Frugality, Education, Infrastructure and Attitude Change is Needed in the West: We Should Not Rely on Keynesian Nostrums to Pull Us Through

By Jon Moynihan

The West’s economic dilemma will not be solved until those countries have not just restructured their balance sheets, by significantly lowering expenditure, but have also significantly changed the mix of that expenditure.

In the UK and the US, and across most of Europe, the debate about national economic woes is framed as ‘austerity’ versus ‘growth’. This Keynesian vocabulary, assuming as it does a static environment, and therefore that there is all the time in the world to turn things around, ignores the steadily mounting debt of most Western countries. Worse, it obfuscates a far wider problem that has led to the debt in the first place: the vast disparity in wages that exists between the developed and the developing economies, and the jobs drain that has resulted from it (Chart 1).

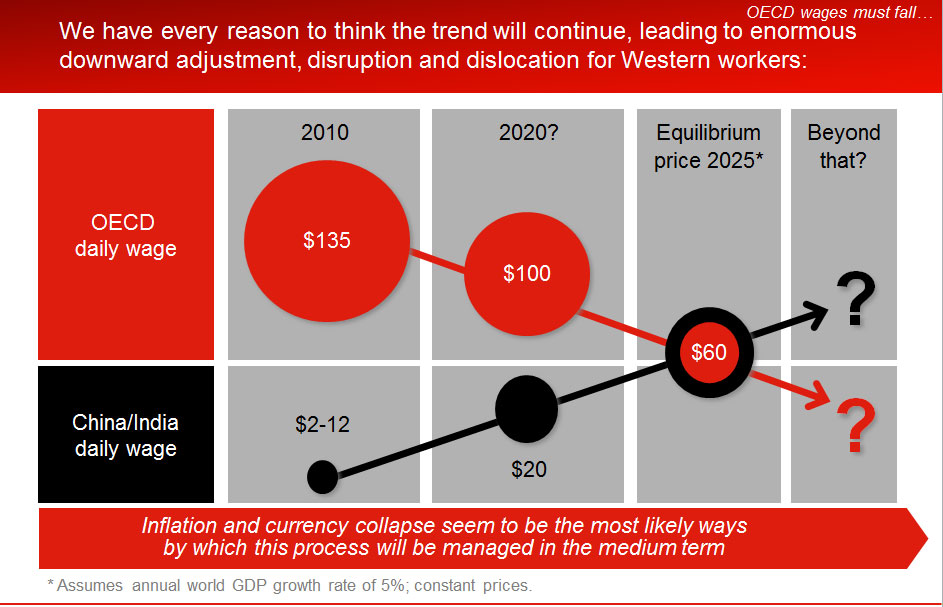

The average worker in developed countries (‘the West’) earns around $135 a day. The average trained worker in developing countries (‘the East’) earns around $12 a day; a non-trained worker in the East, between $1 and $2 a day.

