CFI.co Meets the CEO of Fortress Investments: Hamed Mokhtar

Hamed Mokhtar is the managing director of Fortress Investments of 2011. Born and educated in the United States, Mr Mokhtar brings a wealth of experience and creativity to both the company and the markets it operates in.

Hamed Mokhtar is the managing director of Fortress Investments of 2011. Born and educated in the United States, Mr Mokhtar brings a wealth of experience and creativity to both the company and the markets it operates in.

His key industry of interest is the educational sector, primarily those of Dubai and Abu Dhabi. Fortress has channelled investments worth many millions into this field. Confident about the continued influx of foreign nationals to the region, Mr Mokhtar describes the UAE as “the intelligent man’s land of opportunity.”

Mr Mokhtar’s greatest mission to date has been to help source foreign investments into Dubai. By so doing, he has been successful in developing relationships and partnerships with the royal families of Dubai, Abu Dhabi and other Emirates, further adding to the support and growth of Fortress Investments.

The instability of surrounding Arab countries, coupled to the UAE’s privileged economic position, allow Mr Mokhtar to anticipate even more substantial future inflows of expats to the region. His positive economic outlook for the GCC states has also inspired him to encourage family, friends, and colleagues to relocate to the UAE.

Mr Mokhtar is also chairman of the Fortress Investment Committee. In this capacity he has established a strong track record by consistently generating solid returns for his clients’ investments. “Our philosophy is to invest in global securities that are undervalued due to a combination of negative market factors – whether they are environmental, political, or sector specific,” explains the Fortress CEO.

While most of his peers sought safe harbours in government and corporate bonds and index funds to withstand the recent economic headwinds, Mr Mokhtar and his company chose a different asset preservation model allowing for higher-than-average returns. This was achieved by identifying and securing margins of safety within the global equities and precious metals markets.

“Gold has gone up by some 600% over the last decade while silver has gone up even more. Opportunities still exist to capitalize on further gains,” says Mr Mokhtar pointing to the recent six-month high gold prices reached as a result of safe-haven buying.

A specialist in US equities, Mr Mokhtar has consistently outperformed the market and capitalized on unique asset allocation strategies focused on value investing. Fortress has achieved this by maintaining capital provision ratios of 1:1, as well as a maximum investor rate of return of 8.75%. “We continue to deliver above benchmark yields for our clients and hope to continue to do so well into the future,” concludes Mr Mokhtar.

You may have an interest in also reading…

Richard Teng: Propelling ADGM’s Status as Leader in Progressive Technologies

The Chief Executive of the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority, Richard Teng, began his career with

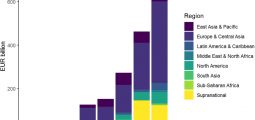

PwC Study: High Demand for Quality Infrastructure in Emerging Markets

Relentless urbanisation is driving increased demand for higher quality, more affordable and greener urban infrastructure in emerging and developed markets.

Interview with Alexis Lecanuet, Accenture Middle East: Creating Value Through Continuous Transformation

How has your professional journey qualified and prepared you for being the Middle East Region MD for Accenture? As a