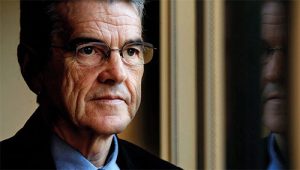

Bill Mitchell: Saving Capitalism from Itself

Proponents of Modern Monetary Theory (MMT) often manage to elicit a nod from more orthodox peers that acknowledges their existence – but does not necessarily imply recognition.

Frequently derided as apologists for free spending, MMT fans insist that austerity is an elitist ploy to keep the masses in their place and to stop them from upsetting the economic apple cart; a cart that, incidentally, carries away the riches.

MMT is akin to the heterodox economic thought that enjoyed its 15 minutes of fame somewhere in the mid-1970s, and has since retreated to fringes mostly found in Latin America. There are, however, a few voices still calling from the wilderness. Bill Mitchell, professor of Economics at the University of Newcastle in Australia, is one of those voices.

Mitchell insists that the emperor has no clothes and flatly refuses to buy into neoliberalist thought. He has been outspoken in his condemnation of austerity policies that prioritise debt repayment and fiscal frugality. He also rallies against progressives for selling out to the right-wing – starting with Tony Blair’s New Labour and including François Mitterrand and other less prominent social democrats who dumped their convictions to embrace the free market.

Mitchell argues that the neoliberal policies now prevalent across most of the Western World have effectively depoliticised the economy, undermining the primacy of politics and depriving voters of a say in the management of their countries. According to Mitchell, this sense of disenfranchisement has sparked a renewed interest in the political extremes of left and right which cater to, and feed on, popular frustration.

The notion that neoliberals want to limit the reach and role of the state is only skin deep, says Mitchell, pointing to bank bailouts as a prime example of the agenda which seeks to privatise profits but insists on socialising losses. This threatens governments with dire consequences for allowing “too big to fail” entities to tumble. Those same forces are also engaged in dismantling antitrust legislation and mechanisms, arguing that bigger is better, and cheaper, and necessary to acquire the critical corporate mass to compete on a global scale.

Mitchell offers MMT as an antidote. MMT departs from the premise that money is essentially created out of nothing. The magic money tree exists, and it is cultivated by banks. Mitchell will hear few economists disputing his assertion that fiat money is an abstract concept of digits entered into a computer.

Few people understand the concept of a medium of exchange created and regulated by governments – as opposed to a currency with intrinsic value, such as gold.

What MMT argues is that any government overly worried about deficit spending or debt load does itself a disfavour by barking up the wrong money tree. As long as a country is in full sovereign control of its own money – which Greece was not – it should have no trouble navigating economic boom and bust cycles, insulating wider society against the fallout.

The University of Chicago, grand central of monetarist thought, argues that money supply must be controlled to keep inflation low. MMT calls for central banks to return to their original duty – to keep unemployment low – instead of fighting inflation.

Though most politicians support the monetarist approach to finance, as espoused by Milton Friedman et al, few dare to practise true orthodoxy. Most actual economic policy is hybrid – and, says Mitchell – ineffective. MMT is, of late, enjoying something of a renaissance as voters grow tired of austerity and begin to question its premises. Mitchell’s core message is getting through: big business has become too big for its own good, and austerity is a bid to balance books for all the wrong reasons.

Voodoo economics to some and an open invitation to emulate Venezuela to others, MMT may be easily dismissed as a set of crackpot ideas. However, that would do Mitchell an injustice. The foundation on which MMT rests is solid, and any idea that challenges orthodoxy without departing from reality surely merits a closer look.

You may have an interest in also reading…

James “Jamie” Dimon: How Not to Be a Good Banker

The CEO, chairman and president of JPMorgan Chase has no shortage of supporters and fans. Just two years ago, James

Graf Henckel von Donnersmarck: Life outside the Comfort Zone

You have geniuses and then you have Florian Maria Georg Christian Graf Henckel von Donnersmarck; filmmaker extraordinaire, fluent in five

Justin Yifu Lin: Eastern Perspectives, Western Preconceptions, and Prospects for Shared Economic Growth

Justin Yifu Lin made history in 2008 as the first non-Westerner appointed as chief economist and senior vice-president of the