Pavilion Global Markets Ltd. – Transition Management and the Pandemic: When to Act in Periods of Higher Market Volatility

Canada: Montreal

While it’s understandable to be squeamish about transitioning assets during periods of high volatility, it can be an ideal environment in which to engage a transition management provider.

To provide the necessary transparency to help asset owners become more comfortable, transition management (TM) providers will require an effective technology platform giving access to liquidity, and providing the ability to monitor execution/venue quality (best ex) and customisation to stay relevant and competitive.

A frequently asked question from asset owners, regardless of the market environment: “When is the best time to effect a portfolio rebalance, or deal with changes to my asset manager line-up?” The increased volatility in global markets brought on by the Covid-19 pandemic has highlighted the need to ask more questions of TM providers and focus on specific criteria when selecting which one may be best-suited to navigate this turbulent environment. For example, there is increased opportunity cost in delaying moving to the desired structure or new higher performing manager, thus how does the opportunity cost compare to the higher transaction cost? How does the TM provider demonstrate in a transparent fashion best execution? What are all the fees captured by the TM provider including but not limited to rebates over and above client disclosed and negotiated commissions?

“We continue to see a greater focus on venue analysis and selection, as well as customisation of trading algorithms in order to mitigate the higher spread / increased vol environment on clients’ executions.”

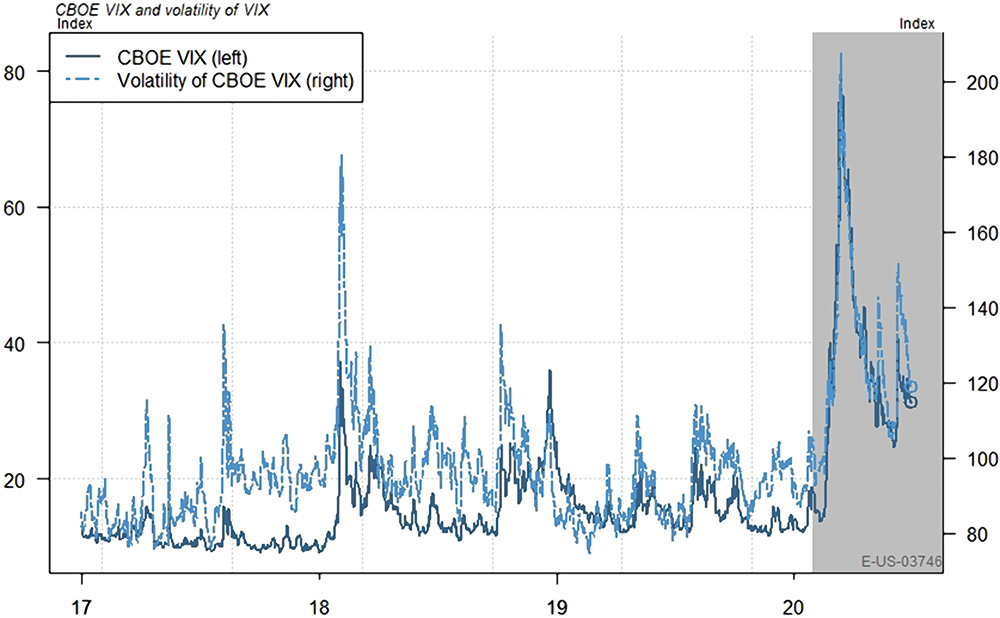

Both empirical evidence and market data have confirmed the volatile nature of global markets since March 2020, relative to preceding months.

Aside from what is clearly evident to the casual observer, there has been a dramatic downturn in median quote size and a striking uptick in spreads and volatility in all regions, particularly in EMEA and APAC. These factors have led to an increase in trading costs, which can take years of investment performance to overcome.

It is important to note that an increase in volatility generally goes hand-in-hand with an increase in volumes. When the VIX peaked at 80, volumes nearly doubled in the US, Europe and Asia.

