledge accounted for about 0.7 percentage point of labour productivity growth a year, or 40% of observed sectoral productivity growth, compared with 0.4 percentage point annual growth during 1995–2003” (see chart 1). According to the report, these results remain robust even when China is excluded, indicating that productivity effects were broad-based among emerging market economies.

Chart 1: Contribution of Foreign Knowledge to Labour Productivity Growth.

Source: International Monetary Fund (2018). World Economic Outlook, April.

International sources of technological innovation are changing, as R&D expenditures skyrocket in China and stocks of international patents pile up in South Korea (see chart 2). These countries have joined traditional leaders in sectors such as electrical and optical equipment and, especially South Korea, machinery. This has happened even as, since the early 2000s, frontier economies have gone through a slowdown in the increase of labour and total factor productivity, a measure of how efficiently inputs are being used in the production process. These economies have also experienced slower growth in patenting and, to some extent, lower R&D investment.

Competing explanations have been offered for the foregoing, either as a time gap in the transition between the third and fourth industrial revolutions or as a secular decline in opportunities to push productivity forward. In any case, prevailing technological convergence gaps and the possibility of simultaneous use of existing technologies have offered emerging market economies the opportunity to keep advancing even if the rhythm decelerated at the frontier.

The WEO also brings to the fore the results of an empirical exercise showing positive effects of heightened international competition on innovation and technological diffusion. That could be considered an additional channel through which globalisation would be reinforcing incentives to innovate and adopt technologies from abroad.

…but there are local requisites to escalate the ladder of innovation capabilities

Simple interconnectedness does not automatically spark productivity increases and local innovation. Any application of technology needs locally specific content that cannot be acquired or transferred by means of textbooks or other codifiable forms of knowledge transmission. This knowledge cannot be made explicit, such as simply using blueprints, and thus cannot be perfectly diffused as either public information or private property. It must be developed locally.

Chart 2: Patenting and Research & Development at the Frontier. Source: International Monetary Fund (2018). World Economic Outlook, April.

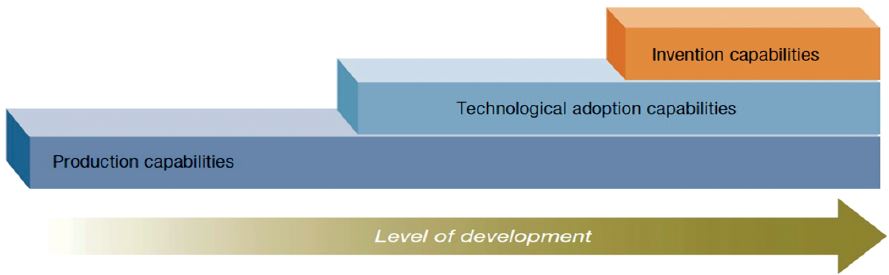

Production, technology adoption, and invention requires a relatively high level of such idiosyncratic knowledge and local capabilities. It is typical for latecomers to start from production and technological adoption and only then move on to invention (see chart 3). That has been the case in South Korea and China. These countries are developing their innovation capabilities after intense learning through using and adapting existing technologies.

Success depends on the presence of a broad set of complementary factors: access to finance, infrastructure, skilled labour, and good managerial and organisational practices. In the absence of these factors, returns from investing in the development of capabilities are likely to be low. Solutions must be found to market failures that generate disincentives to the accumulation of knowledge. The transaction costs associated with doing business, such as trading across borders, hiring and enforcing contracts, also cannot be too high.

Chart 3: The Capabilities Escalator. Source: Cirera, X. and Maloney, W.F. (2017). The Innovation Paradox, World Bank.

This beneficial environment is not widespread, which is why there have not been larger changes in the international innovation landscape. It also explains what Xavier Cirera and William Maloney, economists at the World Bank, have called the “innovation paradox”: low levels of innovation-related investment in developing economies do not correlate with the high returns thought to accompany technological adoption and catch-up. Globalisation may spread knowledge. Profiting fully from that knowledge requires a further effort.

About the Author

Otaviano Canuto is an Executive Director of the World Bank. The opinions expressed in this article are his own. Follow him on Twitter: @ocanuto

You may have an interest in also reading…

Sustainable Investment in the Dominican Republic: Driving Economic Development in the Caribbean

The Dominican Republic has emerged as a regional leader in attracting foreign direct investment (FDI) within Central America and the

Riordan Brings Strong Leadership to Daniels

Prof. Christine Riordan is a perfect example of a dean who practices what she preaches. Riordan has a reputation as

Global Banks’ Retreat from China: What Went Wrong?

Not so long ago, China was hailed as the next big frontier for Wall Street. The nation’s financial markets, once