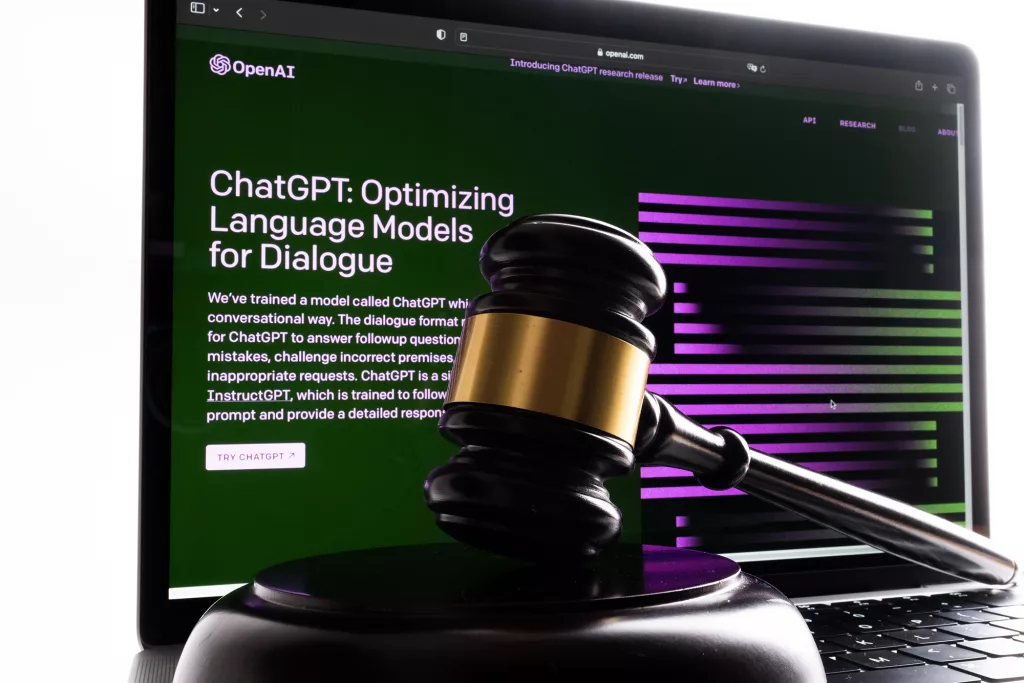

Judges Approve use of ChatGPT in Legal Rulings, Despite Its Tendency to Fib — and ‘Invent’ False Cases

Fallible AI gets the go-ahead in Britain to summarise lengthy texts and perform ‘administrative’ court tasks.

UK judges will be allowed use ChatGPT to help write legal rulings — despite warnings that the technology can “invent” cases that never happened.

The Daily Telegraph newspaper reports that the Judicial Office has issued new official guidance to judges in England and Wales: AI can now be used to summarise screeds of text.

It can also be used in administrative tasks, but the Judicial Office has admitted that chatbots are “a poor way of conducting research” — and prone to making up fictitious cases or legal texts.

The guidance expects bots such as ChatGPT to be used by members of the public when bringing legal cases — and warns that deepfake technology could be used to create phony evidence.

Sir Geoffrey Vos, the Master of the Rolls, said that AI “offers significant opportunities in developing a better, quicker, and more cost-effective digital justice system”.

He said the technology would “only move forwards”, and the judiciary had to understand what was going on. “Judges, like everybody else, need to be acutely aware that AI can give inaccurate responses as well as accurate ones,” he said.

Senior judge Lord Justice Birss recently described ChatGPT as “jolly useful”, admitting he had used the bot to summarise an area of law with which he was familiar — and deployed the copy-paste function in a court ruling. He said he had used ChatGPT as “a test”, and that he had not entered any secret or confidential information into it.

Vos said that lawyers were potentially subject to perjury charges and criminal sanctions if submissions penned by a chatbot produced false evidence. “Nothing changes just because they may have got what they said falsely from an AI chatbot instead of out of their own head.”

Suid Adeyanju, CEO of cyber company RiverSafe, said the use of AI in legal rulings brought with it “great opportunities” — but opened the door to cyber risks. “Hackers have already proven adept at infiltrating and exploiting security loopholes to steal data,” he said, “and in this scenario could also lead to widespread evidence-tampering.

“It’s vital that organisations using this technology tread carefully, and ensure they have the necessary security systems in place.”

Josh Boer, director at tech consultancy VeUP, said this was the most recent example of AI reshaping critical functions. The technology would save time and money by managing administrative tasks, he said. “(It) has huge potential to turbocharge the next generation of UK SMEs,” he said, “providing crucial support in the back office. Yet far too many companies lack the skills and support to embrace it.

“That’s why it’s crucial that organisations get to grips with the latest generative AI capabilities, by embracing AWS and other key platforms, to boost growth through the cloud for the long term.”

You may have an interest in also reading…

Baker and McKenzie: Impact of a New UK Regulatory Framework on Capital Markets

The UK Financial Services Act 2012, which came in to force on 1 April 2013, significantly restructures the regulatory framework

Energy Sector Grapples with Hydra-Headed Problems of Global Supply and Demand

At the recent COP-26 climate summit in Glasgow, government officials and leaders of international organisations put the spotlight on the

Fed Chair Powell: “Recovering to a Different Economy”

A river runs through it. President Christine Lagarde of the European Central Bank (ECB) argues that safely fording the ‘big