Vicky Jones, Norton Rose Fulbright: Debt Capital Markets – A Funding Solution for SMEs and Projects?

The Hague, Netherlands

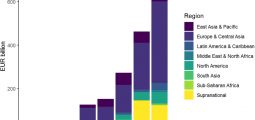

There has been remarkable growth in corporate bond issuance in Europe since 2000, particularly in the aftermath of the financial crisis. Issues by European non-financial corporates rose almost 20% in the first half of 2013 to US$333bn [1]. This is the highest figure since the record highs of 2009. The drivers of this growth from the perspective of investors and issuers are well-known. The question is how to harness the current liquidity in the debt capital markets and extend the enthusiasm for investment grade corporate issuers to funding other sectors of the European economy.

This article looks at recent innovations in bond financing outside investment grade corporates. We take the Netherlands as an example of a country where support from tax and other authorities has enabled debt capital markets (DCM) initiatives and has helped to develop an attractive environment for the location of financing vehicles for the issue of debt securities. The size of the market for Dutch corporate bonds has doubled since 2007, reaching a record high of EUR 105bn in the first quarter of 2013 [2]. The majority of issuers are large companies which are listed and/or rated.

The Funding Problem for SMEs and Infrastructure Projects

The debt capital markets could be helpful in resolving two concerns facing Europe: How to bridge the funding gap for SMEs and how to diversify funding options for public-private partnership (PPP) infrastructure projects. Pre-financial crisis, a prospective project or a successful SME could rely on bank loans to provide the cash needed. Not so today: Banks have been forced to deleverage and tighten their credit standards (particularly with respect to riskier investments) as a result of nationalisation, internal policies and Basel III. SMEs and project sponsors need new sources of finance.

The importance of SMEs is undisputed. They account for more than 98% of Europe’s businesses and provide more than 67% of the jobs in the EU [3]. However, while there are large differences across Europe, the past few years have seen a general reduction in SMEs’ access to finance. This is a crucial problem as many depend on debt to enable growth and to keep trading.

“The importance of SMEs is undisputed.”

The Netherlands has suffered in particular. A report by the policy department of the European Parliament describes the Netherlands as “an outlier, because SME profitability is not as weak as in southern Europe, but there are similar financing obstacles” [4]. Only 46% of SMEs were granted the full amount of credit they requested during the period from October 2012 to March 2013 [5].

There is also no shortage of projects which need to be financed or refinanced across the EU. The Dutch government stated in its negative response to the Europe 2020 Project Bond Initiative that there is sufficient private funding for projects in the Netherlands. This may be true, but there is not the depth of funding available to enable more than a couple of consortia to submit a valid bid for a project in the procurement phase. This reduces competition and potentially increases costs for the government.

Matching the Cash Rich with the Cash Poor

Outside the banks, there is liquidity in the markets. Matching those with money with those in need of it and, ideally, providing fees to the traditional lenders in the market (the banks) is the challenge. Crowdfunding and peer-to-peer lending (increasingly popular in the Netherlands) can assist with small loans, but DCM may hold solutions for bigger financings.

Most readers will recognise the challenges faced by the markets in persuading participants to issue on or invest in the debt capital markets. On the investor side, institutional investors are often limited in the amount of unlisted and unrated debt they can buy and, while the experience of retail investors differs across Europe, Dutch private investors have not been so active in the debt capital markets perhaps due to government regulation of Dutch pension funds not incentivising people to seek their own investments. On the other hand, many SMEs are unaware of DCM as a funding option or are put off by the impression that it will result in increased disclosure and reporting, entering into relationships with unknown investors, extensive marketing and relatively high advisers’ costs. Different difficulties face project finance SPVs; for them an important barrier is that there have been too few project bonds to encourage institutional investors to invest the time and resources necessary to understand the products and their credit risks.

The Advantages of DCM

The benefits should be worth the effort. The debt capital markets allow institutional investors to diversify their portfolio, private investors to obtain higher returns, companies to access a broader range of investors and often to enjoy less restrictive terms and project sponsors to tap institutional investors with long-term investment requirements which match the long-term cash flows of the project.

It is still early days, but the following recent developments in EU, DCM, and the Dutch market in particular, indicate an enthusiasm to assist SMEs, projects and investors.

EU Support for the Debt Capital Markets

It helps that the EU is trying to encourage the use of bonds to finance SMEs and projects. In July 2013, the European Central Bank announced it will continue to investigate the possible acceptance of mezzanine tranches of guaranteed securities backed by SME loans as Eurosystem collateral. EU support for project bonds is also demonstrated by the budget made available through the Europe 2020 Project Bond Initiative, a joint programme by the European Commission and the European Investment Bank (EIB) designed to stimulate capital market financing of large infrastructure projects.

July also saw the announcement of the first successful use of project bond credit enhancement and issue of an EIB supported project bond. The bonds formed part of the financing for the Castor underground gas storage project in Spain. The A11 road project in Belgium has also been tipped to use this EIB product.

DCM Solutions for SMEs

Perhaps the most obvious DCM option for an SME is to conduct a private placement. This is an active sector in the US where investors overcome the lack of publicly available information about SMEs by investing in companies which operate in industries they know well or even operate in themselves.

