Otaviano Canuto: Some Economies May Soon Face a Hard Landing

Weaker performance of emerging markets is expected in the immediate future.

This year began with simultaneous signs of a slowdown in global economic growth and a reorientation toward tightening of monetary policies in advanced economies.

This year began with simultaneous signs of a slowdown in global economic growth and a reorientation toward tightening of monetary policies in advanced economies.

In its latest Global Economic Prospects, the World Bank forecasts that global growth — at 5.5 percent last year — should moderate to somewhere between 3.2 and 4.1 percent this year and next.

In addition to the effects of the pandemic, a fall in fiscal support and lingering supply chain disruptions point to a slowdown.

For China, the World Bank expects a GDP growth of 5.1 percent this year, well below the eight percent that had been forecast. In addition to possible restrictions on mobility due to the “zero covid” approach, the adjustment in the property sector will contain consumer spending and residential investment.

While advanced economies reduce their pace of expansion, central banks are on a tightening path — apart from the Chinese case. The Federal Open Market Committee (FOMC) believes the reorientation of its monetary policy since October has been made clear in the minutes of its meetings, and in statements by Federal Reserve chair Jerome Powell. With unemployment rates below four percent, consumer price inflation ended the year at seven percent, a level not seen since the early 1980s. Its listing as a “transient” phenomenon has been abandoned by the Fed.

A FOMC meeting last September suggested an interest rate hike this year. The end of the Fed’s bond-buying programme was brought forward, while Powell telegraphed that the Fed’s balance sheet reduction should begin as early as mid-year.

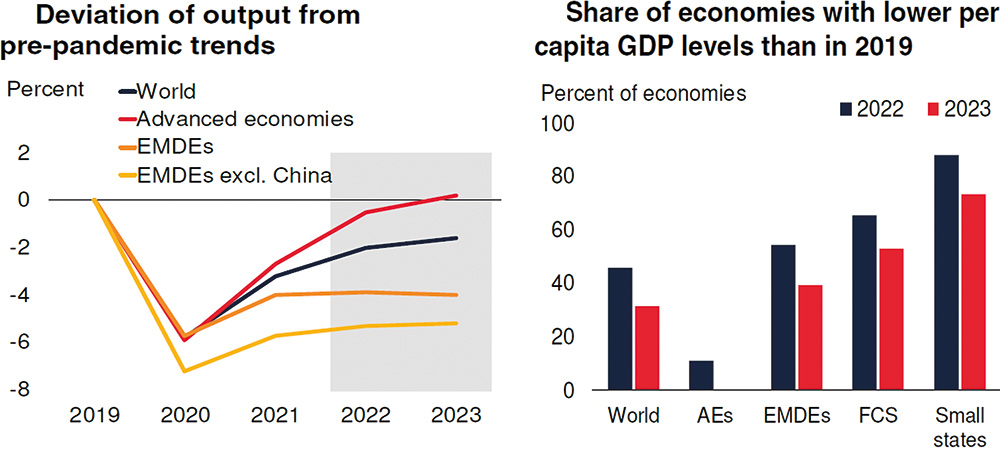

Figure 1: Emerging Market and Developing Economies lagging behind. Source: World Bank (2022). Global Economic Prospects, January.

After interest rate hikes in England, Norway, and New Zealand, the same is expected in Canada. Similar moves by the European Central Bank and Sweden are anticipated for early 2023.

This is the scenario faced by emerging and developing economies that are making a slow recovery from the pandemic. The World Bank does not expect a return to pre-pandemic GDP and investment trends in 2022-23.

High inflation rates and public debt during the pandemic are constraining the adoption of expansive fiscal and monetary policies. Not coincidentally, higher interest rates and the downward revision of fiscal support have taken place in many cases. The question is whether the growth slowdown, with tightening financial conditions in advanced economies, is likely to be disastrous for some countries.

Tightening external financial conditions will doubtless accentuate challenges for emerging market policy-makers. For emerging market economies undergoing domestic inflation, the risk of additional pass-through pressures from currency depreciations — after markets embed higher US interest rates — will be key in setting monetary policy. While tightening cycles began in 2021 in Brazil, Mexico, and Russia as inflation rates moved above target levels, central banks in India and Indonesia maintained an accommodative stance.

Pro-cyclicality of capital flows would also be a factor for those countries. Emerging market economies with a high share of foreign participation in domestic capital markets and more open financial sectors are vulnerable to the volatility of such flows.

