Michael Lewis: Explaining Human Foibles

Few writers can match Michael Lewis’ uncanny sense for capturing, and explaining, the zeitgeist. After detailing the inner workings of capital markets and showing how they appear rigged for failure, the US author has turned his attention to behavioural economics – a pursuit as much science as art that rarely grabs headlines yet shapes our world.

Few writers can match Michael Lewis’ uncanny sense for capturing, and explaining, the zeitgeist. After detailing the inner workings of capital markets and showing how they appear rigged for failure, the US author has turned his attention to behavioural economics – a pursuit as much science as art that rarely grabs headlines yet shapes our world.

The Undoing Project, published late last year to almost universal acclaim, tells the story of the Israeli academic double act Amos Tversky and Daniel Kahneman, two psychologists who worked on heuristics – the simple standardised processes people use to reach decisions and make judgments. Amos Tversky, who passed way in 1996, put it much more succinctly: “We study natural stupidity, not artificial intelligence.”

Obeying the Law of Small Numbers, most people routinely extrapolate conclusions from occurrences that are merely incidental. In its most basic form, this judgmental bias for example assumes that after three successive heads, a coin is most likely to come up tails the next time it is flipped.

Unable and unwilling to live with uncertainty, people since the dawn of time have looked for patterns in random events, trying to detect trends and projecting these into the future. Tversky and Kahneman point out that most of the rules people live by are based on limited experience – the sample pool used is too small to justify firm conclusions. As a result, personal rules often ignore logic and probability. Decisions are then made on the basis of emotions; not a carefully weighed analysis of data. Or, as Daniel Kahneman surmised: “People need a story to reach a decision, not a reason.”

Applied to economics, behavioural psychology offers a welcome explanation for the baffling ups and downs of markets and the apparently counterintuitive actions of its players. Michael Lewis (57) vividly describes Tversky and Kahneman’s most important finding: under conditions of uncertainty, people’s behaviour consistently contradicts the Utility Theory – a fundamental assumption in economics which simply states that decision-makers are motivated to act in their own self-interest.

This seemingly trivial observation constitutes the story behind the story of how markets actually fail and will keep doing so in boom and bust cycles triggered by emotion rather than fact. Michael Lewis shows that whilst the market itself bears little blame, its participants do so all the more.

The Undoing Project complements, and expands on, Freakonomics – the 2005 bestseller by University of Chicago Economics Professor Steven Levitt and New York Times writer Stephen Dubner that demystifies economic and social theory by exposing in an often hilarious way the misuse of statistics and chance. Scientists may scoff at the reductionist approach, but is it indeed mere coincidence that US crime levels dropped sharply precisely seventeen years after abortion was legalised?

What makes Michael Lewis unique amongst economics writers is his ability to distil highly complex issues to their bare essentials, in the process separating fact from spin and uncovering true intent. As the financial universe that underpins modern life becomes ever more complex – and somehow declines to draw lessons from past mistakes – its goings on need constant exposure if “the rest of us” is to understand what “they” – the bankers et al – are up to.

Or, is this all perhaps a self-defeating pursuit, an exercise in futility, since humans seem genetically hard-wired to reject – albeit subconsciously – logic and reason as guiding principles. Financiers may be disliked for causing a crisis every now and again, in the main they perform rather well. It’s just that bankers, much like everyone else, suffer from emotions and judgmental bias which clouds their vision and distorts their decision-making processes. Bankers are human after all.

Algorithms have of course no such qualms and quirks. Then again, machine trading as pioneered by Mr Lewis’ Flash Boys hardly seems the answer, introducing a new set of deplorable ills. Maybe it’s best to learn and live with it – humanity’s inescapable foibles. Why rebel against inevitability.

You may have an interest in also reading…

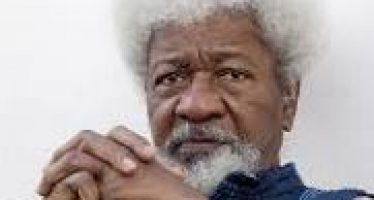

Wole Soyinka: A Literary Thorn in the Side of Power

As religious fanaticism increases, “the scroll of faith becomes indistinguishable from the roll call of death.” Nigerian poet and playwright

Alisher Usmanov: A Likeable Oligarch

Billionaire Alisher Usmanov is a Russian oligarch with a twist. Mostly known for his thirty percent stake in Arsenal FC,

Dick Costolo: Capitalizing the Lure of Future Profits

You have got to be doing something right if your losses surge to almost $65 million, while your corporation’s stock