IFC’s Blended Finance Department: Blending Public and Private Finance to Invest in Challenging Markets

What can be done to encourage more private investment in developing countries, especially the poorest and most fragile? This question lies at the heart of the development challenge today.

Governments and development institutions alike recognise that the private sector is essential for ending extreme poverty. But getting investors to enter those markets has never been easy, despite continued progress in improving countries’ overall investment environments. The COVID-19 crisis has only increased the real and perceived risks of doing business in developing countries. But it is more important than ever to sustain and grow a vibrant private sector that preserves and creates jobs and delivers essential goods and services.

One approach has emerged that could help make a difference: the blending of concessional funds from development partners with commercial investment funds from private sources. Blended concessional finance is proving to be effective at encouraging private investment in challenging markets, helping create and sustain markets, introduce new technologies, and accelerate economic development.

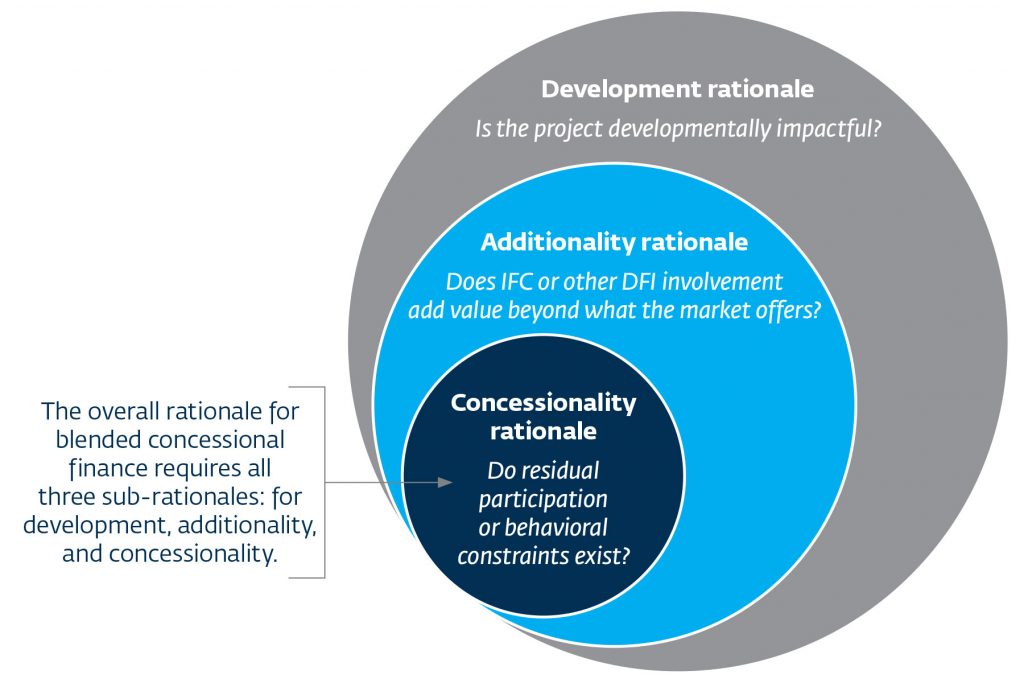

Blended concessional finance can help buffer contextual risks that would otherwise make it impossible or unaffordable to invest, even when the underlying business proposition is sound. Or to target funding at projects with positive spillovers, for instance first movers in a market that is costly to develop but makes it easier for future investors. Or to nudge investors into overcoming misperceptions or outdated behaviors that have held back, for instance, financing for women entrepreneurs.

IFC has deployed and refined this tool for nearly two decades, with a total of $1.6 billion in concessional funds used to support 266 high-impact projects during 2010-20, mostly in the poorest countries. Growth has been substantial, with commitments reaching nearly $500 million in fiscal year 2020. The results have been promising—donor funds have leveraged $6.1 billion in IFC financing and more than $7.1 billion in investment from private sources.

Blended concessional finance has been successfully deployed across sectors and regions. For example, through IFC’s Small Loan Gurantee Program, IFC and the IDA Private Sector Window (PSW) are investing in a Togo-based mortgage refinancing company to increase access to housing finance and strengthen local capital markets. In Afghanistan, IFC and the IDA PSW are supporting a power-generation project that will help the country meet its vast energy needs. In Malawi, the Global Agriculture and Food Security Program (GAFSP) Private Sector Window and IFC are helping farmers tap into the global demand for macadamia nuts. In Pakistan, the Women Enterpreneurs Finance Initiative (We-Fi) is supporting IFC’s investment in Sarmayacar, a fund that provides early stage funding and training to start-ups in Pakistan – with a focus on high-impact women-led startups. In Uzbekistan, the Canada-IFC Blended Climate Finance Program is helping bring an additional 100 megawatts of solar power to the grid.

With many lower-income markets remaining below investment grade, blended concessional finance is one of the tools that is helping address the 2030 Sustainable Development Goals—particularly those related to employment, growth, and poverty reduction. Blended finance is also being used to provide rapid liquidity support and helping preserve jobs for firms struggling because of the COVID-19 crisis. Several such programs were launched by development finance institutions in response to the pandemic, especially in the most high-risk markets.