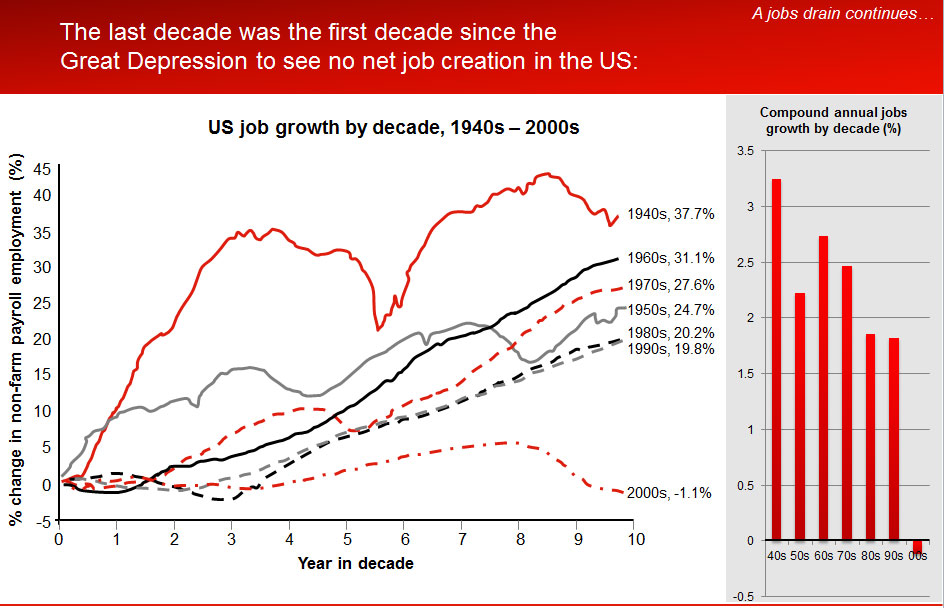

With globalisation, it becomes impossible to ring-fence most work so as to preserve the jobs for these privileged workers in the developed countries. As a result, not only are jobs draining from the developed nations, but that in turn forces significantly lower wages on those whose jobs have not yet moved to developing nations (Chart 2).

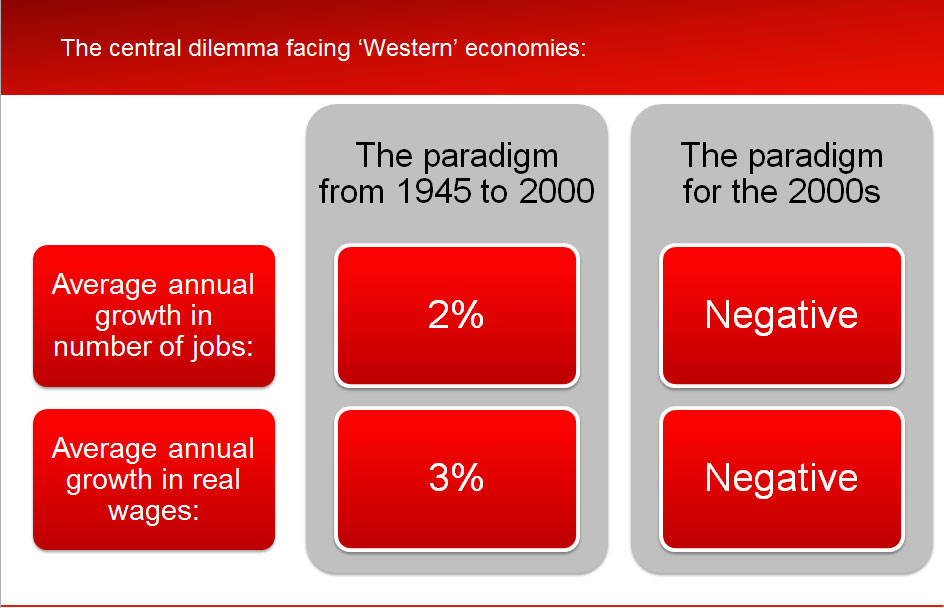

For decades, since 1945, job growth in the western economies was around 2% a year, and annual growth in real wages (for the same job) was around 3% a year. This became, as it were, a democratic ‘right’ for the workforce; there will be jobs as my kids seek them, and I will earn more at my own job each year, for the same effort. This paradigm, lasting for the last fifty years of the twentieth century, was abruptly broken with the abandonment of Marxist and socialist economic policies across the developing world, and their replacement by capitalism, in the period 1990-2000.

The change did not take long to have massive effect; the new paradigm since the year 2000 has been for growth, in both the number of jobs and the annual growth in real wages, to be negative (Chart 3, Chart 4).

In the western economies, with few exceptions, GDP (and job) growth over the cycle has disappeared, whilst at the same time, the size of China’s economy has quintupled.

