Middle-Market Direct Lending

A Lucrative Alternative Asset Class

The US is home to some 200,000 companies dubbed “middle-market” — typically with EBITDA up to $150m.

On a stand-alone basis, America’s middle-market represents a $6.3tn economy, third-largest in the world. Non-bank lending to these middle-market companies is referred to as direct lending or private credit and represents a 75 percent market share.

Middle-market companies seek loans from non-bank financiers, because they provide distinct advantages that align with growth strategies and operational requirements. They include:

- Growth. Opportunities to expand operations, invest in new technologies, enter new markets, support strategic acquisitions, and more.

- Financing structures. Customisable loan structures tailored to meet the specific needs of individual companies.

- Committed capital. Bank lenders typically need to syndicate or sell a portion of their middle-market loans, while non-banks do not.

- Experience. Specialised knowledge with a deep understanding of challenges faced by middle-market companies, as well as niches by industry and geography.

- Speed. Focused approach enables faster and more efficient access to capital.

- Relationship-orientated. Facilitates ongoing communication and collaboration, which results in support beyond the initial financing.

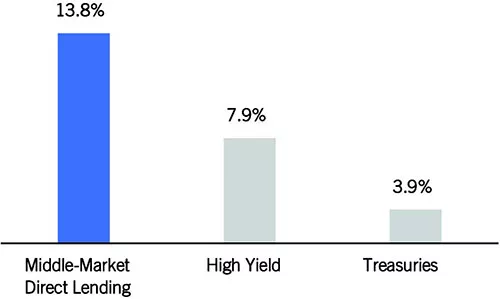

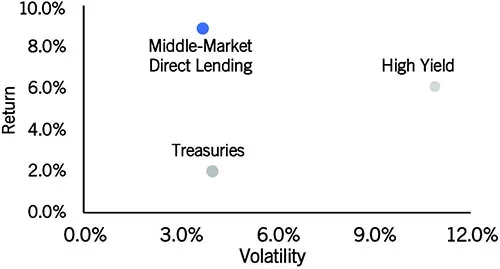

Middle-market direct lending exhibits strong defensive traits, enabling the strategy to adeptly navigate the current uncertain environment:

- Attractive income. Higher annualised yields relative to fixed income instruments such as high yield and treasuries.

- Risk-adjusted returns. Attractive historical performance relative to fixed-income instruments (again, such as high yield and treasuries).

- Hedge against rising rates. Floating rate structure neutralises duration risk from interest-rate movement.

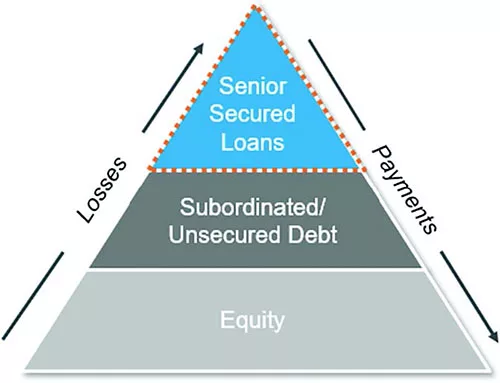

- Senior and secured. Priority in the borrower’s capital structure with robust lender protection through covenants to reduce risk.

Because of Prospect Capital Management’s achievements in middle-market direct lending, investors have placed their trust in the firm’s long-term expertise and track record to protect their capital and generate returns. The firm has over 100 employees and $11.5bn in assets under management as of March 31, 2023.

Prospect is currently offering an institutional-calibre middle-market direct lending solution for income-focused retail investors. Prospect Floating Rate and Alternative Income Fund (PFLOAT) is a non-traded business development company. PFLOAT invests primarily in the debt of privately-owned US middle-market companies and seeks to provide income largely from investing in senior and secured floating rate credits.

PFLOAT’s common stock pays a monthly dividend.

You may have an interest in also reading…

Hands-on, Dedicated to Excellence, Driven by Inclusion and Diversity: Meet the Head of Scottish Friendly

This CEO is fulfilling the aspiration for his mutual to become a leader in the UK insurance sector. Scottish Friendly

Markets Move in Anticipation of Boom Times

Yesterday, equity markets the world over went near-ballistic on the news that an effective vaccine had been developed to tame

The Current Crypto Bear Market & The Future of Blockchain – Asset Backed Token (ABT) ICOs

The current crypto bear market is due much to the network value well exceeding the number of transactions at the