Finance

Back to homepageWorld Bank: How to Accelerate Growth and Progress in Developing Economies

Amid a barrage of shocks during the past four years, the global economy has proved to be surprisingly resilient. Major economies are emerging mostly unscathed after the fastest rise in interest rates in 40 years—without the usual scars of steep

Read MoreDefining Client Expectations — and Quietly Exceeding Them — is the XM Philosophy That’s Proving a Winner

There are plenty of brokers out there — but there aren’t many like XM — a powerhouse that harnesses innovation to create tailored, lightning-fast trades. New brokers are entering the online trading world every day, but some names tend to

Read MoreVector Casa de Bolsa: Five Decades Driving the Growth of the Mexican Economy

As Vector Casa de Bolsa approaches its 50th anniversary, it is time to reflect on the company’s remarkable journey and enduring impact on the country’s economy. Vector Casa de Bolsa has consistently demonstrated its commitment to excellence, innovation, and collaboration, helping shape

Read MoreBerenberg: Strategic Asset Allocation in a Higher Interest Rate Environment

For the first time in many years, interest rates have risen noticeably in 2022 and 2023, and as a result, conditions on bond markets have changed rapidly since then. What some are calling a regime change is, in fact, a

Read MoreFinding the Inside Track to Sustainable Investment — it’s a ThirdWay Speciality

ThirdWay Partners, with offices in Kenya, London, Mozambique, South Africa and Spain, and expanding its presence in Argentina this year, is an impact investment and advisory firm that maintains a steady focus on creating inclusive sustainable development and impact. The

Read MoreCo-ordinates … Co-ordination … Action!

Asia-bound: London-based N51 is taking a City philosophy on an Eastern adventure… Building the Future of Finance! N51 is a private investment holding company that knows where it’s going — and where it all began. The name refers to the

Read MoreFrom Davos to Digital Transformation: The Key Trends that Will Define the Global Financial Services Sector in 2024

World leaders gathered at the Davos World Economic Forum in January and told us what we already know – that the global economy is still highly volatile. Geopolitical conflicts, disruption to Red Sea trade routes, high-profile elections, energy price hikes

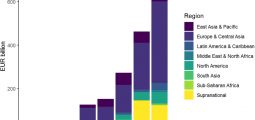

Read MoreWhither China’s Belt and Road Initiative?

The Belt and Road Initiative (BRI), launched by Xi Jinping, passed its tenth anniversary in 2023. It has entered a third phase. The initiative added a label to China’s financing and construction of infrastructure abroad, which had already totaled more

Read MoreModern ‘Alchemy’: No Spells and Incantations, Just a Focus on Integrity — and Excellence

CFI.co in conversation with Emad Shahin, investment director at Ethra Invest… Investment and private equity are facets of the financial universe that call for an understanding of a sort of modern alchemy: creating value through strategic investment in diverse industries.

Read MoreKeeping the Flame of Fascination Alive

Getting inside Emad Shahin’s work ethic at Ethra Invest The dynamic nature of the business world is of continual fascination for Emad Shahin, investment director at Dubai’s Ethra Invest. The rapid evolution of industries, technological advancements, and the ever-changing global

Read More