BNY Mellon: Best Cash Management System Global 2018

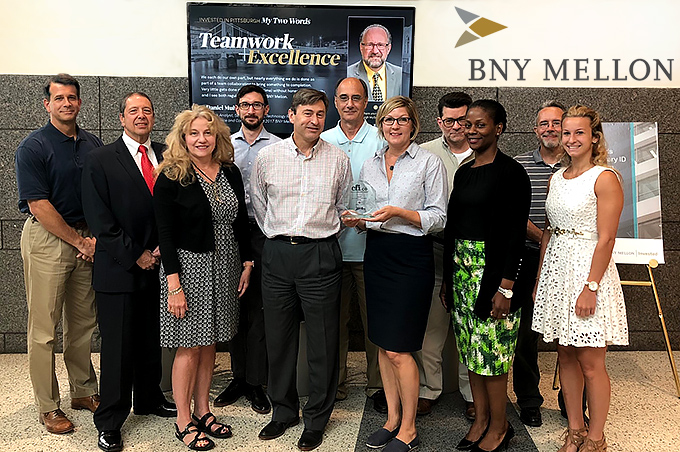

BNY Mellon Treasury Services staff, from left to right: Ron Johnson, Product; Ron Orrico, Global Client Service; Moneque Jeletic, Chief Administration Office (CAO) Administration; Ryan Betz, Business Response; Paul Adamo, CAO; John Peretic, Product; Jen Wagner, Global Head of Client Support; Erin Schuster, Proposal Group; Lulu Adekanye, Business Response; Daniel Steuernagel, Product; and Juliana Galante, CAO Administration.

Boosted by investor interest after registering a solid 9% increase of its year-on-year revenue in Q1 2018, Bank of New York Mellon Corp (BNY Mellon) has amply demonstrated its ability to grow organically, exceeding the expectations of even the most bullish analysts. That was enough to convince Warren Buffet to significantly up his stake in the bank.

BNY Mellon has made waves with a series of successfully executed efficiency drives which streamlined procedures and further improved the bank’s operational performance as evidenced by the boost to its bottom line. BNY Mellon has invested considerable resources in a new technological platform which is expected to help drive growth both from internal proficiencies and externally through improving the client experience.

BNY Mellon’s treasury services offers international corporate clients premier cash management services based on their global treasury technology platform. Servicing 36 countries and 120 currency markets has forced BNY Mellon to think global when digitally innovating – to the benefit of their clients relying on business-critical payments across borders.

BNY Mellon’s role as the frist payment originator on The Clearing House’s Real-Time Payments (RTP) network means it is capable of processing payment transactions with better liquidity, transparency and tracking agility. Speeding up the value chains by enabling swifter payments results in value-add for commerce.

The value creation enhancements of the cash management system benefit also other financial institutions as it is part of the private label treasury services solutions on offer.

The CFI.co judging panel commends BNY Mellon on its proactive approach to the cash management and its overall treasury services business, particularly the company’s continued dedication to precisely tailoring its services to keep up with demands such as real time transparency. The judges are pleased to offer BNY Mellon the 2018 Best Cash Management System Global Award.