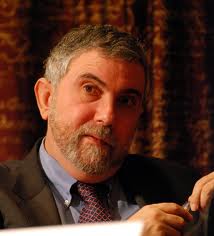

Paul Krugman: A Plea for a Return to Basics in Finance

Author of no less than twenty books, over 200 scholarly essays in peer-reviewed academic journals and more than 750 articles as a columnist, Nobel laureate Paul Krugman is not one to hide his mostly liberal opinions. As an economist, Mr Krugman repeatedly draws attention to the dangers of tinkering with established financial practices. He argues quite tirelessly against the exotic and highly complex financial instruments that entice investors and aim to create paper wealth.

Author of no less than twenty books, over 200 scholarly essays in peer-reviewed academic journals and more than 750 articles as a columnist, Nobel laureate Paul Krugman is not one to hide his mostly liberal opinions. As an economist, Mr Krugman repeatedly draws attention to the dangers of tinkering with established financial practices. He argues quite tirelessly against the exotic and highly complex financial instruments that entice investors and aim to create paper wealth.

Mr Krugman is a saltwater economist pur sang and vehemently defends a rather prominent role for the state in the conduct of macroeconomic affairs considering that it alone is able to avoid frightful booms and even more terrible busts. Still, Mr Krugman is no exponent of Keynesianism in economics. He has been heard to say that sweatshops are preferable to unemployment and has likened the opposition to unfettered free trade to denying the theory of evolution through natural selection.

In a word, Paul Krugman finds his own way. He has been particularly vociferous in his opposition to the untold billions spent in the US and Europe to bail out faltering banks. Mr Krugman thinks that money would have been better spent stimulating the wider economy. In fact, Mr Krugman finds that monetary conservatism by central bankers is apt to needlessly prolong economic crises. The continued focus on reducing budget deficits may even lead to a third depression that would leave “millions of lives blighted by the absence of jobs”.

Needless to say, Mr Krugman is not impressed by the US Federal Reserve’s drawing down its stimulus spending. In his Manifesto for Economic Sense, co-written by British labour economist Richard Layard, Mr Krugman argues that the major industrial economies of the world are mired in a liquidity trap since interest rates cannot be lowered any further in an attempt to jumpstart growth. Krugman and Layard propose deepening counter-cyclical government spending as an obvious way out of this trap.

What Mr Krugman mostly advocates though is a return to common sense economics and finance, considering that most deregulatory experiments have either failed or produced unforeseen, and often painful, side-effects. In today’s world, it’s rather innovative to plead for an end to financial innovation.

You may have an interest in also reading…

Brian Cox: Science for the Masses

Amongst the remains of Kolmanskop, an old mining town in the Namib Desert, a scrawny metrosexual soliloquizes about the nature

UNCDF: Revolutionising International Municipal Finance is Focus of Bid to Tackle Climate Change and Open Global Markets

“They have been drivers of progress throughout history, and now – as the knowledge economy takes full flight – they

Gro Harlem Brudtland: Doctor, Politician and Our Hero

Born in 1939 to an Oslo family in which politics and medicine were part and parcel of daily life, Dr.