World Bank Reports on Affordable Housing in Egypt

Cairo, Egypt

Hamada Mohamed, a taxi driver, is married with a 3 -year-old boy, and expecting a new baby in the coming months. Like 75 percent of young families he has not been able to afford a house and has had to rent. Many others in this large group either buy houses in informal settlements or simply squat. However, early next year, Hamada will move into a new home he bought, an approximately 60 square meters house with a small backyard.

Explaining why he has to move out from his current residence in Cairo, Hamada says, “I pay LE 750 (US$107) a month for a rented apartment. My lease will expire at the end of this year. The landlord asked for almost a 50 percent increase in rent to renew the lease. I simply cannot afford to pay LE 1100 (US$157) a month for rent.”

But how can he afford to buy a new two-bedroom house in Haram City? Hamada answers, “I couldn’t have done it without the subsidized mortgage. I hope all young Egyptians have the same opportunity I did, so they too can actually buy their homes.”

“Hamada was able to move to Haram City thanks to the Affordable Mortgage Finance Program Development Loan (DPL), a US$300 million project co-financed by the World Bank.”

Haram City, located in 6th of October district, 32 Km west of Cairo, is a housing project designed for middle and low income earners. Upon completion, it is expected to host 50,000 to 70,000 units with a population of approximately 300,000 inhabitants. It will include schools, a shopping centre, sporting clubs and other service facilities.

Hamada was able to move to Haram City thanks to the Affordable Mortgage Finance Program Development Loan (DPL), a US$300 million project co-financed by the World Bank. It aims to reform the existing system of subsidies for low income housing, by shifting the current inefficient and poorly targeted supply-side subsidies (going to the developers) to a transparent and economically efficient demand-side system (going directly to low income households).

Sahar Nasr, The Lead Financial Economist for the Middle East and North Africa Region, explains that “the project applies new mechanisms that were put in place after consultations with Egyptian investors, low income beneficiaries, and banks.”

The programme targets middle and low income households, earning between LE 1,000 and LE 2,500 per month. The subsidy amount varies according to the beneficiary’s income. The amount of the subsidy is inversely proportional to the beneficiary’s monthly income.

An added benefit, Nasr explains, is that “the project will alleviate pressure on the government to subsidize housing for middle and low income households by tapping into the banks’ liquidity. It will also play an instrumental role in addressing high unemployment problem by creating job opportunities for the growing young labour force in the building of new houses.”

You may have an interest in also reading…

EY Argentina: Argentina Amends Promotional Tax System for Knowledge-Based Firms

With technology disrupting business models in various sectors of the global economy, Argentina has finally introduced tax incentives for knowledge-based

World Bank’s Vice President for Infrastructure: Now is the Time to Rethink Transport and Logistics

Covid-19 has had a huge impact on transport. The response to the pandemic, from social distancing to lockdown policies for

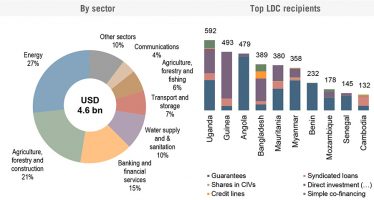

OECD: Plugging the SDG Financing Gap

Ensuring Blended Finance can mobilise private finance, particularly in the Least Developed Countries and towards Social Sectors, will require a