However, the effective use of blended concessional finance requires knowledge and experience that is relatively new to governments and development practitioners, in part because of the complexity of combining public and commercial funds. When wrongly targeted, it can be wasteful at best and distort or destroy markets at worst.

A clear diagnostic and rationale is critical to ensure that the only activities supported are those that deliver significant developmental benefits and would not occur without the use of blended concessional finance. Furthermore, these investments must show a well-mapped path to sustainable commercial financing without subsidies. Good governance is also paramount: there must be transparency regarding the use of public funds, processes that address potential conflicts of interest, and the separation of operational decisions and decision-makers from those on blended concessional finance.

Together with other Development Finance Institutions (DFIs), IFC has been at the forefront of developing and upholding high standards for blended concessional finance. In 2017 an IFC-led working group developed a set of Enhanced Principles for Using Concessional Finance in Private Sector Investment Operations.

Recognising that transparency is essential, IFC informs development partners, its Board and the public about the key parameters of concessional transactions. Public documents disclose the proposed use of blended concessional finance on a transaction-by-transaction basis, the instruments to be employed, the estimated amount of financing, the rationale for deploying concessional finance, the expected development impact, and the estimated subsidy as a percentage of total project costs (for projects mandated after October 1, 2019). A revamped IFC project website provides easy access to this information for all IFC blended finance transactions. The website shares this information for all IFC blended concessional finance transactions (please see below to learn how to access these projects).

To avoid a race to the bottom, where concessional resources are being used not to de-risk highly developmental projects that wouldn’t otherwise happen, but solely to benefit the investor, we need to continue to strive for improved governance, coordination, transparency, and the use of minimum concessionality.

IFC recently released a report as a practitioner’s guide that summarizes its experience in blended concessional finance. It highlights best practices for articulating the rationale for using blended concessional finance; examines approaches for robust transparency, access, and governance; explains how to extend the reach of private sector projects into lower-income countries; and discusses recent financing innovations such as returnable capital contributions. The report, Using Blended Concessional Finance to Invest in Challenging Markets—Economic Considerations, Transparency, Governance, and Lessons of Experience, covers these topics in-depth and provides a practical primer about the key elements of this tool. Click here to see the full report.

Other useful resources:

EM Compass Note 72: Blended Concessional Finance: The Rise of Returnable Capital Contributions

EM Compass Note 66: Blended Concessional Finance: Governance Matters for Impact

EM Compass Note 60: Blended Concessional Finance: Scaling Up Private Investment in Lower-Income Countries

To access detailed information about all IFC Blended Finance projects, visit the IFC Project Information and Data Portal and click “Blended Finance” on the left side of the screen under Refine By. Click on All to view all Blended Finance projects or select them by facility (for example, GAFSP TF).

About IFC’s Blended Finance Unit

IFC’s Blended Finance Unit blends funds from donor partners alongside IFC’s own in order to catalyze investments that would not otherwise happen because of market barriers. These funds can be used to undertake high-risk, high-reward projects that have strong potential to improve lives and reduce poverty. From fiscal year 2010 to 2020, IFC has deployed $1.6 billion of concessional donor funds to support 266 high-impact projects in over 50 countries, leveraging $5.8 billion in IFC financing and more than $6.8 billion from third parties.

About the Author

Author: Kruskaia Sierra-Escalante

Kruskaia Sierra-Escalante is an Acting Director/Senior Manager in IFC’s Blended Finance Department and in charge of managing a pool of contributor funds of over $5 billion focused on accelerating IFC’s engagement in the most developmentally impactful areas: IDA and FCS countries, climate, infrastructure, gender, SME and agriculture. Since 2013, Kruskaia has managed IFC’s blended finance facilities for climate with more than $1 billion in bilateral and multilateral donor-contributions for climate-smart co-investments in IFC projects. During this period, IFC’s blended climate finance portfolio doubled in volume and helped IFC enter riskier markets. She also manages the IDA Private Sector Window, created in 2017 to support private sector development, growth, and job creation in some of the world’s least developed countries. Prior to her current position, she headed the Blended Finance unit, a governance unit performing credit review, quality assurance and knowledgesharing functions and served as IFC’s Global Lead Counsel for Climate and Blended Finance at IFC.

Kruskaia holds a master’s degree in Public Affairs, with a concentration in Economics and Public Policy, from Princeton University’s Woodrow Wilson School, and a J.D. from the New York University School of Law. Before joining IFC in 2003, Kruskaia was at Chadbourne & Parke, LLP, working primarily in project finance in the power sector.

You may have an interest in also reading…

Young Guns: How Business Prodigies are Rewriting the Rules of Success

Forget grey hairs and decades of experience. A new generation of entrepreneurs is proving that age is no barrier to

Green Bonds: How Active Management Aims to Make the Most of a Dynamic Sector

The market for financing linked to environmentally friendly projects and companies has already reached $1trn by some measures and we

Green is the New Gold: Sustainability Takes Centre Stage in the Middle East

Digitalisation is a key part in the puzzle to unlock value — and save the planet at the same time.