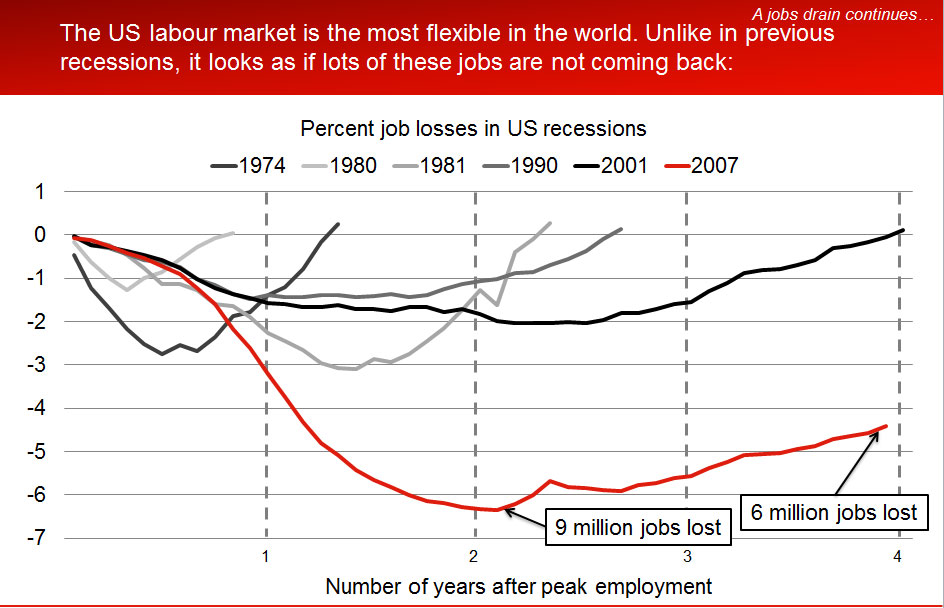

Five years after the 2007 crash, US employment is still six million jobs below the 2007 number. (Chart 4) This job loss is of a different order of magnitude to previous recessions, and speaks of a different reality (Chart 5). Real wages, too, have plummeted, although much of that impact is concealed behind the steady pernicious tick of inflation, devaluing static wages.

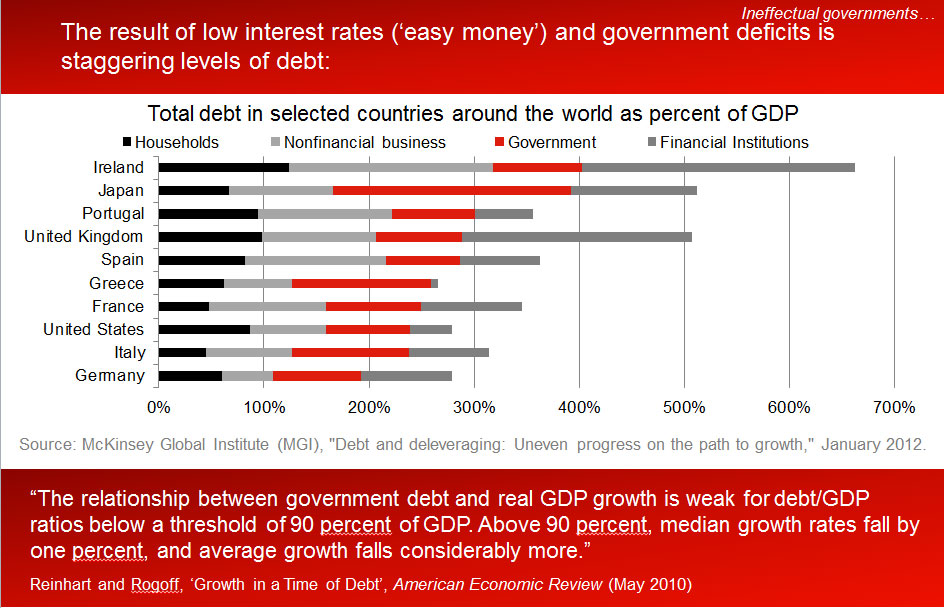

This dynamic has been apparent since at least 1995, yet ignored –so that for almost two decades the western economies have been “fiddling while Rome burned”. With workforces that expected –and in many cases, particularly in the public sector, received– significant real rises in wages every year, and a public and commentariat that was unable to envisage anything but a steadily increasing standard of living, the consequence of trying to stay with that prior, broken paradigm is that the western economies have been, year by year, increasingly living about their means. The consequent build-up in debt – corporate, individual and government – has now become an enormous overhang, the servicing of which will –as has been shown by the systematic analytic work of Carmen Reinhardt and Ken Rogoff– drain wealth from Western societies and lead to further, and much greater, impoverishment.

