US Investment Analysts Have Moved On from Trump

Wall Street doesn’t believe in miracles. In anticipation of a ‘blue wave’, US investors pushed the blue-chip S&P 500 up as the nation decides on the next occupant of the White House. With some 100 million votes already cast, pundits almost unanimously discard the possibility of an eleventh hour upset, pointing to the impressive – although perhaps not commanding – lead of Democrat hopeful Joe Biden in the latest polls.

Wall Street doesn’t believe in miracles. In anticipation of a ‘blue wave’, US investors pushed the blue-chip S&P 500 up as the nation decides on the next occupant of the White House. With some 100 million votes already cast, pundits almost unanimously discard the possibility of an eleventh hour upset, pointing to the impressive – although perhaps not commanding – lead of Democrat hopeful Joe Biden in the latest polls.

Mr Biden’s edge is about twice as large as the one that seemed to usher Hilary Clinton into the seat of power four years ago. Though Donald Trump has been a fathomless fount of surprises, market analysts do not think he’s able to snatch victory from the jaws of defeat.

On a whirlwind tour of key ‘battleground’ states – apparently Americans cannot supress their need to paint just about everything in the language of war – Mr Trump yesterday sounded quite desperate, at one point warning Pennsylvania Governor Tom Wolf that he was being watched closely: “We have a lot of eyes on the governor and his friends.”

Mr Trump also cautioned volunteer poll workers that counting votes after election day could prove ‘physically dangerous’. He went on to predict street violence should official results not be forthcoming within hours of the polls closing. Twitter immediately flagged Mr Trump’s comments as ‘disputed or misleading’. No US state has ever formally declared a victor on election day.

Trinity of Power

Overseas investors took the hint from US premarket trading and pushed stocks higher across the globe. The European bellwether Stoxx 600 gained 1.7 percent whilst MSCI’s Asia-Pacific index added 1 percent on the buoyancy of China and Hong Kong exchanges. Investors are excited at the prospect of a blue wave that will see the Democrats reclaim full control over the US trinity of political power: The presidency, senate, and house of representatives.

Markets expect a new administration to fast track a shock-and-awe stimulus package of unprecedented magnitude to support families and businesses throughout the pandemic and lay the groundwork for a major public works initiative to upgrade and update the country’s dilapidated infrastructure. Pundits in Washington suspect that Mr Biden will push for nothing less than a New Deal 2.0 to make up for his modest personal charisma, deploying a rather novel and refreshing ‘acta non verba’ mantra.

In a sign of returning confidence in a less hectic post-election normal, the Vix volatility index, which tracks market jitters, retreated 6 points from its October high to settle at 36, still almost twice its long-run average of 20. This elevated level of volatility has renewed interest in macro hedge funds to replace fixed income as an equity portfolio diversifier.

Of late, investors have turned sour on the bond market which many consider overpriced after successive interest rate cuts and the strong demand for quality paper from funds seeking a safe haven in turbulent times.

With limited upside potential, bonds are no longer considered an adequate hedge against a stock market sell-off. George Soros-style macro hedge funds span different asset and instrument classes, ranging from currencies and commodities to options and futures, and are actively managed to cash in on broad market moves sparked by major political or economic events – such as the US election or the Corona Pandemic. These funds usually perform well when investors dump risky assets. As such, macro hedge funds are at their best at times of heightened market volatility.

Heading South in Tandem

Whilst the FTSE All-Share index plunged from a mid-February high of 4,256 to a late-March low of 2,727, the HFRI Macro Hedge Fund index rose 2 percent. However, the countercyclical hedge doesn’t always hold: During the 2008 market commotion in the wake of the Lehman Brothers collapse, macro hedge funds failed monumentally, losing 19 percent of their value on average and causing many spooked investors to look elsewhere for solace. Conversely, macro hedge funds hold little excitement when the bulls have it, producing only lacklustre returns.

In a letter to investors seen by the Financial Times, US hedge fund guru and activist investor Paul Singer bluntly states that bonds are no longer a good ‘diversifier’ or even a ‘reducer’ of risk. Mr Singer warned that stocks and bonds may well go south at the same time, exposing investors loyal to the traditional 60/40 portfolio split to a painful double whammy.

Mr Singer seemed particularly worried that a Biden Administration could undo President Trump’s mega tax break for corporate America, arguably his greatest accomplishment. A rate hike from 21 percent to 28 percent, as considered by some of Mr Biden’s policy advisors, would reduce the earnings of S&P 500 companies by an estimated 9 percent, before factoring in spill over costs and ancillary damage.

Oil and gas companies have most to fear from a Biden win. The Democrat hopeful is determined to ‘transition away’ from hydrocarbons and unveiled a $2 trillion four-year plan to cut harmful emissions and electrify mobility. Mr Biden also want to retighten clean air standards slackened by the present administration and slash federal subsidies to the sector. Moreover, Mr Biden is expected to outlaw fracking on federal lands. Pummelled by the pandemic, and by the shift towards renewables, the oil majors’ market capitalisation has suffered considerably with the S&P 500 Integrated Oil and Gas index shrinking by almost 50 percent since the start of the year.

Back to Black

Meanwhile, the world largest asset manager remains bullish on the US economy and is convinced that the anticipated blue wave will lift all boats. Earlier this week, BlackRock upgraded the weight of inflation-protected assets and instruments in its portfolios to the detriment of treasury paper and the dollar, signalling that the firm expects a large fiscal stimulus to fuel both growth and inflation. However, Wells Fargo Senior Strategist Michael Schumacher sounded a note of caution: “The size of the stimulus bill rises or falls with the size of the potential Democrat majority in the senate. Not all blue waves are created equal.”

Remarkably, dissonant noises are increasingly hard to detect on Wall Street. Listening to both pundits and analysts of considerable repute leaves the impression that President Trump has already been relegated to the dustbin of history, adorned with the shameful epitaph of ‘one-termer’.

That begs the question: What if Democrats win by just a sliver or, improbable as analysts may think, Mr Trump pulls off yet another surprise victory? Worse still: What if the election results in a political limbo with both parties rallying their lawyers to dispute the outcome. Even as sheets of plywood are hastily attached to storefronts and the national guard is mobilised to back up local police forces in case of civil strife, Wall Street prefers to ignore all those ominous signs and looks instead at the bright side of life – and the many upsides of wishful thinking. Fanciful, perhaps, but not by no means devoid of reason.

You may have an interest in also reading…

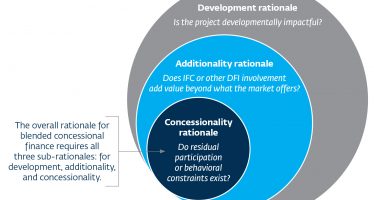

IFC’s Blended Finance Department: Blending Public and Private Finance to Invest in Challenging Markets

What can be done to encourage more private investment in developing countries, especially the poorest and most fragile? This question

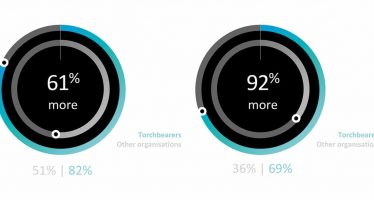

Ian Fletcher, Director IBM IBV: The Trust Economy – What’s My Data Worth?

How Do Organisations Ensure We Get a Fair Return? The driving force behind “stakeholder capitalism” – the theme of this

Global Banks’ Retreat from China: What Went Wrong?

Not so long ago, China was hailed as the next big frontier for Wall Street. The nation’s financial markets, once