In the US, average daily volumes rose 69 percent to 15 billion, far surpassing the previous monthly record of 12 billion. In a global cost review for Q1 performed by Virtu, trading costs in all regions increased due to the volatility associated with the pandemic, reaching levels not seen since the Global Financial Crisis of 2008. Even with the VIX subsiding a little in April, when compared to the previous year, intraday volatility remains multiples higher. The lower quote size, higher spread, and higher intraday volatility all led to higher execution costs. Compounding this is the myriad of venue options, trying to understand where the volumes are going, and where the best sources of liquidity are to effectively manage execution costs.

Pavilion Global Markets: Buyback blackout periods and vol. spikes. Shaded areas = US recessions. Data via Bloomberg.

In the public equity market, there has been a proliferation of new trading venues leading to a fragmentation of the market. High frequency trading (HFT) has the ability to exploit this — to the detriment of client orders, if one’s execution capabilities and technology do not keep pace. Given that spreads more than tripled for S&P 500 symbols in March 2020 against the same period last year, technology is critical in sourcing the various venues to find liquidity via smart order routing.

In addition, one must consider the fact that many brokers and/or TM providers operate their own, or have a financial stake in, certain dark pools that may be dominated by HFT. It is incumbent on these providers to demonstrate that any preferential routing of orders to these venues is to the client’s benefit, and not motivated by other financial considerations. While this has always been important, the increased volatility of the moment exacerbates it.

As a result of all these factors, we continue to see a greater focus on venue analysis and selection, as well as customisation of trading algorithms in order to mitigate the higher spread / increased vol environment on clients’ executions, to bridge the liquidity gap caused by market fragmentation, as well as to help manage risk.

As more and more clients are expressing concern about transitioning / rebalancing in the current market environment, Pavilion Global Markets is seeing a demand for transparency across the entire trading process to help clients better understand the liquidity sourcing preferences, and gain greater insight into how brokers / TM providers are managing their orders and controlling risk.

One way of providing this transparency is the use of venue analysis tools to help shed light on whether a provider’s liquidity venue is being given undue preference, or if a venue is causing too much information leakage.

Customisation of trading algorithms via venue selection, and even real-time venue-monitoring, will become key. Firms such as Clearpool in the US allow for customisation of algorithms “on the fly” to direct orders to achieve best execution. Information leakage is avoided by better venue prioritisation and avoidance of any undesirable venues. To keep pace, technology needs to be customisable, and flexible enough to handle the increasing granularity of the data (from milli- to micro-second, or even finer executions). Without such technology, providers will be unable to compete on a best-execution basis in the future.

Bottom line: with news of rising Covid-19 cases, and the economic implications of such news changing intra-day, volatility will likely remain elevated, with markets seeing spikes for a period of time to come. That said, this period of greater volatility can also be an effective environment in which to transition.

Asset owners should choose a TM provider that has an effective technology platform providing them access to liquidity, and allowing them to monitor execution/venue quality. The platform must also be easily customised to stay relevant and competitive. This will assist in navigating markets, managing risk and minimising execution costs. Transparency remains key.

Pavilion Global Markets – Best Transition Management Team North America 2019

Pavilion Global Markets is an established player in international capital markets, offering securities trading, global macro research and transition management services to institutional investors.

For over half a century, Pavilion Global Markets has provided expertise in execution and advice to institutional clients worldwide. We bring industry-recognized capabilities to the table – including specialized investment research and analysis, a top-ranking global trading desk and state-of-the-art technology – to help our institutional clients worldwide excel in the capital markets.

You may have an interest in also reading…

Active Re COO Luis Antonio Ibáñez: Sound Underwriting, Respect, and an Eye for Opportunity…

‘Our policy? No policy. We have strategy instead,’ quips COO of reinsurance giant Active Re Active Re, founded in 2007

Investing for the Long-term: Gold as a Pillar of NBP’s Reserve Management Strategy

Central banking is typically associated with conducting monetary policy. But central banks have also other important roles, one of which

Hamdi Ulukaya, the founder and CEO of Chobani

Yogurt king Hamdi Ulukaya, the founder and CEO of Chobani, has all his values in the right place Turkish immigrant