Moderna Delivers Booster Shot for Wavering Markets

A sign marks an entrance to a Moderna, Inc., building, Monday, May 18, 2020, in Cambridge, Mass. (AP Photo: Bill Sikes)

Equity markets received a potent booster shot on Monday and barrelled ahead on news that a vaccine developed by US biotech group Moderna had obtained an astonishing 94.5 percent inoculation rate in late-stage trials. On Monday, the benchmark S&P 500 jumped 1.2 percent to close at a record high whilst the Dow Jones was seen cosying up to the 30,000-mark, stopping just 50 points short of smashing that barrier.

The small-cap Russell 2000, a barometer of Main Street sentiment, advanced 2.4 percent and also moved into unexplored territory. Even the tech-heavy Nasdaq, of late a scene of carnage, inched 0.8 percent ahead as a second light was thrown on the contours of a brave new post-pandemic world. On Wall Street, analysts were waxing lyrical about the now almost tangible normalisation of economic life with corporations churning out dividends, governments cutting out budgets, and consumers maxing out their credit cards on travel, leisure, and other trivial pursuits interrupted by the pandemic.

On both sides of the Atlantic, stock markets yesterday continued their rotation away from trendy yet overhyped and overpriced ‘momentum’ stocks towards previously underappreciated and undervalued ‘value’ stocks in a black swan event as tectonic in scope as it was spinning in speed. The catalyst of this massive shift was last week’s announcement by Pfizer and BioNTech of a breakthrough in their search for a coronavirus vaccine.

Brick Blast

The magnitude of the swing was illustrated by Europe’s largest commercial real estate developer and owner URW (Unibail-Rodamco-Westfield) which went from being the most shorted stock in the EU and the UK to becoming the investors’ new BFF.

In just two days of trading, URW stock gained 50 percent in value, causing hedge funds to suffer an almost unprecedented whiplash. New York-based D1 Capital Partners, which had shorted almost four percent of URW’s outstanding shares, saw an estimated €100 million evaporate in a few hours of trading.

Dutch office and retail property manager Wereldhave dealt a similar blow to short sellers as its shares rallied 23 percent. In London, Adelphi Capital and other hedge fund managers of renown received a severe beating for ignoring the ‘factors’ that now steer global equity markets.

Instead of focussing on specific industries – such as tech, energy, financial services, etc – fund managers and their algorithms have been shifting to a more dynamic approach that splits the market into factors: Value, momentum, quality, volatility and size, amongst others, are used as quantitative parameters that define a given stock at a particular moment in time. Factors rely mostly on well-established multidisciplinary academic research into human psychology as a driver of equity markets. Stocks and entire sectors can move between factors as market conditions change and even fall into several at the same time.

After enjoying an exceptionally long and profitable run that saw tech stocks gain 225 percent over the past decade – and 25 percent since the start of the year – the upside of these funds is deemed to be limited. Even before Pfizer broke the news on its coronavirus vaccine, tech momentum stocks had been losing steam. Thus, investors needed only light prodding to revisit boring old ‘value’ stocks which retreated 7 percent so far this year (according to the MSCI Global Index) and had delivered a ‘risible’ 88 percent return in the last 10 years.

Inflationary Inflections

Considering the likelihood of additional vaccines joining the Pfizer-Moderna line-up, and the probable return to economic normality next year with the attendant rise in corporate profits, the market’s optimism seems justified. However, a few analysts remain sceptical and suspect the amount of creative destruction wrought by the pandemic is being overlooked. The true number of zombie companies surviving on cheap credit and state handouts will only emerge after economies reflate on the back of strong demand.

The collapse in bond yields, even on US Treasury inflation-protected securities (Tips), has helped push the stock market to dizzying heights. The widening of the gap – aka inflation break-even – between real (inflation-linked) yields and conventional coupon rates or nominal yields, normally points to an economic growth spurt. Not so this year, when a rise in break-evens coincided with higher bond prices and a pick-up in inflation expectations.

Analysts are still mystified and unsure what this curious trend is supposed to signal but suspect a case of ‘QE addiction’ that requires central banks to keep pushing vast amounts of fresh cash into the economy to sustain asset prices. Also, policymakers may have grown rather too fond of fiscal stimuli and may find it tempting to keep the taps running even after economies have sprung back to life.

So far, investors haven’t been overly worried about inflation with 10-year US break-evens pointing to about 1.5 percent – still well below the Federal Reserve’s target of 2 percent. However, inflation is an unpredictable beast that may roar at the slightest provocation – if conditions are right. Policymakers failing to rein in public spending and ignoring the perils of ballooning deficits and excessive debt may just create such conditions, inadvertently or otherwise.

However, one lesson can already be drawn from the 2020 experience: In a universe of zero or negative real interest rates, market volatility rules with booms and busts following in quick succession.

Scrambling for Doses

Fund managers were particularly encouraged by the Moderna vaccine which seems easier to handle and distribute than the Pfizer equivalent that requires storage at minus 75 Celsius and can only survive for five days at normal fridge temperatures. Moderna revealed that its vaccine boasts a 30-day shelf life when stored at between 2C and 8C.

The latest vaccine is unlikely to become available in the UK before spring 2021. At the last minute, only moments before Moderna released its statement, the government managed to secure 5 million doses of the jab. Nr 10 now anxiously awaits the late-stage trial results of the vaccine developed jointly by Oxford University and AstraZeneca of which it has pre-ordered a more respectable volume of 100 million doses.

At just €3.50 per dose, this promises to be significantly cheaper than the Moderna vaccine’s two-shot inoculation course which runs at an estimated €50. The Oxford University / AstraZeneca alliance is expected to announce the results of its third-stage trial within the next ten days.

You may have an interest in also reading…

Former Student Protest Leader Claims Presidency in Chile

A land of geographical and political extremes, Chile seems to have rejected moderation and elevated a former student protest leader

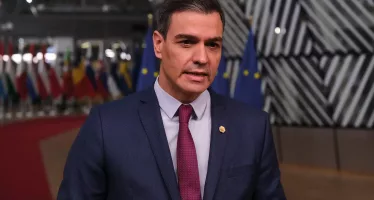

Prime Minister Pedro Sánchez: Seldom Down, Never Out

Echoes of the Franco Era still haunt Spain in subtle and often divisive ways. Now, a vibrant democracy, the country

China’s Economy Is in Flux. Here’s What Businesses Need to Know

This is the transcript of a special episode of The Insightful Leader podcast, produced by Laura Pavin of the Kellogg