PwC: Nigerian Report on Ease of Doing Business

Author: Folajimi Olamide Akinla

In 2016, the Nigerian economy was in a recession recording negative growth of 1.5%. This was mainly triggered by the fall in crude oil prices. There were also foreign exchange shortages and inflation which affected the growth of the services and manufacturing sectors. Central Bank of Nigeria’s (CBN) policies to protect the currency resulted in a decline of foreign direct investment (FDI) and foreign portfolio investment (FPI). These factors formed the catalyst for the government to diversify the economy by creating a business environment to attract investment.

In the 2018 World Bank Ease of Doing Business Report (Report), Nigeria was ranked 145 out of 190 economies, moving up 24 spots from the previous year. According to the report, Nigeria was one of the top-10 most improved economies and top-three improved Sub-Saharan countries, including Malawi and Zambia. Nigeria’s improvement in the Ease of Doing Business rankings did not happen overnight. The improvement can be traced directly to certain initiatives and policies introduced by the federal government’s Presidential Enabling Business Environment Council (PEBEC.)

“At the end of the 60 days, EBES recorded a 70% success rate on all reforms and subsequently a 100% rate of success after 90 days. Following the reforms, Nigeria’s ranking increased across board.”

PEBEC was set up in July 2016 as an inter-governmental and inter-ministerial body. It is chaired by the vice-president of Nigeria and comprises ten ministers including the ministers of Industry, Trade and Investment, Power, Works and Housing, the head of the Civil Service of the Federation, the governor of the Central Bank of Nigeria, representatives of the Lagos and Kano State governments, the National Assembly, and the private sector. The Enabling Business Environment Secretariat (EBAS) is the vehicle through which PEBEC implements its policies.

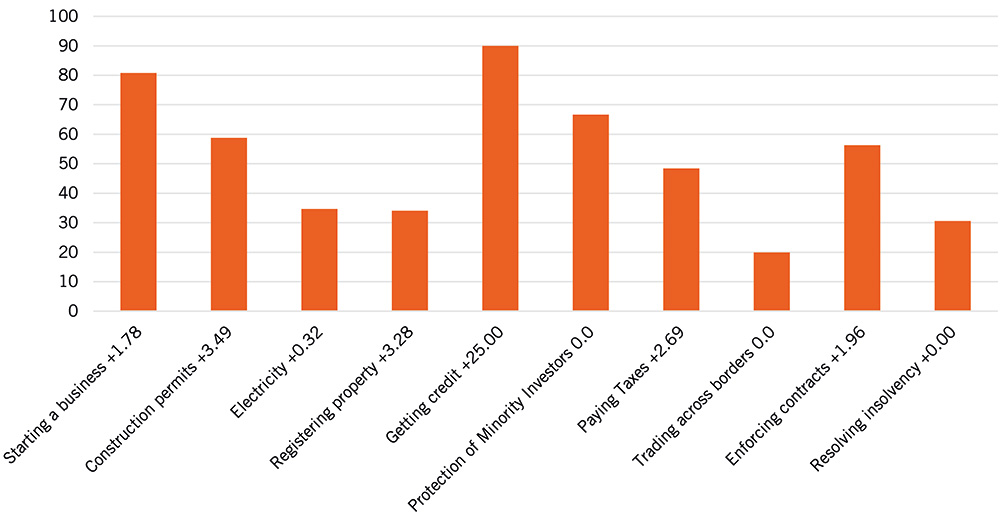

Nigeria: Ease of doing business, 2018.

PEBEC’s core mandate was to improve the ease of doing business, specifically for micro, small and medium-sized enterprises (MSMEs) by removing bureaucratic burdens and administrative bottlenecks across government ministries, departments, and agencies (MDAs). At inception, PEBEC’s principal remit was to increase Nigeria’s Ease of Doing Business rankings 20 places. At the time, the country ranked 169th. One year later, PEBEC had already exceeded its goal. This is commendable, and kudos to PEBEC and the EBAS, but the critical question is whether this progress is sustainable? More importantly, in the highly competitive global environment, can Nigeria improve further on its ranking?

World Bank Indicators and Methodology

In determining the ranking of each economy, the World Bank analyses eleven indicators directly affecting business owners. Each indicator is analysed to determine economic outcomes and identify regulations or policies needed to improve the ease of doing business. The indicators are: starting a business, labour market regulations, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, trading across borders, paying taxes, enforcing contracts, and resolving insolvency.

