Otaviano Canuto, World Bank Group: Fiscal Policy Redux

U.S. Capitol Building

As part of their response to negative shocks coming from advanced economies after the Lehman Brothers’ collapse in 2008, most developing countries resorted to countercyclical fiscal policy. Such a policy choice was available to many developing economies that entered the global economic crisis in good macroeconomic and financial shape, with smaller fiscal and current-account deficits, lower inflation, higher international reserves, lower public and external debt, and less financial vulnerability than in the past.

Today there is a swing toward pursuing more ambitious goals through fiscal policy than countering economic downturns. In that context, it is worth revisiting those requisites that must be in place for fiscal policy to truly succeed.

Counter-Cyclical Fiscal Policies in Developing Countries

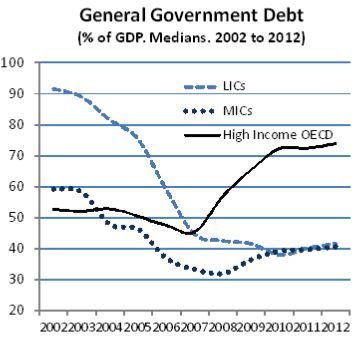

Prior to the financial crisis, an improvement in the fiscal position of many developing countries was reflected in a substantial decline in their public debt during the 2000s (see Chart 1). The median ratio of general government debt to GDP among middle income countries (MICs) almost halved from near 60 percent in 2002 to just over 30 percent in 2008. Median debt in a sample of low income countries (LICs) fell even more precipitously over this period, aided by substantial debt relief.

Chart 1. Source: World Development Indicators, World Bank

Some of that fiscal space built prior to the crisis proved to be a buffer against the crisis, with the strength of post-crisis recovery in many developing countries partially reflecting increased public spending. Median debt ratios rose close to 10 percentage points in the last few years (see Chart 1) and, although not all developing economies are now in a relatively benign position, in most cases the use of short term fiscal stimulus could take place without raising general concerns with fiscal sustainability. Debt build-up has remained modest, given interest rates at low levels and less than GDP growth rates in most developing countries.

“Nevertheless, one can notice an increasing appetite for using fiscal policy as an instrument to foster growth, reduce poverty, boost social inclusion and equity, and to protect against risk and vulnerability to shocks.”

As the global economic environment seems to have changed from consecutive negative shocks to a more chronic disease of low growth in advanced economies, fiscal policy in most developing countries has also shifted from pro-activeness to a more low-profile resort to automatic stabilizers. Nevertheless, one can notice an increasing appetite for using fiscal policy as an instrument to foster growth, reduce poverty, boost social inclusion and equity, and to protect against risk and vulnerability to shocks.

A Three-Pronged Rationale for Fiscal Policy

A threefold rationale for public action through fiscal policy can be pointed out.

First, there is macroeconomic stabilization. Given that often relying on monetary policy is not enough to get the job done, governments should also maneuver taxation and/or spending levels in a countercyclical manner. Before the crisis, many economists had discarded the effectiveness of proactive fiscal policy as a stabilization tool, but its widespread use in the early stages of the global economic crisis has since rescued it from the limbo to which it had been relegated.

Second, there is a resource allocation rationale, i.e., improving economic performance via expenditure and tax policies that raise efficiency and tackle relevant market failures. The existence of public goods, externalities and increasing scale returns, as well as information failures and missing markets, are recognized as factors frequently undermining the operation of pure markets. Therefore, taxes and government expenditures addressing those factors could be considered as policy options as a way to fuel economic growth.

Third, there is the distribution rationale underpinning policies that are designed to mitigate inequalities of income, opportunities, assets, or risks that result from private-market activities. We should not forget to include a dimension of intergenerational distribution, since fairness toward future generations may demand taxes and expenditures that guarantee some carry-over of the value of natural assets, for example. After all, one may ethically consider it unfair that current generations consume the whole gift received from Mother Nature, so to share prosperity over time and for future generations may require taxes and government expenditures.

