ESG in Company DNA Makes Responsible Investment as Obvious as ABC for Invesco

For more than 30 years, Invesco has demonstrated its commitment to responsible investing by actively encouraging ESG practices across every area of its business.

It applies ESG concepts to the products it offers, its investment processes, and its corporate behavior. Invesco’s approach focuses on integrating ESG risk and opportunity factors into investment decisions, differentiated by asset classes and decentralised by local investment centres. This integration extends to engagement and active ownership.

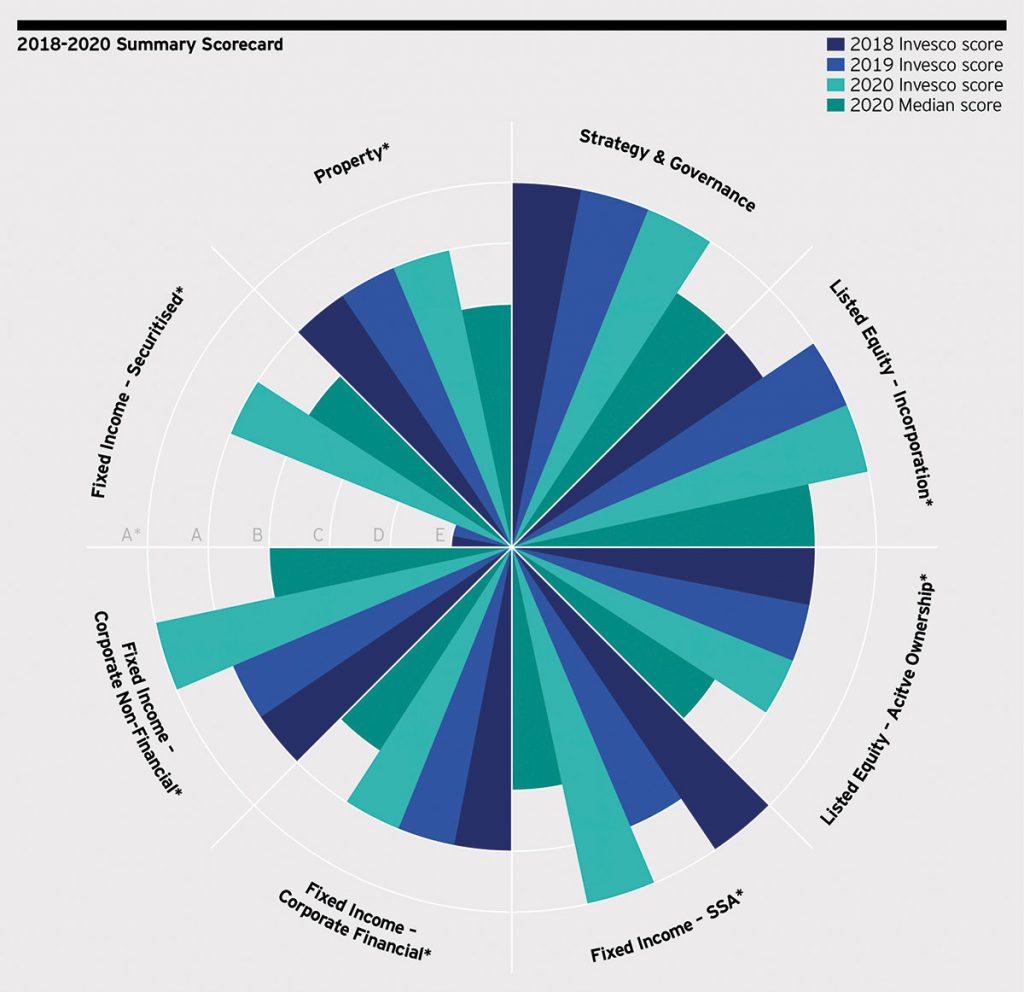

Source: 2020 Assessment Report for Invesco Ltd., PRI. *Direct and Active Ownership Modules.

Invesco’s support for responsible investment comprises the following elements:

Diverse Commitments to ESG

Due to Invesco’s diversity, its investment strategies and styles vary in their approach to implementation. This is underpinned by external research and a global team of experts with the capacity to manage ESG solutions depending on client need.

Engaged Investors

Invesco sees engagement as an opportunity for continual improvement. Dialogue with investment companies is a core part of its investment process and one of the most powerful mechanisms for mitigating risk, enhancing return potential and having a positive impact on society and the environment.

“We have taken a lead investor role with one company in 2020 as part of Climate Action 100+ and are involved in several collaborative engagements,” says Glen K Yelton, head of Invesco ESG client strategies for North America.

Proxy Voting

Invesco’s patented proxy voting portal facilitates investment-led voting decisions. This proprietary tool encourages knowledge collaboration, leverages multiple sources of research and enables investors to focus on long-term shareholder value.