Economies are measured based on the ‘distance to frontier’ (DTF) methodology where each economy is given a DTF score and benchmarked against a ‘frontier’ economy which represents the best performed economy – the highest score being 100 and lowest zero. The overall ranking of the 190 economies is determined by sorting the aggregate DTF scores.

National Action Plan 1.0

In February 2017, PEBEC introduced a 60-day National Action Plan 1.0 to implement initiatives aimed at improving the ease of business specifically for MSMEs. The initiatives were implemented across eight indicators including seven of the World Bank indicators. The indicators are starting a business, obtaining construction permits, getting connected to the grid, registering property, access to credit facilities, paying taxes, trading across borders, and entry and exit of people.

In May 2017, the federal government issued the Executive Order No. 001 of 2017 on the Promotion of Transparency and Efficiency in the Business Environment. The order is broken down into six major pillars: Transparency, Default Approvals, One Government Directive, Entry Experience of Visitors and Travelers, Port Operations, and Registration of Businesses.

Some of the initiatives implemented by PEBEC under the National Action Plan 1.0 include:

Starting a Business

Before now, the Corporate Affairs Commission (CAC) did not have a functional online / electronic platform for prospective business owners to register their businesses. This led to unnecessary queues and congestion at the CAC offices. In addition, the manual registration involved filing seven different forms. There was also a separate process of visiting the stamp duties office for assessment and payment of stamp duties. These challenges often resulted in undue delays, as much as six weeks, to register a company. The average time globally is about two days.

PEBEC set an objective to make it possible to set up a business in 24 to 48 hours. To achieve this, the following measures were introduced:

Online name searches

Allowing online registration of businesses

Improving the reliability and user interface experience of the online portal

Reducing the forms from seven to one

Integrating the payment for stamp duties with the registration process

Currently, the registration process has greatly improved such that it is now possible to register a business in four to five days.

Construction Permits

Before the reforms, it took at least 42 days to obtain construction permits. Some of the causes of delay included lack of an online platform to apply for permits, lack of clarity in the procedures, applicable fees, and qualification of professionals (architects and engineers) permitted to supervise construction activities. In addition, the criteria for obtaining waivers for soil and environmental impact assessment tests were not clear leading to uncertainty and failed applications.

To address these challenges, major reforms were introduced in Lagos and Kano (the most populous states). In Lagos, the Lagos State Physical Planning Permit Authority (LASPPPA) introduced an online platform for applying, tracking, and paying for permits. Rules and procedures on applying for permits and relevant fees were published on LASPPPA’s website. Information on the appropriate qualifications, as well as the applicable laws relating to the qualifications, were published on LASPPPA’s website. To streamline the requirements on soil and EIA tests, soil tests were no longer required for construction below four-stories not being in marshy areas whilst EIA tests are no longer required for low scale construction.

Registering Property

The procedure for registering titles to land was characterised by long delays in obtaining governor’s consent due to the large number of applications, multiple stages in the application process, as well as multiple fees paid by the applicants. There was also no effective complaints mechanism to pass on complaints to relevant authorities and the procedure for conducting due diligence searches at the registry were unnecessarily cumbersome.

To remove these bottlenecks, powers to issue governor’s consent were delegated to specific commissioners. E-signatures were also introduced to replace the governors’ handwritten signatures. The process of registration was also streamlined and a single payment introduced to consolidate multiple payments. A Complaints Unit has been set up for applicants to direct any complaints to and the procedure for conducting searches has been made easier by removing the need for getting a sworn affidavit from the courts.

Similar to Lagos, Kano now publishes the list of documents, fee schedule, and service standards for property transactions making the land registration process more transparent.

Connection to Grid

Before the reforms, there were nine steps to getting connected to the grid. On average, it took almost 200 days to get connected to the grid. However, to improve the process, the Nigerian Electricity Regulatory Commission (NERC) – the regulatory agency – issued draft orders reducing the steps from nine to five and the number of days to 61.

Access to Credit

Nigeria ranked sixth overall for access to credit and was one of four Sub-Saharan African (SSA) countries ranked top 10 in this area. Before the reforms, MSMEs encountered considerable difficulty in obtaining loans for their operations due to insufficient information and creditors’ reluctance to accept moveable assets as collateral.

In addressing these challenges the National Assembly (the federal legislative arm) enacted two laws – the Credit Bureau Services Act (CBS Act) and the Secured Transactions in Movable Assets (Collateral Registry) Act (STMA Act).

