IMF: KSA Is One of The Top G-20 Performers

On July 08, 2013, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Saudi Arabia.

On July 08, 2013, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Saudi Arabia.

Saudi Arabia has been one of the best performing G-20 economies in recent years, and has supported the global economy through its stabilizing role in the global oil market. Generous financial support has also been provided to countries in the Middle East region.

The Saudi economy grew by 5.1 percent in 2012, benefitting from high oil prices and output, strong private sector growth, and government spending. Inflation has risen over the past year to 3.8 percent in May 2013, driven by higher food prices and housing costs. High oil prices and production led to large fiscal and current account surpluses, and international reserves rose further. Credit growth has remained strong, and the banking system is well-capitalized and profitable, with Basle III capital standards implemented in January 2013. Following an expansionary fiscal stance in 2011, government expenditure growth slowed in 2012 and the non-oil deficit began to narrow. Consistent with the exchange rate peg, monetary policy settings have remained unchanged.

“The Saudi population is young and increasingly well-educated, and as it continues to enter into its working-age years, there is a tremendous opportunity to boost growth and raise living standards further.”

Looking ahead, growth is projected to slow to 4 percent in 2013. Private sector growth is expected to be strong, but oil production is likely to be below 2012 levels while government spending growth may slow. Inflation is expected to ease toward year-end in line with declining international food prices. With oil prices and production expected to be lower, fiscal and external surpluses, while remaining large, are projected to narrow this year.

The Saudi population is young and increasingly well-educated, and as it continues to enter into its working-age years, there is a tremendous opportunity to boost growth and raise living standards further. Against this background, the government is continuing to implement initiatives to boost the employment of Saudi nationals, increase the supply of housing, improve infrastructure, particularly in the area of transportation, and develop the small-and medium enterprise (SME) sector.

Executive Board Assessment

Executive Directors welcomed the continued strong performance of the Saudi Arabian economy and the systemic and stabilizing role that the country plays in the global oil market. They also acknowledged Saudi Arabia’s role as an important source of financial assistance and remittances for many developing countries. Directors noted that the outlook for the Saudi economy is positive. Looking ahead, they stressed the importance of continuing reforms aimed at maintaining macroeconomic stability and addressing demographic challenges.

Directors agreed that the fiscal and macroprudential policy settings are appropriate. They noted that if signs of inflationary pressures were to emerge, capital spending would need to be slowed and/or macroprudential policies would need to be tightened. Over the medium term, while the non-oil fiscal deficit is expected to decline as infrastructure spending tapers off, additional measures would be needed to further strengthen the fiscal position. Directors welcomed the measures the authorities have undertaken to strengthen fiscal management, but saw scope for further improvements. They generally agreed that moving to a medium-term budget framework that better integrates the five-year national development plans and sets the expenditure envelope based on a long-term estimate of the oil price would be useful.

Directors noted that an upward adjustment of energy prices would help curb the growth of energy demand. Implementing the adjustments in a phased and well communicated manner would allow businesses and households time to adjust. Vulnerable groups would need to be protected from the effects of higher prices.

Directors welcomed the continuing steps to promote financial development and strengthen financial regulation and supervision. They noted that Saudi Arabia is among the first countries to implement Basle III capital standards. Directors agreed that the pegged exchange rate remains appropriate. A few Directors considered that, if at a later stage a flexible exchange rate were to become appropriate with the evolution of the structure of the economy, steps to facilitate the transition would be helpful. Directors looked forward to enactment of the bill on countering the financing of terrorism.

Directors noted that the young, rapidly growing Saudi population provides both an opportunity and a challenge in raising growth and living standards. In this regard, reforms under way to boost employment, support the housing market, develop infrastructure, and foster the small and medium enterprise sector will help address the challenges. Directors welcomed the large investments in education aimed at strengthening the skills of the population, noting that such spending should be monitored vis-à-vis achievement of desired outcomes. They also cautioned that implementation of labor market policies to boost Saudi employment should be carefully coordinated with macroeconomic policies.

Directors noted that considerable progress has been made in improving economic statistics but saw scope for further improvement. Subscription to the Special Data Dissemination Standards would be an important goal.

You may have an interest in also reading…

Statement on World Bank’s $2.1 Billion Support to Nigeria

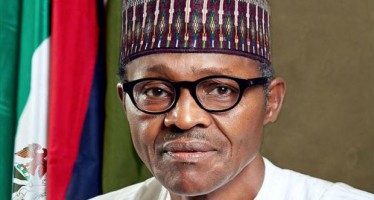

On Tuesday, July 21, 2015 the World Bank Group President Jim Kim held a meeting with Nigerian President Muhammadu Buhari

Ernst & Young: Argentina – New Government Measures to Improve and Strengthen Employment

Argentine payroll costs are the highest in Latin America, standing at a maximum of 40%. Social security and health care

Dr. Ross Jackson: Tackling the Global Crisis

With crisis all around us at this critical time in history, it is time to start asking ourselves some hard