Meet Nordea Asset Management’s Responsible Investments Team

Nordea Asset Management (NAM) has one of the largest and most experienced responsible investment teams in Europe: 26 dedicated ESG analysts from academia, independent organisations, and investment circles.

To stay at the forefront of responsible investing (RI), Nordea Asset Management’s team — set up in 2009 — continuously refines its ESG approach in keeping with the increasing complexity, depth and scope of the field.

The strength of NAM’s approach is that its investment teams and RI team are fully integrated — ESG analysts sit side-by-side with equities and fixed-income teams. Fund managers are involved throughout the research process, and directly tie results to their investment decisions.

The team is fully integrated with NAM’s investment boutiques managing ESG products, and carries out research, active ownership, and represents NAM in international RI initiatives.

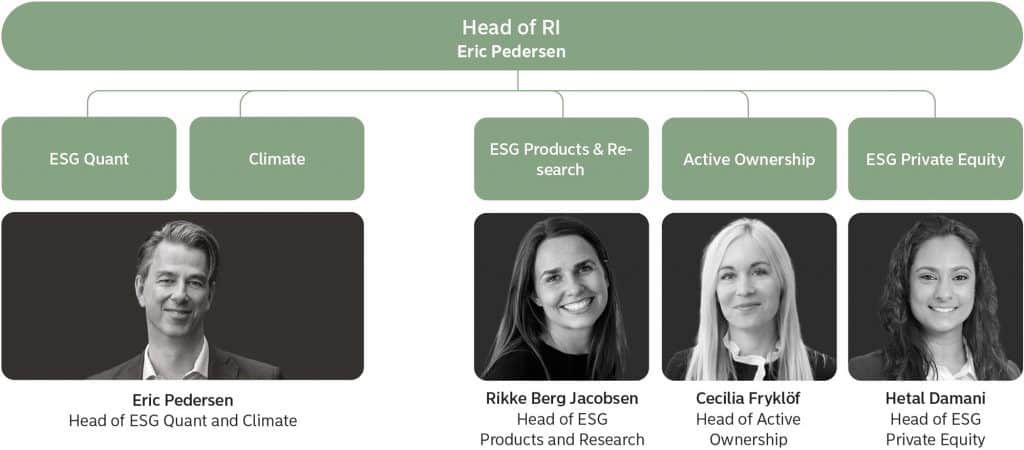

The team is subdivided into five units.

- The Active Ownership team is responsible for NAM’s engagement activities, as well as for driving the Responsible Investment Committee agenda and RI policy-development. This group also works with the corporate governance team on proxy voting.

- The Climate group maintains focus on climate-change factors and policies, implementation and reporting on TCFD recommendations, and the firm’s membership and obligations under the Net-Zero Asset Managers’ Initiative.

- The ESG Private Equity team supports NAM’s private equity collaboration with Trill Impact.

- The ESG Products and Research team carries out company-specific research and engagement for NAM’s ESG funds, as well as product development.

- The ESG Quant team develops and maintains NAM’s proprietary ESG-scoring model and ESG data platform, as well as advanced applications of ESG data, including the new Principal Adverse Impact module.

The team maintains a broad RI coverage with a particular focus on NAM’s ESG-enhanced strategies, including the ESG STARS and Thematic Sustainable Solutions ranges. It works closely with the respective portfolio management teams. Over 2021 and 2022, these ESG-enhanced strategies have grown with the launch of strategies such as the Green Bond, Global Climate and Social Impact, and Global Climate Engagement.

Members of the RI team are hands-on. In 2021, they led 1,033 engagements and voted in 4,200 AGMs, in collaboration with NAM’s Corporate Governance Team. In 2021, NAM ramped-up its voting activity — over 90 percent of its holdings were voted on, with some 10 percent of votes going against management. Votes related to climate and social issues were prioritised.

The RI team is also active in the global RI community, taking part in the industry-wide discussion around responsible investment and promoting best practices across the investment community. It is active in 36 investor initiatives across several ESG topics, including the Net-Zero Asset Managers’ Indicatives and the Finance for Biodiversity Pledge, as well as in several Sustainable Investment Forums around Europe.

You may have an interest in also reading…

Le Groupe La Poste: Committed to its Customers — and Sustainability

Since the 15th century, French postal service Le Groupe La Poste has been connecting the country, keeping pace with societal

Nazca: Meet the Team Keeping Entrepreneurs on Track

Nazca professionals have the qualifications and verve to keep things moving in Latin America. Héctor Sepúlveda Co-founder and Managing Partner

Pollen Street Capital: Beyond ESG, and Accelerating Progress by Adding ‘Caring’ to the Priority List

Pollen Street Capital believes that its investments and business support have positive impacts for the financial services industry — and