The CBS Act promotes access to accurate and reliable credit information for creditors to rely on in granting loans to MSME. Under the act, credit bureaus can issue credit ratings of borrowers to banks and other creditors who then have sufficient information before granting loans.

Two of the primary objectives of the STMA Act are to improve lending to MSMEs and facilitate assess to credit secured by movable assets. The act provides the framework for MSMEs to register, in the National Collateral Registry, movable assets used as collateral. The web based register allows creditors carry out due diligence searches on collateral by providing creditors with sufficient information to assess any security interests registered on collateral to help them determine loan terms and conditions.

Trading Across Borders

Many of the goods imported into Nigeria are brought in through the ports in Lagos, particularly Apapa and Tincan. Before the reforms, goods were imported into Nigeria without being properly packaged in pallets and manifests were not available. This caused disorder at the ports as cargoes were not properly packaged and it became almost impossible to determine the arrival of cargo.

Because of this, importers made screening arrangements by themselves without going through the Nigerian Customs Service (NCS.) This created more confusion and opportunities for bribery and rent seeking. Documentation requirements were also onerous.

Sometime in 2017 and January 2018 respectively, the Revised Import Guidelines, Procedures, and Documentation Requirements under the Destination Inspection Scheme (Guidelines) were revised and then an addendum was added to the guidelines. Amongst other things, the guidelines now mandate all containerised cargo to be palletised, the Combined Certificate of Value and Origin has now been replaced with a single Certificate of Origin, and the NCS is now responsible for scheduling and coordinating the Mandatory Joint Examinations to ensure there is a single point of contact between importers and other regulators / officials. The documentation has also been reduced from ten to seven (in the case of exports) and fourteen to eight (in the case of imports).

Entry and Exit of People

Travelers were often faced with filing multiple entry and exit forms, had their luggage subjected to manual searches, uncertainty in the rules for obtaining visa on arrival, infrastructure deficit at airports and their environs, as well as inordinate delays in issuance of visas at Nigerian missions.

PEBEC reforms to address these challenges include consolidating arrival and departure forms, simplifying the rules and procedures for obtaining visas on arrival, eliminating manual searches of luggage, and imposing a 48-hour timeline for issuance of visas by Nigerian missions abroad. Business visas are now issued to expatriates where a temporary work permit would have otherwise been required. The Nigerian Immigration Service (NIS) also decentralised the passport re-issuance process by allowing state commands to re-issue passports instead of only at its headquarters in the Federal Capital Territory (FCT) Abuja. A total of 28 new residence permit production centres have also been opened across state commands. Previously, three state commands shared a zonal production centre, often causing delays and backlogs.

Nigeria’s Progress

At the end of the 60 days, EBES recorded a 70% success rate on all reforms and subsequently a 100% rate of success after 90 days. Following the reforms, Nigeria’s ranking increased across board.

National Action Plans 2.0 and 3.0

Due to the success of the reforms, PEBEC implemented National Action Plans 2.0 and 3.0. Under 2.0 (October – December 2017), PEBEC introduced even more initiatives to these areas as well as three additional areas (enforcing contracts, selling to government, and trading within Nigeria) to consolidate the reforms and progress made under the 1.0 Plan. Some of the new initiatives include:

Enforcing Contracts

PEBEC resolved to reduce the time taken to resolve cases related to commercial contracts by training magistrates to handle commercial cases. Recently, the Lagos State government introduced the Small Claims Court under the Magistrates’ Court Law (Practice Directions on Small Claims) where magistrates have jurisdiction to hear commercial cases of claims not exceeding N5 million (c. $16,400). These courts provide easy access to an inexpensive and speedy resolution of debt recovery disputes. It is expected that other states would set up similar courts.

Selling to the Government

The Bureau of Public Procurement (BPP), the agency responsible for monitoring and the procurements by the federal government, has various procedures to encourage transparency in the public sector. These procedures are often burdensome for MSMEs. In view of this, PEBEC resolved that simplified processes should be introduced for MSMEs. Many MDAs are now issuing simplified procedures for smaller businesses.

Trading within Nigeria

To encourage the easy movement of goods and people across Nigeria, PEBEC resolved that all illegal roadblocks be removed from all roads across the country. In September 2017, the Nigerian Police Force ordered the immediate removal of roadblocks in all states. This is not the first time government has ordered a removal of roadblocks. However, it appears that many roadblocks have now indeed been removed.

