The Saudi Arabian Stock Exchange: Opening to Foreign Investors in June

As of June 15th this year, the largest stock market in the Middle East– Saudi Arabia’s Tadawul – will be open to foreign investors for the first time.

As of June 15th this year, the largest stock market in the Middle East– Saudi Arabia’s Tadawul – will be open to foreign investors for the first time.

The Saudi exchange, which is worth well over $500 billion, is dominated by energy-related and financial organisations including major banks and petrochemicals giant Saudi Arabian Basic Industries Corporation (SABIC). After a roller-coaster ride since July 2014 when the intention to liberalise was announced (and a barrel of oil traded at $100) the market is up 11 percent this year.

This long anticipated development confirmed on April 15th by the Saudi government will go a long way towards positioning the Kingdom as a highly significant emerging market. Given the size of the Saudi market (similar to that of South Africa) there is a virtual guarantee of eventual inclusion in the MSCI Emerging Market Index, moving up from the Frontier Markets Index. Two much smaller regional players (Qatar and the UAE) were promoted in this way last year.

This stock market liberalisation programme should also result in the acknowledgement of Saudi Arabia as a key G-20 economy. It is widely thought that the opening up of the exchange would be the final piece in the economic jigsaw.

The Saudi stock market is relatively more representative of the real economy than many others in the region. The country is also very active in the IPO markets and last year the National Commercial Bank raised $8 billion in the largest share sale in the Arab world.

Worries that a change of government following the death of King Abdullah in January would result in a reconsideration of the opening up of the market were thus shown to be unfounded.

You may have an interest in also reading…

UNCDF: Bringing New Parties to the Table – Engaging the Private Sector to Drive Investment into Least Developed Countries

It is widely understood that the world is falling far short of the funding flows required to achieve the Sustainable

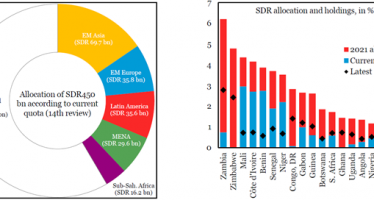

Rescue by Helicopter Reserves

The world woke up on Monday 23 with higher international reserves for all countries. A new allocation of US$650 billion

Bentley Motors: Keeping Assembly at Home

The Bentley SUV Bentley Motors recently confirmed that it will proceed with the development of the Bentley SUV, the company’s