Otaviano Canuto: Middle-Income Countries Should Not Be Rushed to ‘Graduate’ Status

Many donor countries seem eager to see middle-income countries (MICs) graduate to non-client status in multilateral development institutions before achieving their full development potential.

Many donor countries seem eager to see middle-income countries (MICs) graduate to non-client status in multilateral development institutions before achieving their full development potential.

Such institutions can significantly contribute to the sustainable development of MICs, while seizing many benefits from this relationship.

Multilateral development banks operate in two main ways: regular lending and concessional finance. Regular lending uses interest rates close to market levels and relies on the banks’ wealth of knowledge to create attractive projects for MICs. Concessional finance, on the other hand, is attractive for low-income countries for that knowledge and because it offers low interest rates or grants.

In recent years, major donors and multilateral development banks have steadily increased their focus on low-income countries. By doing so, they would achieve higher impact. However, a necessary increase in efforts aimed at low-income countries should not mean neglecting relatively well-off countries which still have a way to go before achieving full development.

The trade-off is false, for two reasons. Firstly, MICs borrow at close to market rates, which means that the financial cost of maintaining these countries in the client list of multilateral development banks is low. MICs mostly benefit from the knowledge they can access.

Secondly, knowledge that MICs access and use in no way drains the knowledge for use by low-income countries (LICs). Fixed costs for development knowledge are high, and a good share of that knowledge is non-rivalrous. MICs, because of their higher economic sophistication, allow for a better training ground for innovative approaches. Maintaining programmes in MICs can thus be beneficial for LICs, through what has been called the Hummingbird Effect.

One could argue — and many have — that independent of these arguments, MICs are already on a path to development. The resources which multilateral development banks devote to MICs are insubstantial compared to other sources. And multilateral development banks do not have infinite capacity for programme generation.

If multilateral development banks are not really decisive for MICs, then why should they not concentrate on where they will make a greater impact? Unfortunately, the progress that MICs have made so far is by no means guaranteed to be sustained. Considering that the share of the world’s population — and of the world’s poor — that live in MICs is high, we cannot afford to leave them in a possible middle-income trap. The measures which can be taken to help MICs are in the interest of all countries, poor and rich.

A major challenge for MICs is the accumulation of human capital. Recognising the importance of this does not automatically translate into higher levels. Years of schooling are not the same thing as better learning, even if there is a link between the two. Multilateral development banks can help MICs design effective policies to increase the level of learning-adjusted school years (a metric that combines quantity and quality of schooling) for a relatively low cost.

A business-friendly environment is essential to moving from middle- to high-income levels. The benefits of specialisation and scale, as well as innovation, depend on a healthy environment where starting, operating or closing a business are not cumbersome endeavours. Multilateral development banks have an essential role here. They can help MICs by increasing the scope of evaluations like the Doing Business Report, to better and transparently reflect the business environment of the countries they examine.

MICs are the “low-hanging fruit” of climate change mitigation. While their emissions are higher than those of the LICs, their carbon-efficiency is still low. This means that they are the cheapest environment where technologies can be used to reduce greenhouse gas emissions while expanding economic activity. Cutting emissions in MICs is in the world’s interest, and multilateral development banks can still expand such projects in MICs.

A rush to graduate and cease multilateral development bank activities in upper-middle income countries would come at a higher cost than is assumed. The development trajectory of these countries is far from a guaranteed, linear path. The emergence and persistence of the middle-income trap has demonstrated this.

Multilateral development banks, however, can do a lot to help ensure that these countries “graduate with honours” and even go on to become some of the main financiers of development — in the interest of all countries.

You may have an interest in also reading…

Quantitative Tightening and Capital Flows to Emerging Markets

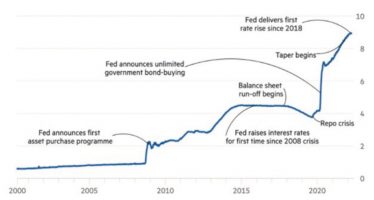

In its May 15th meeting, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve (Fed) lifted its benchmark

MIGA (World Bank): Energy in Africa – The Many Sides of Sustainability

Africa is booming—mostly. Much of the continent has experienced strong and sustained economic growth over the last two decades. Many

Otaviano Canuto, World Bank Group: Commodity Super Cycle to Stick Around a Bit Longer

Some analysts have predicted that the commodity price boom has played itself out. However, natural resource-based commodity prices (with the