Global Commitment to ESG Investing

ESG is a strategic competitive differentiator that helps Invesco clients to get more out of life. “We ensure that we’re doing what’s right for our clients,” says Yelton, “as well as our shareholders, employees and the communities in which we operate.”

The depth of the innovative strategies provides opportunities to deliver sustainable, long-term performance to clients.

Invesco globally formalised its commitment in 2013 when it became a signatory of the UN-sponsored Principles for Responsi

“As an investor in global equities, corporate and sovereign fixed income, real assets and multi-asset strategies, Invesco recognises the differences between asset classes and geographies, and applies ESG principles accordingly.”ble Investment (PRI). “We were proud to be awarded an A+ rating in 2020 for our overall approach to responsible investment for the fourth consecutive year,” Yelton says.

The PRI carries out the annual assessment based on how a signatory has progressed year-on-year and relative to peers. The rating demonstrates the firm’s efforts in terms of ESG integration, active ownership, investor collaboration and transparency.

As an investor in global equities, corporate and sovereign fixed income, real assets and multi-asset strategies, Invesco recognises the differences between asset classes and geographies, and applies ESG principles accordingly.

Teams incorporating ESG into their investment process consider it as part of the evaluation of ideas, company dialogue and portfolio monitoring. Assessment of ESG aspects is incorporated into the wider investment process as part of a holistic consideration of risk and opportunity. ESG aspects are considered along with other economic drivers when evaluating the attractiveness of an investment.

“Our fund managers have absolute discretion in taking a view on any given ESG risk or opportunity,” says Yelton. “The core aspects to our ESG philosophy include materiality, ESG momentum and engagement.”

Materiality refers to consideration of ESG issues on a risk-adjusted basis and in an economic context. ESG aspects are not seen as constraints, aside from certain restrictions driven by legal obligations in certain territories — such as Invesco’s non-investment policy in controversial weapons in EMEA.

The concept of ESG momentum, or improving ESG performance over time, is a constant focus. Companies that improve their ESG practices tend to enjoy favorable financial performance in the longer term.

Dialogue with portfolio companies is a core part of the investment process at Invesco’s fundamental teams. “We often participate in board-level dialogue and are instrumental in giving shareholder views on management, corporate strategy, transparency, and capital allocation as well as wider ESG aspects,” says Yelton.

“The starting point for our company level ESG research is the analysts and portfolio managers, who will look at a variety of factors. These will differ per asset class, sector, geography and company and will typically be one component of an overall investment view.”

Should the portfolio managers and analysts wish for more detailed ESG information, Invesco’s global team can provide proprietary analysis. Crucially, while there is global centralised support, decisions are ultimately made by investment managers and analysts — the experts who best know their asset classes and sectors.

ESG investing is key to a sustainable future, driving a holistic perspective on the investment industry’s role in creating value. “Our commitment goes far beyond deliver elements of ESG at a functional level,” says Yelton, “it goes to the heart of being a trusted partner.”

Diversity of thought means the firm’s ESG implementation is not generic. The global ESG team sets standards and provides specialist insights on research, engagement, voting, integration, tools, client and product solutions. Invesco’s investment officers and teams leverage this to tailor ESG approaches relevant to asset classes and investment styles.

Invesco ESGintel

Invesco ESGintel is a proprietary tool built by the global ESG research team in collaboration with the Technology Strategy Innovation and Planning (SIP) team, providing insights, metrics, data points and direction of change. ESGintel provides users with an internal rating, a rating trend, and a rank in GICS sectors.

A sector-materiality focus to select indicators ensures a targeted focus on the most vital issues for sustainable value-creation and risk management. This provides a holistic view on how a company’s value chain is impacted in different ways by various ESG topics.

These data points are then classified by sector or regional relative performance at the indicator level. Machine learning algorithms and extrapolations ensure broad coverage in the absence of coverage data, using a process by which statistical proxies are created in place of missing data and an estimated ESG score is assigned to an indicator. Ratings on a scale of one to five are calculated at the overall company, topic and indicator levels to facilitate a focus on higher risk company-specific issues. In addition to the individual rating, the momentum highlights the changes to the rating over time.

ESGintel has been developed with a focus on materiality, allowing Invesco to compare companies on the most important ESG indicators. Invesco ESGintel is housed in a proprietary platform available to Invesco employees.

You may have an interest in also reading…

A CEO Who Worked His Way Through the Ranks of a Family Firm to Lead From the Front

Thai Life Insurance Chief Executive Officer Chai Chaiyawan started his career in 1982 in the most basic way: learning the

stc: High Ideals, and a Series of Firsts for Kuwait

Kuwait Telecommunications Company (stc) believes the pandemic highlighted the importance and necessity of a strong telecom infrastructure. “People were eager

ICBC Dubai (DIFC) Branch: Innovate to Differentiate

Innovation is a key element written in ICBC’s core value – “integrity, humanity, prudence, innovation and excellence”. Awarded as the