The UK’s total debt of all sorts –Personal, Corporate, Financial and Government– is now, as a percentage of GDP, lower only than Japan’s and Ireland’s – higher than that of Greece, Spain or Italy (Chart 6). In any event, apart from the obvious exception of Germany, most developed countries are much in the same boat: the fact that the West has been living above its means for so long means that its situation is qualitatively no different to that of Greece and Ireland, countries who have recently learned to their cost what happens when reality is ignored. Sooner or later, if a country does not recognise that its overall standard of living is unsustainable, the market brutally enforces that fact on the country, leading to major economic disruption and widespread immiseration, of a sort that most in the West currently find unimaginable, despite the chaotic scenes being played out in Euro fringe countries in recent months.

“… if a country does not recognise that its overall standard of living is unsustainable, the market brutally enforces that fact on the country, leading to major economic disruption and widespread immiseration …”

The failure to recognise the problem, or do anything about it, over the years was exacerbated by commentariats who by and large took a Keynesian view, asserting that the issue was to get the economy back into full employment through kick-starting it into ‘growth’. The trouble with this view is that for ‘growth’ one only has to substitute the words ‘continuing to live above our means, without any expectation of being able to pay for it’ and the fatal flaw is seen.

The consensus, against all the lessons of economic history, is clear: We should spend our way out of this. Since 1987, when Alan Greenspan took over the Federal Reserve, the response to any economic downturn has been to flood the system with cheap money so that governments, corporates and consumers could continue to live above their means. As a result, the Fed Funds rate declined from the mid-teens in the ‘80s, to now one quarter of one percent. Since the beginning of the 1990s, the US and the UK have had only 3 years (out of 22) each in which (very small) surpluses were achieved: the Euro area has run a deficit in every single one of those years.

The need to keep consumption high led to ever-diminishing investment in western economies (apart from the notable example of Germany). For example, in the most recent Spending Review, capital investment by the UK Government has been massively cut – 30% less in real terms in 2014 than in 2010, even though Government’s running costs are increasing slightly over the same period. To keep people in jobs, and preserve entitlements in the short-term, the long-term is being made even worse than it would otherwise be.

When a company in the Private Sector goes badly wrong, and is no longer financially viable, the bankruptcy code (particularly Chapter 11 in the US) has proved effective in getting the failing organisation out of the hands of those who led it into failure, and into the hands of those who have demonstrated a better understanding of the problem, and an ability to solve it. Bankrupt organisations in the US tend to carry on after reorganisation with very little loss of the underlying assets, since the process is swift and the chief change is that those managing the assets are replaced.

In the UK national context, the failing institutions and organisations who have led our economies into failure are the governments, regulators, central banks, and commentariat who, over decades, failed to spot these trends, or speak out against the polices that led us to now. It’s not surprising that acceptance of the need for radical change has been so slow in coming, because those running these institutions are strongly entrenched, and captive to the status quo.

In the UK and even more so in continental Europe, the governing castes have an iron grip on the policy levers, and it is unrealistic to expect them to even recognise that the policies that they pursued for decades were wrong, and that radical change is essential. Yet the vast majority of discussion is still about how to preserve our current standard of living – a standard of living which is unsustainable. In the words of Herb Stein: “that which cannot go on forever . . . won’t”.

Basic industries – steel production, and the like – have already been taken over by China and other developing countries. More advanced industries, such as car production, are going the same way. With each stage of advancement up the industrial ladder in the East – from low know-how, to medium and high capital intensity, to scientific and creative, and on to professional services and other high know-how businesses (Chart 7) — there is a corresponding jobs drain from the West to the East. And while the West focuses on spending money to sustain existing standards of living, with capital investment dropping year after year, China’s investment levels (however misdirected some of those investments may be) have risen to almost 50% of GDP (the West is at around 15%, and falling).

