Q&A with CEO of First Pension Custodian, Nigeria: Kunle Jinadu

His excitement hasn’t faded — and nor has his optimism for the sector.

CEO of First Pension Custodian, Nigeria: Kunle Jinadu

What excited you about the businesses you worked for during your earlier career, and what excites you about the business you now lead?

Kunle Jinadu: My first full employment was with Deloitte Haskins and Sells (now Deloitte Touche), a firm of chartered accountants. I had just graduated from the university and had been selected from the country’s National Youth Service Corps because of my grade. I was excited by my posting to an International firm of accountants.

I have matured now, but I still feel excitement. The people I lead give me the impetus to deploy my time and energy to bring about initiatives that drive the company’s narrative.

What is special about the management style at your organisation, the team you lead, and the workforce?

KJ: The pension industry reform in Nigeria is fast evolving, and managing a pension custodian had been made very complex by reform. Custody operations as a stand-alone process was novel to the environment. We had to employ transformational and collaborative management styles to inspire our workforce.

My company is a member of a larger group, the First Bank of Nigeria Ltd. The group management style allowed subsidiaries considerable autonomy within the group governance framework.

How would you characterise short to mid-term prospects for the pension industry in which you operate?

KJ: The short-term project was to establish pension reform. Pension administration in Nigeria was determined to be unsustainable, and there was a need to convert to a contributory scheme and move away from defined benefits, which were largely non-contributory. This has been, to a large extent, achieved. The aim is to find benefit adequacy to achieve the goals of adequate benefits for workers.

What are the personal and business strengths that qualify you as a corporate leader?

KJ: Knowledge of the subject of the business comes first. This is capable of delivering values when combined with situational awareness, collaboration skills, and ability to work with different personal styles.

Business strength is situated in knowledge, self-awareness with confidence. Collaborative skill is the acceptance of delegation as a tool for getting results. I think also that a positive attitude helps with creativity. It’s usually not difficult to get my colleagues to see the usefulness of the initiatives.

What, to your mind, makes for good corporate leadership?

KJ: I think the first thing is to understand oneself. One must be honourable, positive, with strength outweighing the weakness. One must be strong in one’s knowledge, have ability to seek information, and be decisive when required. People must have faith in your judgement, and trust your abilities and enthusiasm. It is important to try new approaches, either by personal innovation or by working with a small creative team. When things go wrong, it’s time to wake up the team.

What are your short-term hopes for the future of your business, and for the industry as a whole?

KJ: The business is in its 14th year, with considerable growth in all areas. One major hope is for consolidation of all the company’s initiatives to ensure the success of digital processes, and guarantee quality service to clients. One of the aspirations of the company is to be the custodian of First Choice and this a target, to surpass clients’ expectations and assist with the increase in market share. We hope to shed operational costs to achieve a competitive cost-to-income ratio.

For the industry, continuing stakeholder collaboration is needed to tackle various drawbacks to the smooth implementation of the Contributory Pension Scheme. If this is not addressed, it could erode the gains to this point.

How are pension funds impacting the wider economy?

KJ: What is certain is that the pension fund administrators remain committed to deploying funds for the benefit of the wider economy. We see willingness to participate in financing for infrastructure that has come into the market space. The operators want enabling government instruments to ensure that funds remain safe and liquid. The largest potential sponsor of infrastructure transactions is the government.

The contributory scheme is mandatory, and compels employees and employers in the public and private sectors to collectively save a minimum of 18 percent of an employee’s monthly salary into the RSA. This has increased national savings. The fund has come in as an independent financial intermediary, as the nation’s private businesses no longer rely on banks as the sole sources of outside capital. The fund has developed the equity market, which has been shown to enhance overall economic development.

The Pension Reform Act 2014 made provision for specific institutions that should manage the contributory scheme, including PenCom (regulator), PFAs, and CPFAs, who employ hundreds of graduates of diverse professions. This helps to provide for young graduates who otherwise be roaming the streets in search of jobs.

You may have an interest in also reading…

Région Île-de-France: A Region Spearheading Sustainable Finance

Région Île-de-France is home to more than 12 million inhabitants — a fifth of the country’s population — and accounts

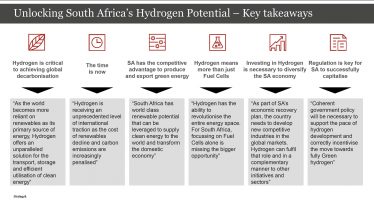

PwC: South Africa Has an Unprecedented Opportunity to Capitalise on the Rapidly Developing Global Hydrogen Economy

Hydrogen can be a game changer for the South African economy. Opportunities exist for South Africa to partake in the

Lord Waverley and Paul Baker: The Promise, Potential and Pitfalls of Britain’s Relationship with Africa

The concept of Africa Rising is truer today than ever. Despite the pandemic disruption that has caused the continent’s first