Before, the trademark registry had a backlog of marks yet to be registered. The registry has now been directed to clear all backlogs and then publish over 30,000 outstanding marks.

In February 2018, the government introduced National Action Plan 3.0 to implement more reforms within a 60-day period. About 27 government agencies were involved in implementing the reforms. Some of the major reforms include:

- Introducing an online feedback platform where businesses can give feedback to PEBEC. This would allow government to receive real time and direct feedback on the effectiveness of the reforms.

- Setting up PEBEC secretariats in each state to allow effective monitoring of reforms.

- Enacting an Omnibus Bill to give legislative effect and force of law to executive orders as well as other initiatives.

- Creating airport concessions starting from the major airports – Lagos, Abuja, Port Harcourt.

Top Ten Economies of Africa

Whilst Nigeria was one of the top-ten most improved economies, it remains outside the top 10 economies in SSA. Currently, it sits at number 22 in Africa. The top 10 SSA economies are:

- Mauritius (25)

- Rwanda (41)

- Kenya (80)

- Botswana (81)

- South Africa (82)

- Zambia (82)

- Seychelles (95)

- Lesotho (104)

- Namiba (106)

- Malawi (110)

Even though Nigeria made notable progress in the 2018 rankings, there is still scope for improvement when compared with Africa’s top-ranked economy – Mauritius. To close the gap, Nigeria would require at least an annual investment of $100-$120 billion over the next three years (2018-2020). Based on a PwC study on the sub-national business environment in Nigeria, land availability and security, and tax harmonization remain the top challenges to doing business at the state level.

In 2018, Nigeria improved eleven steps (from 182 – 171) on the 2018 Paying Tax Report rankings. Whilst reforms were made to paying taxes, requiring taxpayers to pay tax at the nearest tax office and enforcing use of the centralised electronic payment system (which resulted in a reduction, by 69 hours in the time required to pay tax, to 360 hours), businesses still bear the burden of multiple taxes from different tiers of government and multiple agencies. On the average, businesses are exposed to about 21 different type of taxes. This remains a huge impediment to the ease of doing business.

Conclusion

Government efforts have proved effective given the results contained in the report. However, other critical areas are insecurity, multiple taxation, outdated labour laws, and a lackadaisical civil service. There is also the pressure on different state governments to raise their internally generated revenue. In some cases this has resulted in policies that were not perceived as being business friendly. For example the Lagos State Government introduced a new Land Use Charge Law which effectively increased the duties paid by businesses and individuals. Many taxpayers kicked against this. On a more positive note, the senate recently passed a bill to enact a new Companies and Allied Matters Act. The act gives many of the reforms statutory effect and introduces the Limited Liability Partnerships and Limited Partnerships as additional entities to be relied on by businesses. Other welcome reforms to increase the ease of doing business would be amendments to the Land Use Act and other outdated tax and commercial laws.

About the Author

Folajimi Olamide Akinla is a Manager and Tax Lawyer in PwC Nigeria’s Tax & Regulatory Services unit. He writes regularly on topical legal and tax matters. His core interests are resolving complex legal and tax problems, advising on tax policy and private wealth matters.

He is a member of the Ministerial Committee on the Voluntary Asset and Income Declaration Scheme (VAIDS), Nigeria’s first full scale tax amnesty.

Before joining PwC, he worked in a law firm renowned for its dispute resolution practice. He is an alumnus of Queen Mary, University of London (LLM, Tax Law) and the University of Lagos (LLB).

About PwC

PwC Nigeria is one of the leading professional services firms in Nigeria with offices in Lagos, Abuja and Port Harcourt, over 1,000 staff and 31 resident partners.

“We are committed to serving as a force for integrity, good sense and wise solutions to the problems facing businesses and the capital markets. We are guided by one promise – to do what is right, be it with our people, clients, community, or environment.”

Read the article from the CFI.co Summer 2018 print issue, or from the CFI.co app (download from iTunes or Google Play).

You may have an interest in also reading…

Dairy Price Surge Hits UN Food Price Index

A sharp surge in the price of dairy products pushed the overall costs of food one percentage point higher in

Participants at Cityscape Kuwait Showcase Latest Unique Projects & Services

Cityscape Kuwait, the premier real estate investment and development event in the State of Kuwait, will be opening its doors

Lord Waverley and Paul Baker: The Promise, Potential and Pitfalls of Britain’s Relationship with Africa

The concept of Africa Rising is truer today than ever. Despite the pandemic disruption that has caused the continent’s first