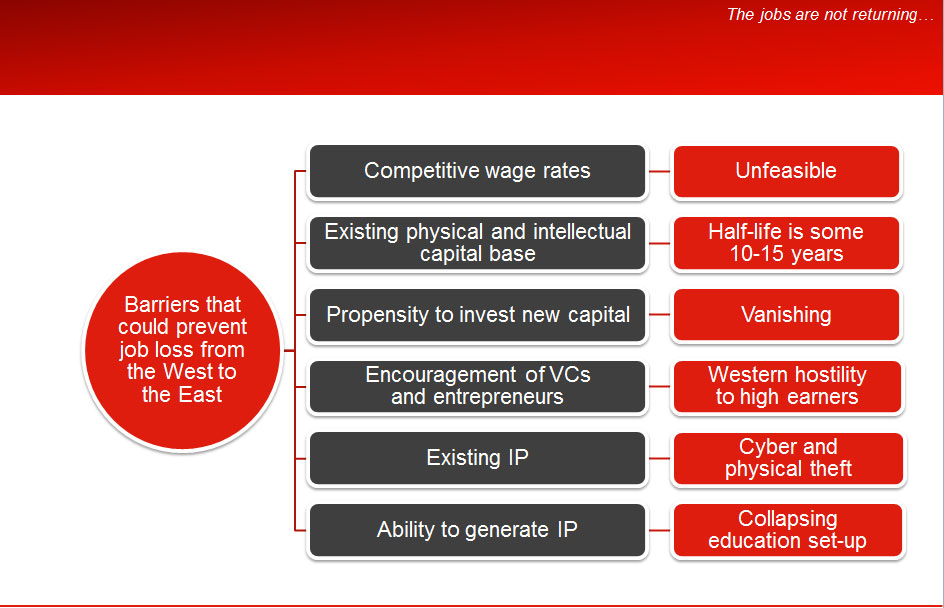

The barriers with which the West has been able to keep the East and South at bay are disappearing, and for the first time in centuries we have to compete on an even playing field with the rest of the world. It is infeasible that we will be able to offer competitive wage rates – you are not going to get to Eastern levels of wages without a complete collapse of the economy, and general destitution. Even as wages in developing countries increase (a slow process, given all those workers on $1 a day waiting to join the industrial workforce, and exerting downward pressure on industrial wages), any equilibration of Western with Eastern wages will result in an average level well below the west’s current $135 a day: our preliminary analysis indicates a crossover, in the 2020s or 30s, of around $60 a day (Chart 8) –a number that poses enormous societal and economic questions. Even at that equilibrium, there is no reason why the West’s wages will not continue to slide further, through inflation or currency collapse, if existing policies are continued with and our barriers to competition continue to erode (Chart 9).

Our existing physical and intellectual capital base is disappearing fast, eroded by technological advance, the internet, to some extent cyber-theft of much of our IP, and the fact that our best universities are (arguably quite correctly) educating the future business and economic leaders of the developing countries. Our propensity to invest new capital is lower than the East; our encouragement of venture capitalists and entrepreneurs is not notable (in the alleged words of Deng Xiaoping, “Zhifu Guangrong” – “to get rich is glorious”; we can compare that with the UK’s Nick Clegg: “we need to get tough on irresponsible and unjustified top remuneration” and the UK’s general focus on increasing taxes rather than incentives).

The pioneering work of Daron Acemoglu and James Robinson at MIT has shown that in every society, ‘extractive’ groups emerge over time to take an unfair share of society’s wealth, thus diverting it from more productive uses (see their book, ‘Why Nations Fail’). In the UK, for example, we have a variegated group, ranging from bankers to civil servants to middle-class and other benefit claimants, who arguably fall into this category. These entitled groups will kick very hard against losing their hard-won privileges. But freeing up that extractive share of the national wealth that they have their hands on is an essential part of restructuring the economy to be competitive with the East.

In the UK, as in Europe, government is such a large part of GNP that the need to tighten our belts, which in the private sector most families have already been doing, is crucial for the public sector –both for public sector employees, and for recipients of benefits. Productivity in the public sector has declined over the past decade, while in the private sector it has massively increased, yet wages in the public sector have gone up significantly more than in the private sector. On the recipient side, the economy has grown fourfold in real terms since the 1950s: welfare spending has increased tenfold. We all want a compassionate society that seeks to help the disadvantaged. But if that is done in unaffordable ways, it defeats itself – when the economy craters, there will be no tax monies available to pay over-large benefits. Indeed, many benefits paid out by the government are not at all to the needy, and are far more a function of the perceived need to capture voters. Nearly 80% of maternity pay goes out to middle class households in the UK: over 40% of child benefit, and 40% of student support. Why do middle class pensioners need winter fuel allowances, or free bus passes? How can that be justified when our public finances are in such disarray?