Central banks in these countries may be forced to tighten monetary policy beyond what would be adequate from a growth perspective: South Africa and Mexico are potential examples. In cases of financial markets that are largely domestically funded — India, Brazil, and Malaysia — the vulnerability to capital outflows driving substantial currency depreciation is lower.

The answer to the question about the nature of landing of emerging market economies will ultimately depend on how aggressively the monetary policy reorientation in advanced economies takes place. If growth remains minimally robust as inflation moderates in the US, due to reduced fiscal stimulus and fading supply chain restrictions, emerging markets could avoid a hard landing.

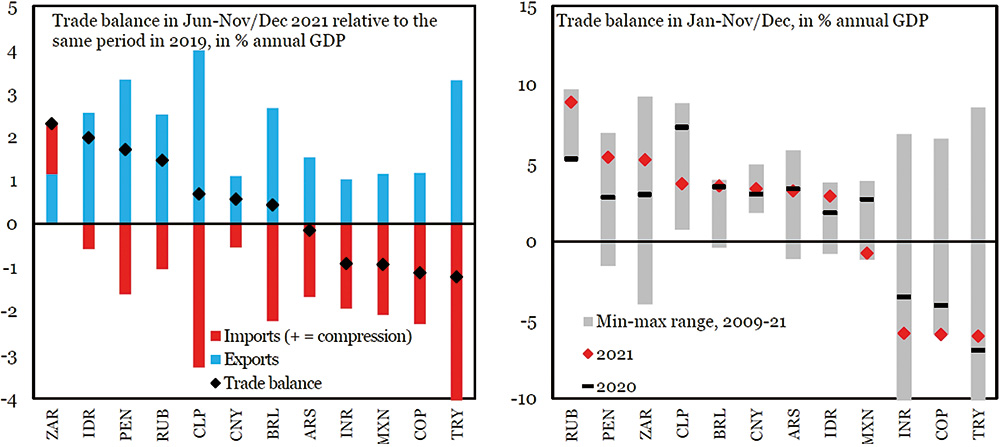

Figure 2: Emerging market trade balances. Source: Lanau, S. and Fortun, J. (2022). Economic Views – EM External Imbalances in 2022, Institute of International Finance – IIF, January 11.

There has not been a large inflow of foreign capital into emerging market economies in recent years. Jonathan Fortun, in the capital flows tracker by the Institute of International Finance (IIF), suggests that there has already been a sudden stop, albeit with great differentiation between emerging markets.

Sergi Lanau and Fortun also highlight that emerging-market current account deficits have been low or nil in the past two years. In the case of Latin America, foreign reserves increased in 2021, following the reinforcement of liquidity buffers started in the second half of 2020, in addition to the increase in Special Drawing Rights (SDRs) by the IMF last year.

Are exchange rates at levels of overvaluation that make them vulnerable to sudden and catastrophic devaluations? Here Robin Brooks, Fortun, and Jack Pingle, all from the IIF, suggest a more heterogeneous picture. Although most emerging currencies have experienced real devaluation in the past decade, there is huge differentiation, with some now exhibiting devaluation and others overvaluation.

In the case of Brazil, they estimate a degree of around 20 percent of excess devaluation of local currency below what its fundamentals would indicate, such as current account balances and stocks of foreign assets and liabilities. The non-return of the exchange rate to pre-pandemic levels contributed to the Brazilian inflation ending 2021 in double digits — on top of food and energy shocks. In the case of Brazil and other emerging countries without exchange overvaluation, a high probability of dramatic exchange rate adjustments is not foreseen — provided that the reorientation of monetary policy in advanced countries does not take on dramatic contours.

Except in the case of drastic monetary adjustments in advanced economies, one must focus on domestic factors to understand the weaker performance of emerging markets in the immediate future.

This article first appeared at Policy Centre for the New South.

About the Author

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a visiting public policy fellow at ILAS-Columbia, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past ten years.

Follow him on Twitter: @ocanuto

You may have an interest in also reading…

A Passion for Inclusivity and the Arts: Meet the Chief Exec of an Islamic Bank

Mufaddal Idris Khumri, CEO and managing director of the Maldives Islamic Bank, has deep expertise in the sector… Mufaddal Idris

World Bank Group: Financial Inclusion – Banking on Low-Income Households

Financial exclusion restricts economic opportunity and constrains poverty reduction. Yet today there are an estimated 2.5 billion adult people worldwide

UN Expects Subdued Asia-Pacific Growth in 2013

Growth in Asia-Pacific remains subdued due to the impact of persistent weaknesses and uncertainties in the developed economies, the United