Recipes for Fiscal Policy to Succeed

There are preconditions that must be followed if fiscal policies are going to deliver. First of all, the quest for stabilization has to be symmetrical on both upturn and downturn stages of the economic cycle. The fiscal space of maneuver used to offset negative shocks has to be replenished during boom times, to make sure that public finance remains sustainable, rather than becoming another source of macroeconomic instability. Fortunately, good news is the proportion of developing countries implementing countercyclical fiscal rules went up from less than 10 percent in 1960-99 to above one-third in the new millennium. This is an encouraging trend.

“Quality of public investment management is crucial.”

The pursuit of economic growth, in its turn, will justify the resource allocation rationale only if costs of government failures do not exceed the costs of the same market failures that fiscal policy is supposed to address. That will require efficiency in revenue collection by governments, cost-effective public service delivery, and protection of public resources against waste and corruption. Quality of public investment management is crucial. In that context, besides capacity-building in governments, transparency and feedback from stakeholders – civil society organizations, citizens, users of public infrastructure, and contractors – have been shown to help improve performance. The good news is that information and communication technology has made it easier to progress on transparency and social monitoring.

Finally, shared prosperity can only be obtained through fiscal policy if tax structures and government expenditures adopted for the other two rationales do not conflict with that objective. The good news is, on the expenditure side, a lot has been learned in the last decades about what works and under what conditions regarding cost-effectiveness of different social and environmental policies. On the taxation side, the challenge remains how to reconcile adequate levels of revenue with progressivity on income and wealth among citizens and generations.

The Special Case of Natural Resource Rich Countries

Fiscal policy in natural resource-rich countries demands a separate discussion, as they share many uniquely distinctive features. Taxation and royalties from the natural resource sector too often become a predominant source of government revenues. Given the high volatility of international resource prices, they also face a tendency of high volatility in government revenues and economic activity. In the case of so-called “point-source” natural resources – such as minerals and oil – they become a tempting target for corruption and rent-seeking. The struggle to control such assets is sometimes a source of civil strife and war. Extractive natural resources themselves are depleting assets so a key question arises as to how much to consume today and how much to save for future generations.

The problems of natural resource-led development get exacerbated in Low-Income Countries (LICs), where governance conditions are often weak, present consumption demands by the large numbers of poor are hard to resist and where it is hard for governments to commit and stick to rational plans for natural resource depletion.

Fiscal policy in resource-rich countries plays a central role with respect to capital accumulation and long run growth. The key to increasing future living standards lies in increasing national wealth, including not only traditional measures of capital such as produced and human capital, but also natural capital. Standard economic measures of GDP and savings are inadequate to tell us whether national wealth is indeed rising: we need instead measures of adjusted net national income and savings which, among other things, take into account the depletion of natural assets as a form of depreciation, complemented by comprehensive measures of the stock of wealth. This is a matter of much practical importance: conventionally measured GDP growth has been strong in many Sub-Saharan African countries in recent years, for example, but may be unsustainable because adjusted savings rates are estimated to be negative, indicating that their overall wealth may be declining.

To ensure that their long run growth is sustainable resource-rich countries must ensure that they capture an efficient and fair share of natural resource rents, and then invest that share effectively, so as to increase the country’s wealth. This is where sound fiscal policy and good public sector governance become crucial.

Bottom Line: A Fiscal Policy Renaissance?

The global economic crisis has given back to fiscal policy its high profile as an instrument of macroeconomic stabilization. A revived interest in the potential of fiscal policy to boost economic growth, poverty reduction and equity has followed. Instead of denying it, we believe the most fruitful path is to work on those conditions necessary for it to succeed.

About the Author

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

You may have an interest in also reading…

Women, Science and Robots: The Gender (R)evolution Ushers-in Precision Medicine

In Germany, a team developing an AI-based human resource tool thought they had found a way to feed their system

UNCDF: Enabling Transformation – Investing in the Local Needs of Women

In 1990, in the first Human Development Report of the United Nations Development Programme (UNDP), Pakistani economist Mahbub Ul Haq

World Economic Forum: Less Is More and Other Wisdom from Davos

Less is more, and you better get used to it. That is the message US real estate tycoon Jeff Greene