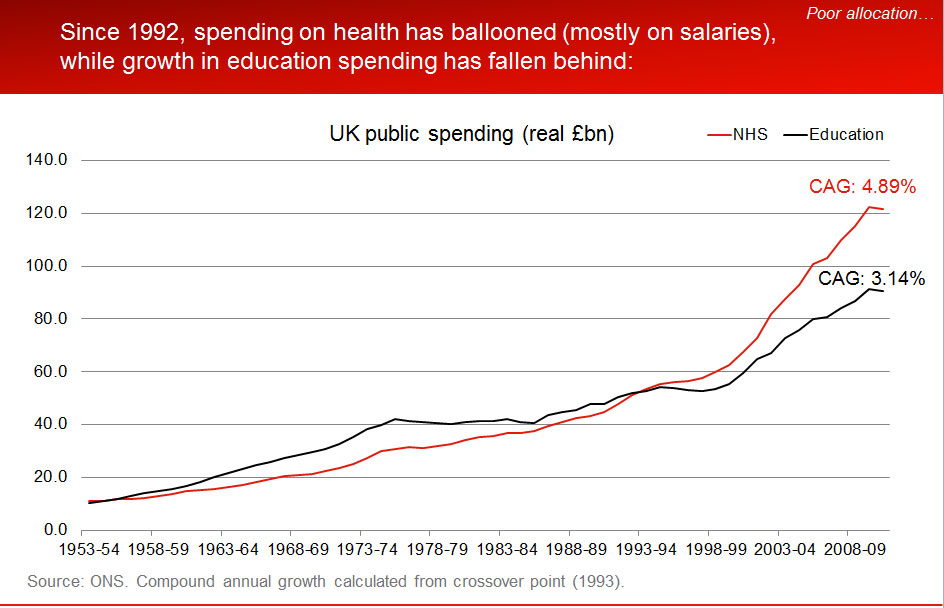

There will of course be real choices to be made, beyond removal of such fringe benefits. One choice that has been made in the UK since the 1950s has been to grow health expenditure at a much faster clip (nearly 5% a year, real terms) than education (3% a year); over 60 years, due to the magic of compounding, this has been a huge reallocation of resources (Chart 10).

It has been said that 22% of health care is spent in the last year of life. Which is more important for our future: the last year of life, or the first twenty? Indeed, education, particularly the shrinkage of science teaching both in schools and in universities, is at the heart of the dilemma we face. 60% of current STEM (Science, Technology, Engineering, and Mathematics) graduate students in universities across the UK have come from abroad and most of them will leave again after graduating (particularly given the UK’s unwelcoming approach to immigration). And yet, it is in a highly educated workforce, particularly but not just in the sciences, that our future lies.

Almost 20% of our children leave school without having attained “the essential reading skills to participate productively in society” (OECD 2009). The comparison statistic in Shanghai is, by the way, under 4%. It is the least educated who suffer the most in terms of low pay. Again from the OECD, the two things a government can spend money on that have the most impact on the long-run growth of an economy are education, and infrastructure. With an educated population, we can develop the technologies and companies that can give employment and continue to grow the economy.

“… the tax mix needs to be reformed, away from corporate and personal income taxes and more towards consumption and property taxes …”

The government has a central part to play. Apart from reorienting government spending, the banking sector clearly needs to be transformed (and that, with currently planned legislation and regulation, is not happening); the tax mix needs to be reformed, away from corporate and personal income taxes and more towards consumption and property taxes (again, from the OECD, shifting to the latter two improves GDP per capita; to the former two reduces it).

Moreover, support must be given to the development of new technologies; and an integrated industrial policy needs to be driven through, that focuses on the building of technology ecosystems across the country, ties into innovation centres near to universities, and focuses on the multiple technologies (in current cod parlance, bio/nano/info/neuro/cogno/anti-carbo) where future economic growth is going to be found.