The appetite for private placements of SME bonds in Europe has grown as the financial crisis has continued, but lack of publicity and information relating to bonds issued by smaller, private companies has limited demand. A possible solution to this is a platform for European private placements by SMEs reported in the Netherlands in July 2013 which should offer SMEs the chance to raise their profile with potential investors.

The initiative has broad support from the Dutch government and regulators as well as Dutch banks, some larger insurance companies and the big four accountancy firms. The stated aim is for the platform to extend to the UK, France and Germany and talks are already being held with insurers in those countries. It would help this type of arrangement if equal regulatory treatment of SME debt could be agreed across the EU.

Although details are still being worked through, our expectation is that such a placement platform would still not reach as many investors as a traditional debt listing. In this respect, the Dutch stock exchange (NYSE Euronext) has had an exchange-regulated market since 2005, called Alternext, which is aimed at companies with market capitalisation of under EUR 1bn. There have been relatively few issues on Alternext by SMEs (the most recent being in May 2012) and, presumably with this in mind, NYSE Euronext launched EnterNext in July 2013. With its own teams and resources, EnterNext is more focused on encouraging initial equity and debt issuances by Dutch SMEs through lower cost, standardised issuance procedures.

Another possible alternative is to “bundle” SME loans into larger products. This diversifies risk and could improve marketability. An example of such bundling has been seen in Germany where the first covered bond programme was established by Commerzbank. The Commerzbank programme was established in December 2012 and is backed by loans to SMEs established or located in Germany and involved in a range of different industrial sectors. The regulatory treatment and cost saving of this instrument could lead to its replication in other European countries with attractive covered bond legislation. A product similar to a covered bond is reportedly currently being developed by banks in France with a view to easing SME funding.

DCM Solutions for Projects

Author: Vicky Jones

The development of the PEBBLE platform by ING and the Commute product by NIBC are important indicators of DCM innovation in the Netherlands. PEBBLE (which is slightly easier to say than Pan European Bank to Bond Loan Equitisation) provides standard documentation to be used by banks to diversify funding options and match investors with long-term investment needs with an investment that generates reliable, long-term cash flows.

Through an issue of long-term (over 25 year) notes privately placed to institutional investors, a medium term subordinated loan and a short maturity revolving credit facility, it attempts to provide something for everyone. Sponsors obtain cheaper funding and tap a broader range of investors who could facilitate larger projects while institutional investors get access to a higher quality long-term investment backed by government cash flow in the form of availability payments with construction risk mitigated (through subordination of the loan and the pari passu nature of the revolving credit facility). It is proposed that the senior notes make up approximately 85% of the funding so DCM investors will be playing a pivotal role.

PEBBLE has not caught on in the way which was envisaged when it was launched in 2012, but there remains hope that, once investors become comfortable with this initiative, it will be used extensively.

The high quality of Dutch infrastructure projects means that they are well-placed to benefit if a deeper market for project bonds develops. A bond option was mooted as part of the finance package for the A1/A6 road project and it is anticipated one will be included in the financing arrangements for many of the upcoming projects in the Netherlands not least because of government support for broadening the investor base. However, there are limits to the breadth of the investor base because committed finance is required for bids on public projects and this is tricky to prove with a retail bond.

Conclusion

The support of the EU and the Dutch government for new sources of funding is evident, but success requires both institutional and individual investors to educate themselves as to the risks and rewards of the new products on offer. There is talk in the market that the current popularity of corporate bonds has led to a bubble which is likely to burst. However, with few signs that banks will make a swift return to the lending market, companies in need of finance do not have many places to turn. One has to hope, in particular, that once institutional investors have tasted the benefits of a project bond, their appetite will not be quickly sated.

![]()

About the Author

Vicky Jones is a banking lawyer based at the Amsterdam office of Norton Rose Fulbright.

[1] Floating rate bond issuance jumps in Europe, Christopher Thompson and Ralph Atkins, Financial Times , 29 August 2013

[2] Omvang bedrijfsobligaties gegroeid tot boven EUR 100 miljard, Statistisch Nieuwsbericht, De Nederlandsche Bank, August 2013

[3] Report on improving access to finance for SMEs, Committee on Economic and Monetary Affairs, Philippe De Backer, 21 December 2012

[4] Economic and Scientific Policy: Banking system soundness is the key to more SME financing, Directorate General for Internal Policies Policy Department, July 2013

[5] Survey on the Access to Finance of Small and Medium-Sized Enterprises in the Euro Area, October 2012 to March 2013, European Central Bank, April 2013

You may have an interest in also reading…

Baker & McKenzie: Kazakhstani International and Domestic Securities Offerings

By Edward A. Bibko With its large natural resources and relatively transparent legal regime, Kazakhstan has long been a destination for

The View From Belgium: Top Banker Pleads for Caution

Ernest Hemingway’s maxim that bankruptcy arrives gradually “and then suddenly” applies to banks as well: “The proliferation of social media

EY Argentina: Argentina’s Promotional Tax System for Knowledge-based Companies is Gaining Ground in the Local Market

After more than two years of the enactment of the “knowledge-based” Law, time has come to ask whether this new