It’s particularly essential to reduce welfare-type distribution from government, if only because to grow the economy in the longer term, significant infrastructure investments need to be made in the UK, and our debt situation is such that we cannot borrow further to make those investments. Lord Wolfson’s ‘brain belt’ (the Oxford to Cambridge motorway/science park ecosystem); local bypasses; universal WiMAX or other ultra-high speed broadband; ‘Boris Island’ (a Thames estuary-located airport); a Manchester to Sheffield motorway; university/science/business ecosystems; all these are crying out to be invested in, and each should grow the economy significantly.

“… a 15% immediate decline in living standards is needed just to balance Western economies today …”

But above all, a national consensus is needed on what is necessary to implement the above vision, and in particular to accept that we have been living above our means. Until such time as we have grown the economy through the above vision, an increasingly lower standard of living for most is inevitable. OECD and World Bank numbers indicate that something like a 15% immediate decline in living standards is needed just to balance Western economies today, never mind what happens in the future as more jobs slip away to the East – 15% is a level that many private households have already implemented, but with government spending so large, private retrenchment alone cannot accomplish that over the entire economy (and of course with the inevitable knock-on effect that retrenchment will have on the economy, the shorter-term shrinkage is likely to be larger).

This restructuring of consumption should by gradually managed, as otherwise it will be forced on us, in more brutal fashion, by the markets. We cannot expect Government or opposition to stand up and say this to us unless we all of us start being prepared to accept the fact and say it ourselves. This is the alternative to the Keynesian “growth” story. It’s a bleak view, but it contains the truth in it that all of us in our hearts know – that in order to recover, you have to pull back.

This article is an abridgement of a recent talk by Mr Moynihan at the London School of Economics (LSE).

A video of the talk

In order to grow, you have to invest. Capitalism works by creating surpluses and investing them in productive ways, not by borrowing monies and squandering them on consumption. There are still major issues that would face us even if we were able to get a national consensus behind this idea –for example, I challenge anybody to show an existing, carefully worked-through example of how the US or the UK are going to unwind Quantitative Easing without enormous pain and possibly disastrous disruption– but if the West is to avoid more generally suffering the fate of countries such as Greece and Ireland, and even before them, Argentina (a hundred or so years ago, one of the richest countries in the world), we have to make a start by owning up to our true situation, and the fact that the current consensus and approach is only digging us even further into trouble.

For reasons of space, this article focuses on the UK as an illustration, but its points are intended to apply to the developed economies overall.

About the Author

Jon Moynihan, Executive Chairman, PA Consulting Group

Jon has been first, Chief Executive Officer and now, Executive Chairman of PA Consulting Group, overseeing PA’s worldwide activities. Prior to working with PA Consulting Group, Jon worked with First Manhattan Consulting Group in New York, Strategic Planning Associates in Washington, McKinsey and Co in Amsterdam, Roche Products in London. Jon has written and been quoted in publications ranging from the Economist to the Financial Times, the American Banker, Barrons and Newsweek. Jon has lectured at Wharton, University of Michigan, Massachusetts Institute of Technology. Jon was educated at Balliol College, Oxford University; North London University – MSc Applied Statistics; Massachusetts Institute of Technology – SM Business/Finance. Jon was appointed an OBE in 1994.

About PA Consulting Group

PA Consulting Group (PA) is a management and IT consulting and technology and innovation organisation with specialist expertise across sectors: financial services, life sciences and healthcare, government and public services, defence and security, energy, telecommunications, consumer goods, automotive, transport and logistics. Founded in 1943, PA has annual turnover of approximately US$ half billion. The 2,154 employees (PA is employee owned) operate globally from offices across Europe, the Nordics, the United States, the Gulf and Asia Pacific with headquarters in London. See www.paconsulting.com.

You may have an interest in also reading…

The Middle Power Dilemma: The UK and the Sovereignty Paradox in a Tri-Polar World

The hypothesis is simple. In a trade system increasingly shaped by the United States, China and the European Union, a

Pioneering Spirit, Boldness, and a Deep Understanding of ‘Unity’

Nordic firm United Bankers has history and success behind it — and a great future ahead. Helsinki-based United Bankers set

Built on Trust, Powered by Client Commitment: The XMTrading Standard

In the world of trading, trust is the ultimate currency, and transparency is the gold standard. XMTrading, a broker that